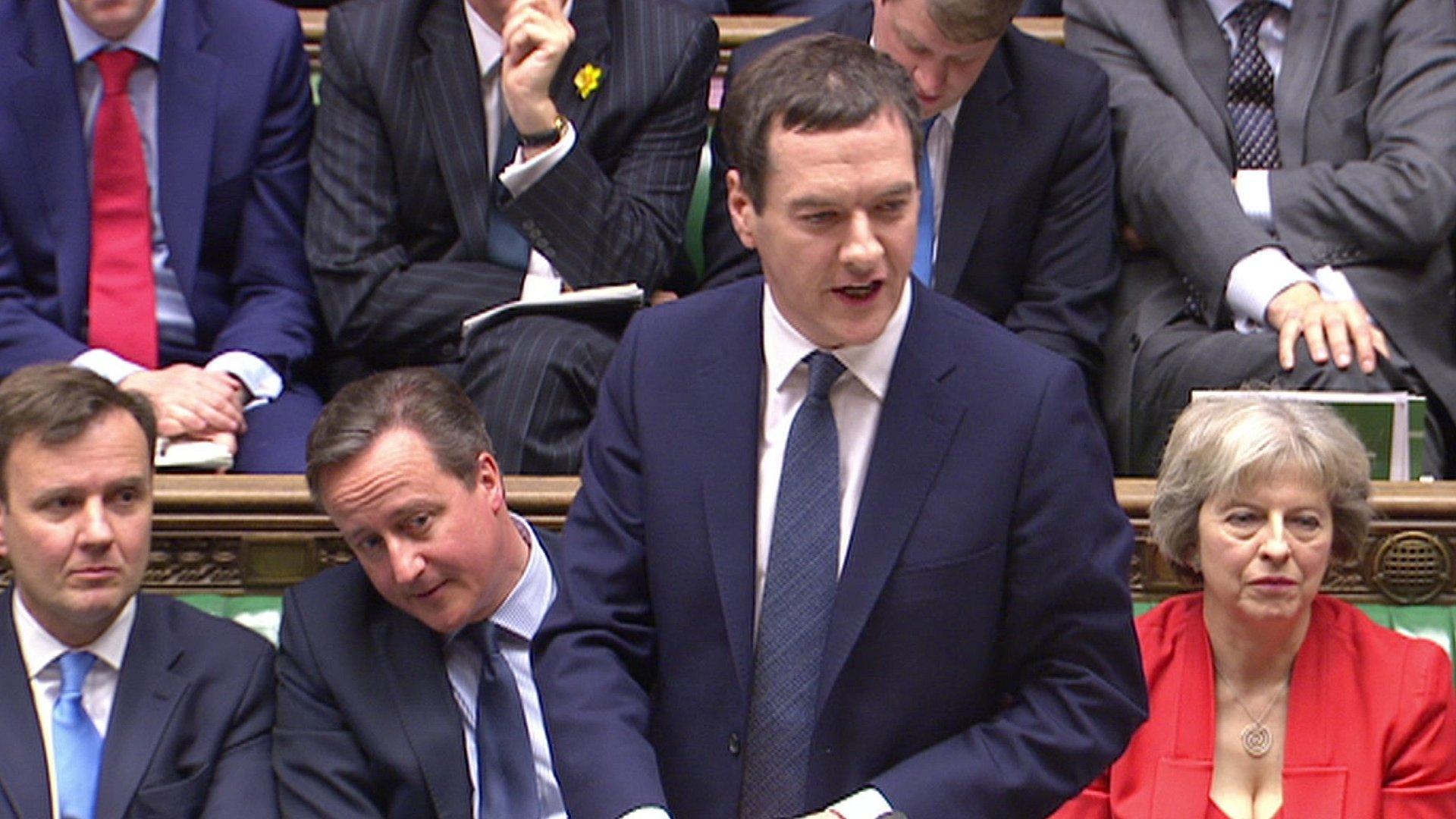

Sugar tax legal challenge: George Osborne says 'bring it on'

- Published

Chancellor George Osborne has told soft drinks companies to "bring it on" over reports some are considering a legal challenge to the new sugar tax.

The tax on the soft drinks industry was announced in the Budget, and will take effect from 2018.

Mr Osborne said the policy was legal and the government would "robustly" defend it against any court challenge.

He said the tax was the "right" thing to do, would help to combat childhood obesity and had been widely welcomed.

Mr Osborne told the Treasury Select Committee many companies were already doing "the right thing" by reducing sugar in their products and urged others to follow suit.

'Reformulate'

Asked about reports that some companies were considering challenging the legality of the policy, he said: "I would say, if they want to have an argument about the sugar tax, bring it on.

"We are going to introduce a sugar tax, it's not a threat or a promise, it's the way it's going to be."

The chancellor said the government would consult on technical details of tax ahead of its introduction in 2018 - a date, he said, which had been chosen to allow firms time to adjust.

Firms should use that period to "reformulate" their products rather than "waste time and money" on a legal challenge to the tax, he added.

The money raised by the tax is to be spent on primary school sports

The sugar tax on soft drinks was a surprise announcement by the chancellor in his Budget statement on 16 March.

It will be levied on the volume of the sugar-sweetened drinks companies produce or import.

There will be two bands - one for total sugar content above 5 grams per 100 millilitres and a second, higher, band for the most sugary drinks with more than 8 grams per 100 millilitres, with the levels yet to be set.

The £530m it is expected to raise - the equivalent of about 18-24p per litre, the government says - will be spent on primary school sports in England, with the devolved administrations in Scotland, Wales and Northern Ireland free to decide how to spend their share.

- Published16 March 2016

- Published16 March 2016