Budget 2020: 'No apology' for borrowing, says chancellor

- Published

- comments

Rishi Sunak delivered the Budget to the Commons on Wednesday

Borrowing more money to invest into the UK is "the right economic thing to do", the chancellor has said.

Rishi Sunak told the BBC that interest rates were at a "multi-decade low" and he was "not going to make an apology" for the Budget - which included a £30bn package of investment.

The Bank of England announced a cut in interest rates on Wednesday.

But the Resolution Foundation warned of a £575 a year blow to households, even before the impact of coronavirus.

The think tank said the mark down of the UK economy by the Office of Budget Responsibility, without taking the outbreak into account, was "incredibly grim and yet still unbelievably optimistic".

Its chief executive, Torsten Bell, said: "In reality, once we take the economic impact of coronavirus into account, this is the weakest official growth outlook on record."

Labour's John McDonnell told the BBC's Today programme he welcomed more investment from the government, but "10 years of austerity brought the country to our knees" and the Budget was "only going part way to making up" for Tory cuts.

The chancellor said the plans he laid out on Wednesday were a "significant step change" for the government and the amount it would invest in infrastructure.

As well as a £5bn emergency response fund for the NHS and a number of other measures to tackle the coronavirus outbreak, he announced spending of more than £600bn on roads, rail, housing and broadband across the next five years.

Sunak: Budget is a "very coherent plan"

But questioned over the OBR's low growth forecasts in the short term, Mr Sunak said the organisation had praised the government's long-term investment plans.

"We can look at that as see we are on the right track with the plans we are doing, and it will start to have an immediate effect on people," he told Today.

'Unprecedented'

Former Prime Minister Theresa May urged "restraint and caution" on spending after the Budget announcement.

She told the Commons: "Although spending a lot of money may be popular and may seem the natural thing to do, there is, of course, that necessity to have a realistic assessment of the longer term impact of those decisions and of the longer term consequences.

"It is also necessary to ensure that we have that restraint and caution that enables us to make the public finances continue to be strong into the future."

Mr Sunak defended his plans, saying he would be sticking to the fiscal rules set out in his the Tory's election manifesto.

"But we are going to take advantage of these historically and unprecedented very low interest rates to invest in the long-term productivity of our economy," he said.

"That is, I think, the right economic thing to do, whilst overall having stable management of our debt."

Mr Sunak added: "I am not going to make an apology for responding at scale in a comprehensive fashion to the immediate challenges we face from coronavirus. I do think that is the right thing to do."

This is a new government with a new chancellor much hungrier for spending, much hungrier for borrowing and much less bothered about the size of the national debt - and we are talking about very, very big numbers here.

The case the government makes is: it is coherent and correct to do this as it is dead cheap for governments to borrow in the long term.

Rishi Sunak believes that what started off as a temporary, extraordinary period of low interest rates is basically now locked in for the long term.

It is the economic and political fashion now to think it is going to be a long-term situation, therefore if borrowing is so cheap, why wouldn't you want to be more flash with the cash?

But with respect to the economists, sometimes their crystal balls are a bit wonky, things can change, and some Conservatives on the backbenches believe this may not be the time to run up a new, additional, huge overdraft.

However, the government's judgement is 'now is the time' - not least because they want to be able to keep the very many promises they have made to electorate.

Easy budgets are ones where you stand up and write big cheques. But sometimes they pave the way for much harder budgets in the years to come.

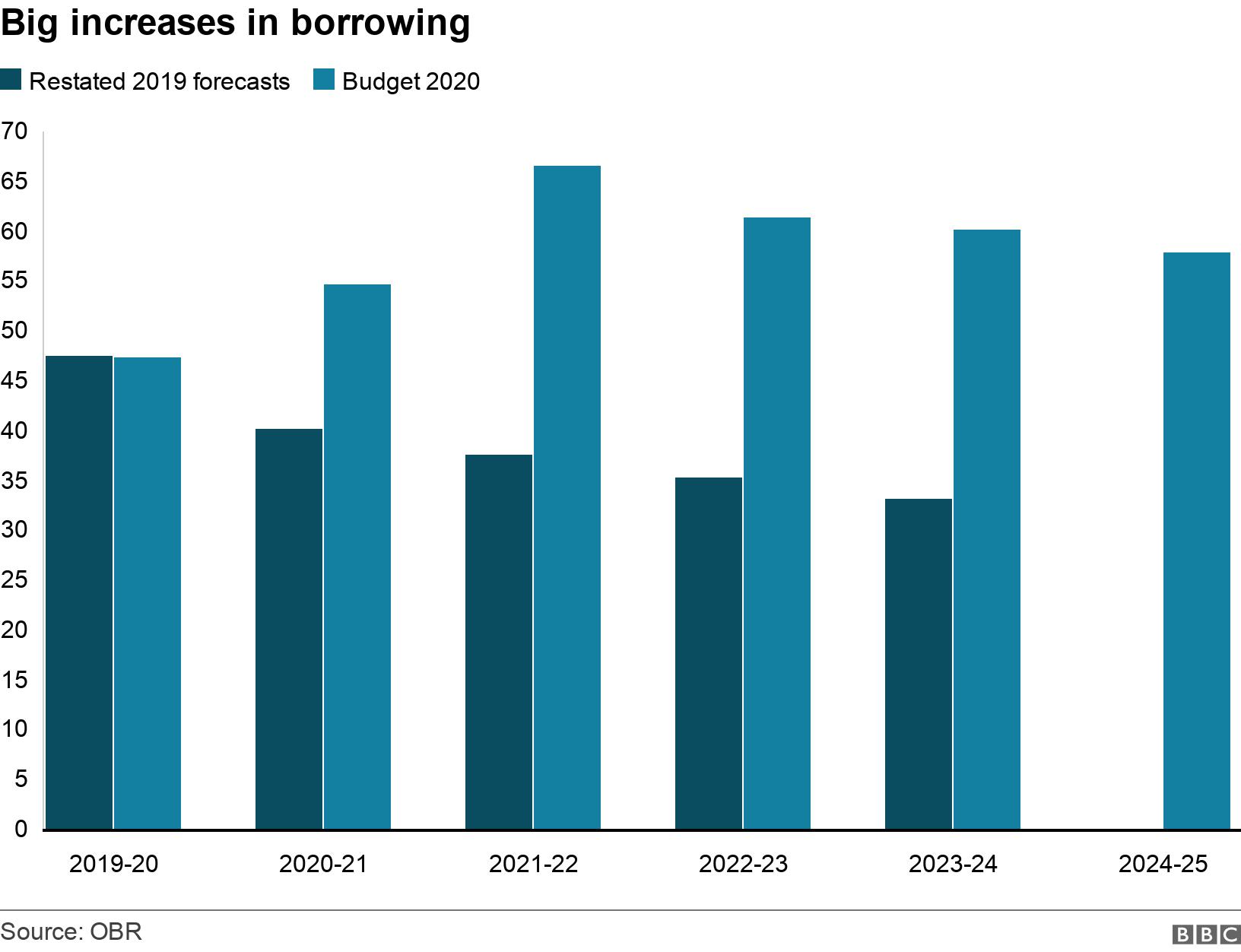

The spending in this Budget is being largely paid for with a big increase in government borrowing.

The government expects to borrow almost £100bn more in this Parliament (before mid-2024) than was expected the last time we had any forecasts.

And that figure does not include £12bn to be spent on getting the economy through the coronavirus outbreak.

The Treasury documents say that money will be accounted for in the next Budget in the autumn.