Budget 2017: Self-employed 'tax raid' a 'rookie error'

- Published

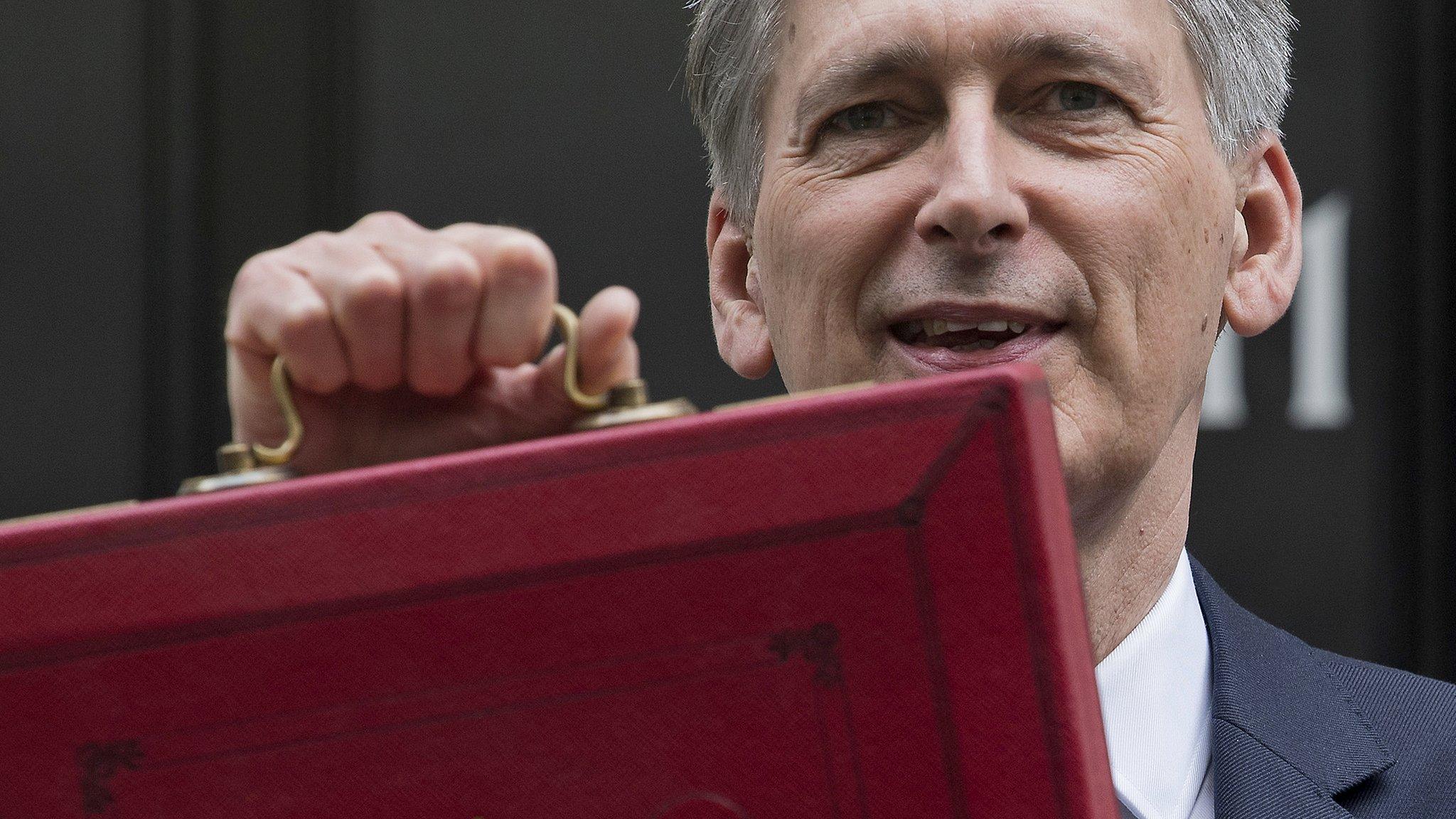

Chancellor Philip Hammond gave his Budget on Wednesday

Chancellor Philip Hammond's "tax raid" on the self-employed in the Budget has been described as a "rookie error" by former Tory chancellor Lord Lamont.

He told the BBC the Conservative election pledge not to increase National Insurance, income tax and VAT was a "mistake".

He said Mr Hammond should "drop" the NI increase, which has been criticised by newspapers and some Conservative MPs.

But Prime Minister Theresa May has defended the rise as "fair".

The Institute for Fiscal Studies think tank has also backed the proposal, arguing the current system had needed reform.

