Reality Check: How is the referendum affecting the pound?

- Published

The claim: The pound is up and the FTSE 100 share index is at the same level as it was in March.

Reality Check verdict: Nigel Farage is right about the levels compared with March, but looking a few months further back and considering options markets may give a more useful view of concerns on the currency markets about the risks of a Brexit.

UKIP leader Nigel Farage was asked on the Andrew Marr show about Friday's falls on the markets and whether it was to do with fears about the UK leaving the European Union.

Mr Farage said: "Sterling is up since March. Since Brexit became a possibility, sterling is up and FTSE is exactly the same level it was in March.

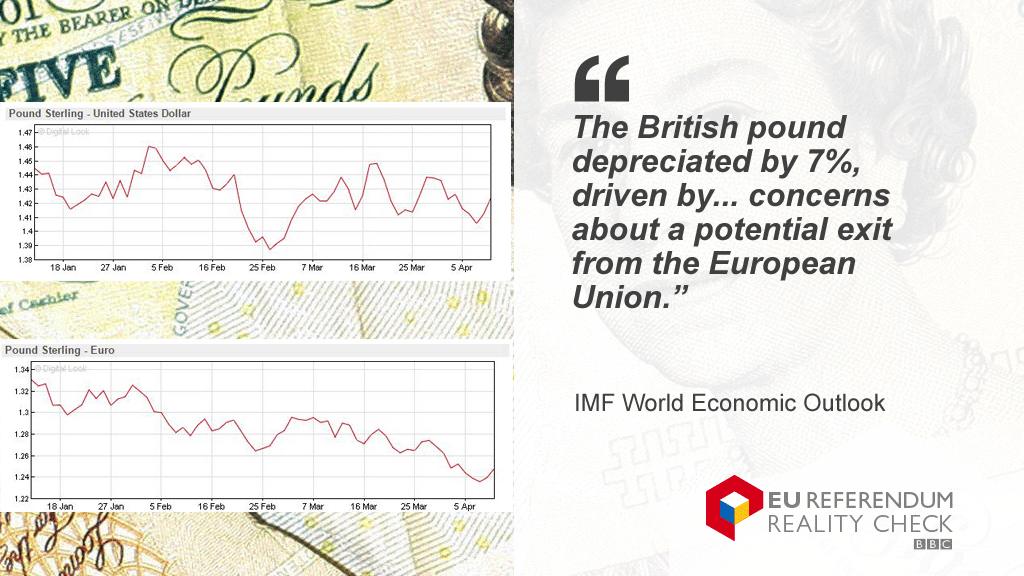

Let's have a look at the value of the pound against the euro first. It was below the level it is now towards the end of March.

But was March a good month to compare it with? The Bank of England's quarterly inflation report, external in May blamed half of the fall in the value of the pound since November on uncertainty about the referendum. It's now fallen by about 11% since November.

There have also been signs on the options markets that traders have concerns about a depreciation in the pound. Bank of England governor Mark Carney told a parliamentary committee in March that there had been big increases in traders buying options as protection against falls in the pound in the coming months.

The FTSE 100, meanwhile, is also trading at levels it saw in March, although it is less clear how closely tied the index is to the state of the UK economy - many of its biggest components are multi-national companies, more affected by commodity prices than whether the UK stays in the EU.

There are various forecasts for what would happen to the pound if the UK left the EU.

The National Institute of Economic and Social Research predicted that by 2030 one pound would be worth about one euro, which would be a depreciation of more than 20%, but that comes with the usual caveats about the uncertainties surrounding forecasts and economic modelling.

- Published6 June 2016

- Published6 June 2016

- Published12 April 2016

- Published22 February 2016