Budget 2015: George Osborne targets savers in pre-election package

- Published

Britain is "walking tall again" the chancellor said as he began his speech

George Osborne has announced tax cuts for first-time buyers, workers and savers in his final Budget before May's general election.

The chancellor claimed Britain was "walking tall again" after five years of austerity.

He also cut 1p from beer duty, 2% from cider and whisky and froze fuel and wine duty. Cigarettes will go up by 16p a pack as earlier planned.

Labour leader Ed Miliband said Mr Osborne had "failed working families".

"This a Budget that people won't believe from a government that is not on their side," Mr Miliband told MPs.

The Lib Dems - who will set out their own tax and spending plans on Thursday - claimed credit for coalition plans to raise the personal income tax allowance to £10,800 next year, more than previously expected.

Users of the BBC News app tap here, external for the Budget Calculator.

Lib Dem Business Secretary Vince Cable told BBC News: "Where we differ from the Conservatives... is that we don't believe you can deal with this deficit problem simply by cutting public spending.

"Many of our public services are already under a lot of pressure so we will be arguing for a different mix."

In his final set-piece pitch to voters before May's election, Mr Osborne announced that if the Conservatives win power the first £1,000 of savings interest would be tax free - meaning 95% of savers would pay no tax.

He also said savings put aside for a deposit by first-time buyers would be topped up by the government - to the tune of £50 for every £200 saved - in a move that will come into force this Autumn. The new Help to Buy ISA accounts will be made available through banks and building societies.

Other measures include:

Relaxing pension rules from April 2016 to allow up to five million existing pensioners to swap their fixed annual payments for cash

Annual tax returns to be scrapped and replaced with "digital tax accounts"

A fresh crackdown on tax avoidance and evasion, which he said would raise £3.1bn

Raising the rate of the bank levy to 0.21% to bring in an additional £900m a year

A further boost for regional growth, including extending enterprise and housing zones - and plans for a tidal lagoon to generate green electricity in Swansea Bay. Severn Crossing toll rates will be reduced from 2018

£1.3bn in tax cuts for North Sea oil exploration and continued production in older fields

The price of 20 cigarettes will go up by 16p as part of a the long-standing formula that the price rises by 2% above inflation but there will be no change to that formula

Read more - Budget reaction live and Budget key points at-a-glance

Mr Osborne hailed slightly better than expected growth figures, which suggest the economy will expand by 2.5% this year, rather than 2.4% and described his economic package as a "Budget for Britain - a comeback country".

He said the government had met its 2010 target to end this Parliament with Britain's national debt falling as a share of GDP, meaning the "the hard work and sacrifice of the British people has paid off".

Setting out his plans in the Commons, Mr Osborne said: "We took difficult decisions in the teeth of opposition and it worked. Britain is walking tall again.

"Five years ago, our economy had suffered a collapse greater than almost any country.

"Today, I can confirm: in the last year we have grown faster than any other major advanced economy in the world."

He said he would use a boost in the public finances caused by lower inflation and welfare payments to pay off some of the national debt and end the squeeze on public spending a year earlier than planned.

In 2019/20 spending will grow in line with the growth of the economy - bringing state spending as a share of national income to the same level as in 2000, the chancellor told MPs.

The BBC's Robert Peston said this was a move aimed at neutralising Labour's claim that the Conservatives would cut spending to 1930s levels.

But Shadow Chancellor Ed Balls said the Treasury's own figures showed spending at the "lowest level since 1938" in 2018/19 while the independent Office for Budget Responsibility, in its analysis, said Mr Osborne's plans implied a "rollercoaster profile" for expenditure over the next five years.

