Akshata Murty: Inquiry into leak of Rishi Sunak's wife's taxes begins

- Published

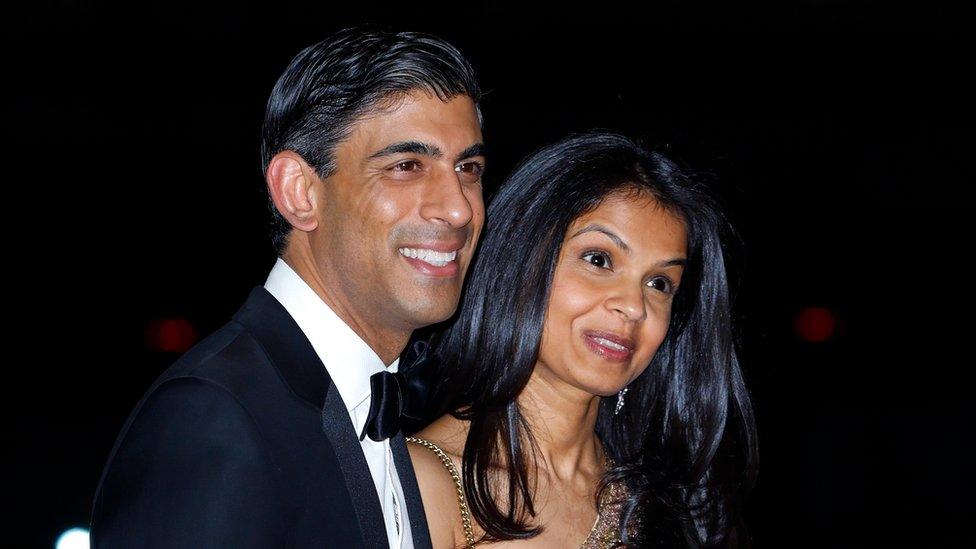

Rishi Sunak married Akshata Murthy in 2009, after meeting her as a student in California

A Whitehall inquiry is under way into how the tax affairs of Chancellor Rishi Sunak's wife were leaked to the media, the BBC has been told.

Akshata Murty has said she will pay UK taxes on her overseas income, following a row over her non-domicile status.

She owns £700m in shares of the Indian IT giant Infosys - founded by her father - from which she received £11.6m in dividend income last year.

Labour has said the row raises questions about Mr Sunak's judgement.

As a non-domiciled (non-dom) UK resident, Ms Murty is not required by law to pay UK taxes on her overseas income. The BBC estimates this would have saved her £2.1m a year in UK tax.

After details of her non-dom status appeared in the press on Wednesday evening, Mr Sunak said his wife had not "done anything wrong" and it was unfair to attack her as a "private citizen".

But on Friday, Ms Murty announced she would change her tax arrangements, telling the BBC she did not want to be a "distraction" for her husband.

Asked about the U-turn on the BBC's Sunday Morning programme, Policing Minister Kit Malthouse said the couple had recognised the situation "offended against a British sense of fair play".

"They recognise that there was a disconnect perhaps in the British public's understanding of what was appropriate, and they've corrected that situation now for the future," he added.

No 10 has rejected newspaper reports that its staff leaked damaging stories about Mr Sunak to the media.

Elsewhere, Health Secretary Sajid Javid told the Sunday Times, external he had claimed non-domicile status for six years when he was a banker, between 2000 and 2006.

A non-dom is someone who lives in the UK but declares their permanent home to be in another country.

It has been a bruising week for the chancellor, leading to him asking senior civil servants for a full investigation to establish who divulged his wife's tax status.

His allies say very few people had access to the personal information, which Mr Sunak declared to Whitehall officials when he became a minister in 2018.

Some Conservative MPs say he was naive to think the details would remain private, and that he should have predicted that the tax arrangements would be criticised as inappropriate, despite being legal.

Mr Sunak's team has dismissed suggestions of a rift with Downing Street and say the prime minister has been "incredibly supportive".

But Mr Sunak's brand - vigorously promoted since he came to office - has been damaged, with some Tories questioning his judgement.

Friends have also confirmed to the BBC reports in the Sunday Mirror, external that the chancellor's wife and daughters are moving out of Downing Street and back to the family home in west London. Mr Sunak will join them at weekends.

The decision is said to have been made well before this row hit the headlines.

Labour's shadow home secretary Yvette Cooper said there remained a "series of questions" for the chancellor to answer - including whether he had declared his wife's tax status when taking "policy decisions" affecting non-dom households.

She told the Sunday Morning programme: "The lack of transparency does raise questions about conflict of interest.

"But it's also about basic fairness - and I don't think the chancellor still gets that, and that raises real questions about his judgement.

"The fact that they have changed their tax arrangements now shows that they do recognise it's a problem - but they wouldn't have done that if this hadn't been public."

The Liberal Democrats have urged Mr Sunak to ban the partners of ministers from claiming non-dom status, calling it a "loophole".

Labour has previously advocated scrapping non-dom status entirely, under previous leaders Ed Miliband and Jeremy Corbyn.

Asked whether her party still held that position, Ms Cooper said its policy on non-doms was subject to a wider review of tax policy being undertaken by shadow chancellor Rachel Reeves.

What is a non-dom?

A non-dom is a UK resident who declares their permanent home, or domicile, outside of the UK.

A domicile is usually the country his or her father considered his permanent home when they were born, or it may be the place overseas where somebody has moved to with no intention of returning.

For proof to the tax authority, non-doms have to provide evidence about their background, lifestyle and future intentions, such as where they own property or intend to be buried.

Those who have the status must still pay UK tax on UK earnings but do not need to pay UK tax on foreign income. They can give up their non-dom status at any time.

Ms Murty has chosen to be domiciled in India via her father, the billionaire Narayana Murty.

Read more here.

Related topics

- Published7 April 2022

- Published8 April 2022

- Published9 April 2022