'What is said matters'

The change, announced on Wednesday in Mr Hammond's first Budget statement since becoming chancellor, will see millions of self-employed workers pay an average of £240 a year more but ministers say those earning £16,250 or less will see their NI contributions fall.

Lord Lamont told BBC Radio 4's Today programme: "The real danger is that this continues because what he made clear was that this gap in the taxation - the national insurance of the self-employed and the employed - he intends to eliminate.... That would be a profound error."

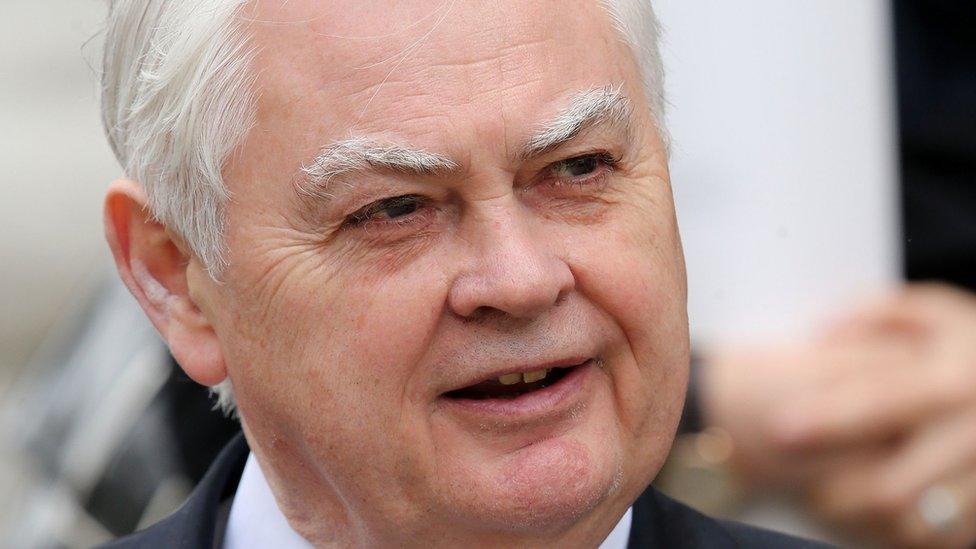

Lord Lamont was chancellor between 1990 and 1993

Lord Lamont said the increase was "not just a political mistake" but also an economic one as the UK had benefitted from the rise in the number of self employed people.

Writing in the Daily Telegraph,, external Lord Lamont described the government's manifesto pledge as "unwise in the extreme".

Lord Lamont, , who was chancellor from November 1990 until May 1993, wrote: "Election pledges should not be lightly given... and tax pledges cannot be lightly cast aside...

"What is said in a general election matters.

"Whatever politicians like to think, voters don't focus on the small print.

"What really counts when voters are making up their minds is the overall drift they pick up.

"It's therefore unwise for politicians to act as if the small print offers an escape route."

He added: "My guess is that, in time, the chancellor's tax raid on the self-employed will be seen as a rookie error."

Labour and the Liberal Democrats have criticised the change - as did more than a dozen Conservative MPs, including Iain Duncan Smith, John Redwood, Anna Soubry and Dominic Raab.

Mrs May has defended the rise, saying the poorest workers will pay less and the change will "close the gap in contributions".

But she has said the plans will not go before MPs until the autumn.

The BBC's political correspondent Ross Hawkins said the move was an attempt to take the heat out of the immediate political crisis.

The decision prompted Labour to say the government was in "disarray" and had carried out a "partial u-turn".

Labour's shadow chancellor John McDonnell said: "The fact the prime minister won't fully support her own chancellor's Budget measure, and has been forced by Labour to row back on it just 24 hours after he delivered his speech in Parliament, shows the level of disarray that exists at the top of government."

'Death tax'

Meanwhile the increase in probate fees, which concern the administration of a dead person's estate, has also been criticised by Tory backbenchers calling it a "death tax".

Previously the charges were capped at £215 but the limit will now sit at £20,000 and be linked to the size of the estate.

Plymouth, Sutton and Devonport MP, Oliver Colvile, told the Daily Mail, external: "I have real concerns about this. We absolutely do not need a death tax - which is what this sounds like."

During consultation for the increase, 810 of the 831 responses were negative.

It is not right for the government to introduce "stealth taxes", North East Somerset MP Jacob Rees-Mogg said.

"Probate charges should relate to the cost of the probate work, which is broadly irrelevant to the size of the estate.

"There might be some more work for bigger estates, but the difference will not necessarily be as large as has been proposed."

- Published10 March 2017

- Published9 March 2017

- Published9 March 2017

- Published8 March 2017