Paradise Papers: Celtic shareholder Dermot Desmond’s private jet firm used tax haven

- Published

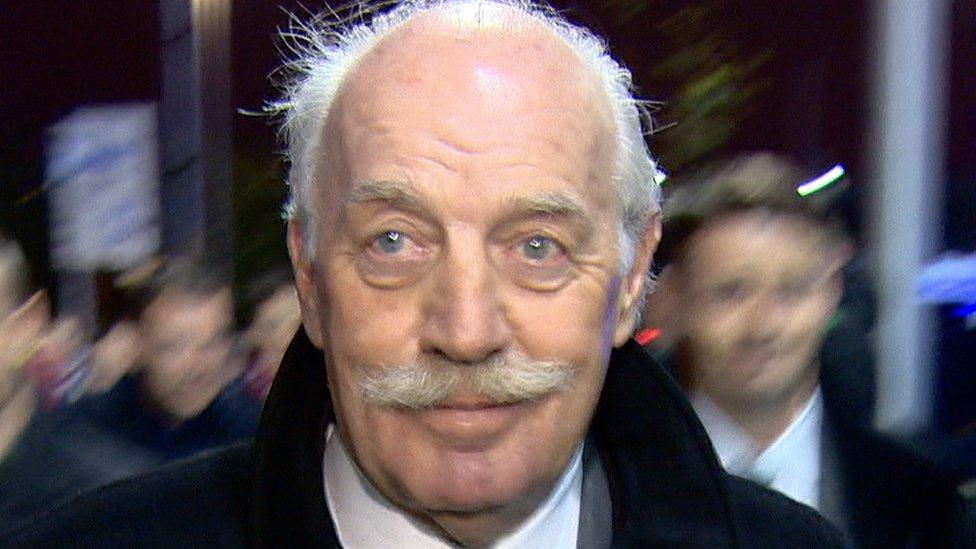

The BBC attended Celtic Park to question Dermot Desmond about the tax arrangements

Billionaire Dermot Desmond's exclusive private jet company used an offshore tax haven to avoid taxes, according to documents in the Paradise Papers.

The Irish businessman, who is the biggest single shareholder in Celtic FC, owned the Swiss-based Execujet for eight years until he sold it in 2015.

The leaked papers reveal Execujet asked a law firm to open an Isle of Man company in 2012 to avoid Swiss taxes.

Mr Desmond strongly denies his former company avoided tax.

He said it was "tax and regulatory compliant in all jurisdictions it operated in".

BBC Scotland's investigations team is the only Scottish partner involved in the global media project examining more than 13 million documents mostly leaked from the offshore law firm Appleby.

Paradise Papers - exposing the tax secrets of the ultra-rich

Emails from the leak, dubbed the Paradise Papers, suggest Execujet may have avoided up to $1.3m (£1m) in Swiss taxes over three years.

The offshore structure implemented by Appleby is legal but tax expert Philip Simpson QC told the BBC it appeared to be "an aggressive avoidance arrangement".

He added that the Isle of Man company seemed to be controlled from Switzerland, which could make it liable for taxes there.

"Negative tax consequence"

Execujet is based in Switzerland

Execujet is an exclusive aviation company that manages 160 business jets and employs about 1,000 people in seven regions around the globe.

Its headquarters are in Switzerland.

Internal Appleby documents explained that Execujet had to pay a 5% stamp duty levy on its insurance premium because Switzerland was listed as its main office for insurance purposes.

The documents called this a "negative tax consequence".

They said: "Accordingly ExecuJet would like to set up a company in the Isle of Man, namely ExecuJet (IOM) Limited, to be the primary insured under the above policy."

The Isle of Man is a self-governing British Crown dependency that lies in the Irish Sea between Cumbria and Northern Ireland. It considers itself to be a low-tax financial centre rather than a tax haven.

There is no aviation insurance tax in the Isle of Man, meaning that by switching its primary insured office from Switzerland to the island Execujet was able to avoid the 5% charge on a $3.8m (£2.91m) insurance policy, resulting in savings of up to $190,000 (£145,000) a year.

To do the switch, Appleby staff created a shell, or "brass plate", company in the Isle of Man calling it Execujet (IOM), and installed another shell company, General Controllers, staffed with Appleby executives, as the sole director.

