More Scottish authorities agree 2017/18 council tax rises

- Published

Edinburgh residents will have a 3% rise

Four more local authorities in Scotland have agreed to put up council tax bills.

While Edinburgh, East Renfrewshire and Borders councils agreed rises of 3%, while Aberdeenshire Council approved a rise of 2.5%.

Earlier this week, Midlothian and Comhairle nan Eilean Siar (Western Isles) voted for a 3% increase.

Orkney Council may also indicate whether it may raise bills but a formal decision will not be made until later.

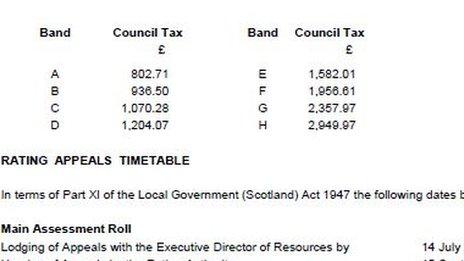

Local authorities can raise the basic council tax bill by up to 3% but people in Band E-H properties face automatic rises because of national changes.

Typically a 3% rise in Band D bills will cost householders £3-£4 a month - the figures vary from council area to area. However, Band E-H billpayers will still have to pay more even if a council decides to freeze the basic bill.

City of Edinburgh Council's decision will result in a general increase of 3%

The rest of Scotland's 32 councils will decide whether to raise basic council tax over the next few weeks.

Many have given no public indication of what may happen.

However, Labour-run Glasgow, West Dunbartonshire and Fife councils are likely to opt for 3% rises.

But South Lanarkshire and Inverclyde councils, which are also led by Labour, have both said they plan to keep basic bills frozen.

Local government funding has been the subject of intense debate at Holyrood.

Cosla, which represents most councils, says local authorities across Scotland face some £200m of cuts.

The Scottish government has consistently argued that its plans would mean more money would be available for local services overall. Its calculations included the changes to council tax nationally, potential local increases and ring-fenced money that will be given to head teachers to help them raise attainment.

But councils countered that there would be less government money for ongoing commitments.

Last week the government agreed to give £160m more to councils than originally planned to win support from the Greens for its Budget.

The council tax typically accounts for about 15% of a council's budget.

The overall amount raised by a 3% rise and the changes to bands will often be relatively modest. Western Isles said the two changes together would bring in just over £500,000.

As a general rule, more prosperous areas will benefit the most from the changes to the way bills for Band E-H properties are calculated - but head teachers in these areas will also get less from the government's ring-fenced money to raise attainment.

- Published2 March 2017

- Published9 February 2017

- Published9 February 2017

- Published8 February 2017

- Published8 February 2017

- Published16 January 2017