Autumn Statement: Welsh control of nearly £3bn taxes

- Published

George Osborne also confirmed the full devolution of business rates

Wales could control nearly £3bn in taxes by 2020 under the powers set to be devolved, the first ever official predictions have said.

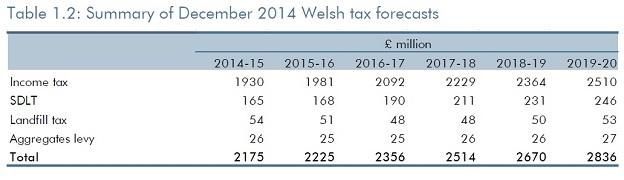

The Office for Budget Responsibility (OBR), external has estimated the likely proceeds from income tax, stamp duty land tax, landfill tax and the aggregates levy.

It came as Chancellor George Osborne revealed his tax and spending plans.

The Welsh government will get an additional £123m to spend next year as a result of the Autumn Statement.

It confirmed that an extra £70m resulting from more health spending in England would also be spent on health in Wales.

Most of the rest of the extra money will come from the devolution of business rates, which was part of David Cameron and Nick Clegg's announcement on tax powers for Wales in November 2013.

The extra cash confirmed on Wednesday represents 0.8% of the Welsh government's budget for the next financial year - at £15.3bn for 2015-16.

Tax take

The first-ever official Welsh tax predictions, external, and what they say about the strength or otherwise of the Welsh economy, will be pored over by politicians as Wales enters the next phase of devolution.

They cover the taxes which are set to be devolved once the Wales Bill, external going through Parliament becomes law, including the ability to vary income tax rates by up to 10p in the pound.

Source: Office for Budget Responsibility

The OBR estimates Wales would have had control of around £2.2bn of taxes in the current financial year, rising to more than £2.8bn in 2019/20.

Income tax would make up the bulk of taxes under Welsh control, accounting for £1.9bn of the total in this financial year, rising to £2.5bn by 2019-20.

However, the devolution of income tax powers will depend on the result of a referendum.

The rest of the Welsh government's budget of around £15bn would need to be covered by the UK Treasury.

'Powerful package'

In his Autumn Statement, the chancellor announced a reform of stamp duty on the sale of property, a 25% "diverted profits" tax on multinational companies, and a freeze on fuel duty.

News of the extra funding from health budgets for Wales and UK government support for a £1bn power-generating tidal lagoon in Swansea Bay had already been announced earlier in the week.

Jane Hutt says the extra cash will not make up for cuts 'damage'

Welsh Secretary Stephen Crabb welcomed what he called "a powerful package of measures to drive forward the Welsh economy and provide greater economic security for hardworking people across Wales".

However, Welsh Finance Minister Jane Hutt said the extra money for Wales "goes a small way towards redressing the damage that the deep cuts in public service provision has done to people in Wales and across the UK".

Welsh Liberal Democrat leader Kirsty Williams credited her party's role in the UK coalition government for stamp duty reform and increased income tax thresholds.

"This Autumn Statement shows that the Liberal Democrats are building a Britain where everyone is given the opportunity to get on in life," she said.

Plaid Cymru Treasury spokesperson Jonathan Edwards MP welcomed the devolution of business rates but said there was "little here on offer to our nation".

"If we are to tackle unemployment and generate economic growth, Wales must be handed the same job-creating powers as Scotland or risk being left behind," he said.

Janet Jones, chair of the Federation of Small Businesses Wales, hoped the Welsh government would reform business rates, claiming small firms in Wales paid more than those in England.

"Wales now has a huge opportunity to reform this outdated and unfair tax, and in doing so support the small businesses which are the key job-creators in our communities," she said.

Euro Foods pays £250,000 in business rates every year

Analysis by Nick Servini, BBC Wales political editor

It's a sign of the times that the biggest tax change announced by George Osborne relates to a tax that will be devolved in a few years.

The changes to stamp duty on the sale of property kick in at midnight. It's being devolved in four years.

The decision to remove the slab nature of the tax, where there are steep rises at set amounts like £250,000, was something being considered by Jane Hutt and her officials.

One question is whether it's taken the wind out of the sails of a new Welsh government treasury team that was looking to introduce something far more progressive than in England.

I think it's fair to say the result in the long run will be that when it comes to stamp duty at least, there's unlikely to be any major differences between Wales and England.

- Published3 December 2014

- Published3 December 2014

- Published3 December 2014

- Published2 December 2014

- Published2 December 2014

- Published1 December 2014

- Published18 November 2014