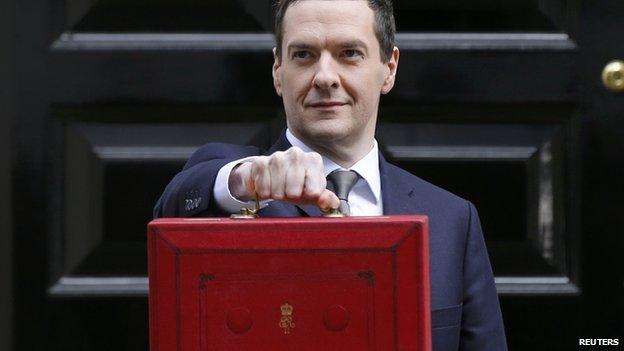

A traditional pose outside 11 Downing Street on Budget morning

Will we ever see a Conservative-Lib Dem coalition Budget again?

George Osborne was on his feet for 58 minutes in the Commons

Labour's frontbench team as the Budget is delivered

The government frontbench team watch Ed Miliband as he responds to the Budget

Mr Osborne insisted that deficit reduction remained his top priority but also unveiled measures aimed at increasing the amount people can earn before paying tax to £10,800 next year and an above inflation rise to £43,300 by 2017 for the amount people can earn before having to pay the 40p tax rate.

Some of the plans in Mr Osborne's statement are likely to depend on a Conservative victory on 7 May. Whoever wins the election is likely to set out another Budget later this year.

Analysis by BBC economics editor Robert Peston

If you think getting the debt down is the big priority, the last five years have seen a good deal of austerity for very delayed gain.

It is taking precisely twice as long as George Osborne hoped to get the debt down to 70% of GDP.

And to achieve that deferred gain, the Office for Budget Responsibility says the acuteness of austerity will get worse, before it gets a lot better.

Labour leader Ed Miliband claimed the Conservatives had a "secret plan" to cut the NHS because they would not be able to deliver their planned "colossal cuts" to other areas of public spending and they would also be forced to increase VAT.

He said Labour would reverse the tax cuts for millionaires and introduce a mansion tax to fund the NHS.

He also pledged to abolish the "vindictive and unfair" housing benefit changes he calls the "bedroom tax".

Ed Miliband: "This is a Budget people won't believe"

The SNP said Mr Osborne had "blown his last chance" to deliver for Scotland.

SNP deputy leader and Treasury spokesman Stewart Hosie said: "Today George Osborne could have delivered a Budget focused on delivering economic growth by tackling inequality.

"He has not - he has decided to continue with his utterly failed austerity agenda."

Analysis by BBC deputy political editor James Landale

The chancellor sprayed largesse far and wide - on drinkers and drivers, orchestras and air ambulances, churches and charities.

So yes no massive giveaway, no massive rabbit, as some Tory MPs had wanted, but a glimpse of better things to come and the road - as Mr Osborne put it - from austerity to prosperity. But the essential political argument hasn't changed.

UKIP Leader Nigel Farage said: "Mr Osborne talks about a long-term economic plan, today he pushed all his targets back and created a long grass economic plan."

Green Party leader Natalie Bennett said the chancellor's "triumphalist tone" would "leave a bad taste in the mouth" of people on zero hours contracts or struggling to put food on the table.

Plaid Cymru Treasury spokesman Jonathan Edwards said: "This was a 'jam tomorrow' Budget from a chancellor who is busy sharpening the axe ready for the next Parliament."

Mr Osborne's sixth Budget statement came against a backdrop of a strengthening economic recovery, a fresh fall in unemployment and a rosier picture expected as a result of falling oil prices dragging down inflation.

In was, in parts, an openly electioneering Budget, with Mr Osborne saying: "The critical choice facing the country now is this: do we return to the chaos of the past? Or do we say to the British people, let's work through the plan that is delivering for you?"

The Budget was largely welcomed by business leaders with CBI Director General John Cridland saying it would provide the "stability and consistency" needed to boost growth.

The trade unions were less impressed, with the TUC General Secretary Frances O'Grady saying: "He did not spell out where, if re-elected, he will make the huge spending cuts he plans for the next Parliament, nor did he tell Britain's low paid workers which of their benefits he will cut."

- Published18 March 2015

- Published18 March 2015

- Published18 March 2015

- Published18 March 2015

- Published18 March 2015

- Published18 March 2015

- Published18 March 2015

- Published17 March 2015

- Published18 March 2015

- Published17 March 2015