Greek bailout: UK 'could be overruled' on bridging loans

- Published

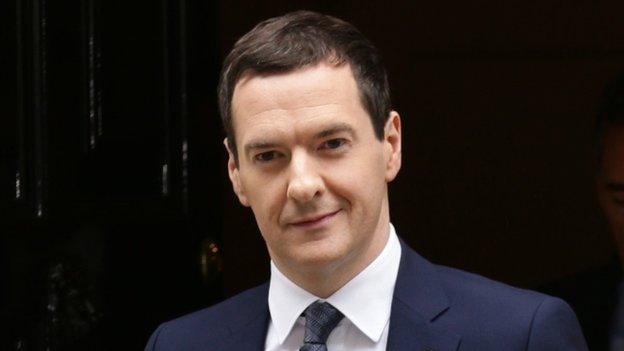

Chancellor George Osborne objected to the use of EU funds during a meeting with EU finance ministers

The European Commission is to suggest using an EU-wide emergency fund as part of the Greek bailout - despite UK opposition.

EU officials said the commission had legal backing to use the fund for loans of 12bn euros which could be given to Greece in the coming weeks.

The final decision will be made by a qualified majority of EU countries, which means the UK could be outvoted.

But Chancellor George Osborne said the eurozone should "foot its own bill".

The debate relates to the European Financial Stability Mechanism (EFSM) which is a fund , externalto support any of the 28 EU member states in financial difficulty.

It is funded by borrowing against the EU budget, to which the UK contributes.

The voting rules mean 15 countries representing 65% of the EU population would have to support using the fund - so the UK and the Czech Republic, which also objected, could be outvoted by the likes of France, which is in favour.

BBC Europe Correspondent Chris Morris said it was "certainly possible" that the fund would be invoked and there was "not much" the British government could do about it.

'Unanimous agreement'

Prime Minister David Cameron said in 2010 he had won a "clear and unanimous agreement" that the EFSM would not be used for further eurozone bailouts, after it was used to assist Ireland and Portugal.

Instead, responsibility was meant to fall on member states using the single currency.

But a commission source told BBC Europe correspondent Chris Morris the 2010 agreement would not apply in this case, and that the fund could be used to provide bridge financing for about four weeks until a new permanent bailout for Greece could be fully negotiated.

Britain would be liable for roughly 15% of any request - in the form of a guarantee rather than a hard cash transfer, he said.

'Non-starter'

Downing Street said there was no proposal at the EU finance ministers' meeting for the EFSM to be used.

A source close to the chancellor told BBC political correspondent Chris Mason the British government was "immovable on the key principle" that "British taxpayers won't contribute to Eurozone bailouts".

When pushed about the prospect of the UK losing such a vote, he was told "we will cross that bridge when we come to it".

Speaking as he arrived in Brussels, Mr Osborne said: "It's in the interests of economic stability across Europe that this Greek deal is now signed and sealed.

"But let me be very clear. Britain is not in the euro, so the idea that British taxpayers are going to be on the line for this Greek deal is a complete non-starter. The eurozone needs to foot its own bill."

- Published14 July 2015

- Published14 July 2015