Source documents

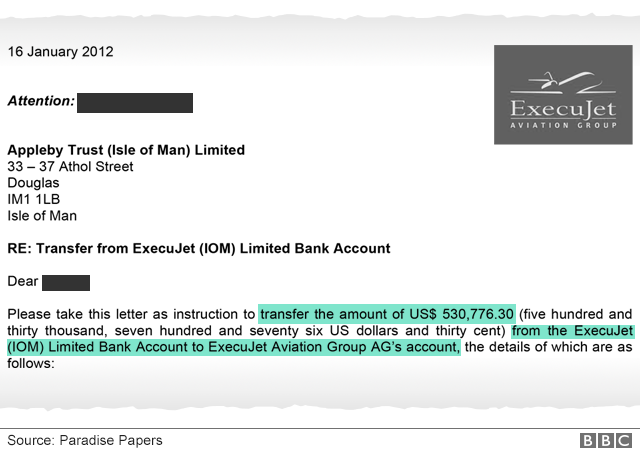

Execujet sent money from the Isle of Man straight back to its headquarters in Switzerland

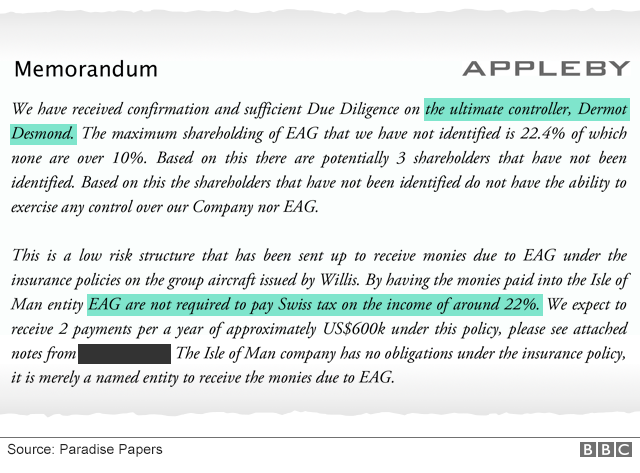

The money paid to the Isle of Man company meant EAG did not have to pay Swiss tax

Swiss tax

But that was not the only benefit.

Due to the way its aircraft insurance was structured, Execujet was entitled to a "brokerage" fee from its insurers, which amounted to about $1.2m (£920,000) a year. According to the data, this could be classed as income and therefore would be taxable in Switzerland.

An Appleby memo said: "By having the monies paid into the Isle of Man entity EAG [Execujet Aviation Group] are not required to pay Swiss tax on the income of around 22%."

It added: "We expect to receive two payments per year of approximately US$600k (£460,000) under this policy."

According to the leaked emails, that cash was funnelled straight from the Isle of Man back into Switzerland, apparently tax free, on instructions from Execujet executives in Switzerland.

The BBC asked both Mr Desmond and Execujet whether tax on this income had been subsequently paid.

Neither responded directly to that question, but said that all taxes that were due had been paid.

Making all the decisions

The emails suggest the Isle of Man's activities were being dictated from Execujet's Swiss HQ.

For example, on 9 June 2015, Execujet's insurers, Willis, wanted to make a payment of $45,000 (£34,500) to Execujet (IOM).

But Willis dealt with Execujet in Switzerland.

A Swiss-based EAG executive then emailed an Appleby employee on the Isle of Man to say: "When this payment arrives, please transfer it to our EAG bank account."

On another occasion, Execujet instructed Appleby to transfer more than $500,000 into the Swiss account.

Tax expert Philip Simpson QC told the BBC that if individuals in Switzerland were making all the decisions about what the Isle of Man company did, such as immediately paying money to the Swiss companies, then it would mean the company was actually tax resident in Switzerland.

This might leave the structure open to challenge by the Swiss tax authorities.

Mr Simpson said: "If it's resident in Switzerland then, despite the structure that has been put in place, stamp duty is due on the insurance premium paid and Swiss corporation tax is due on the money received back from the insurance broker.

"From what I've seen it suggests control may be being exercised from Switzerland.

"It would certainly be reasonable to describe this as an aggressive avoidance arrangement given, in particular, what appears to be a lack of economic substance to the Isle of Man company."

Written inquiries

Mr Desmond bought Execujet in 2007, and sold it 2015. The data suggests the tax avoidance scheme operated from 2012 until at least 2015.

The BBC wrote to Mr Desmond five times during its investigation, asking about the structure. He failed to respond to any written inquiries.

Dermot Desmond questioned outside Celtic Park

Are you a Rangers supporter?

When approached by BBC Scotland's Mark Daly outside Celtic Park on Tuesday last week, ahead of the Celtic v Bayern Munich match, he said it was "absolutely wrong" to suggest the Isle of Man Execujet company was a tax avoidance vehicle.

When pressed further, Mr Desmond said: "I'm not duty bound to educate you in how we run our affairs.

"Every company in the Isle of Man is not for avoidance of tax," he added.

When asked why the Isle of Man company was created if it was not for the purposes of avoiding Swiss aviation tax and to repatriate brokerage fees that were being made to Execujet from its insurers, Mr Desmond replied: "That would be giving away confidential information about a company that I no longer own and I'm not in a position to give you that information."

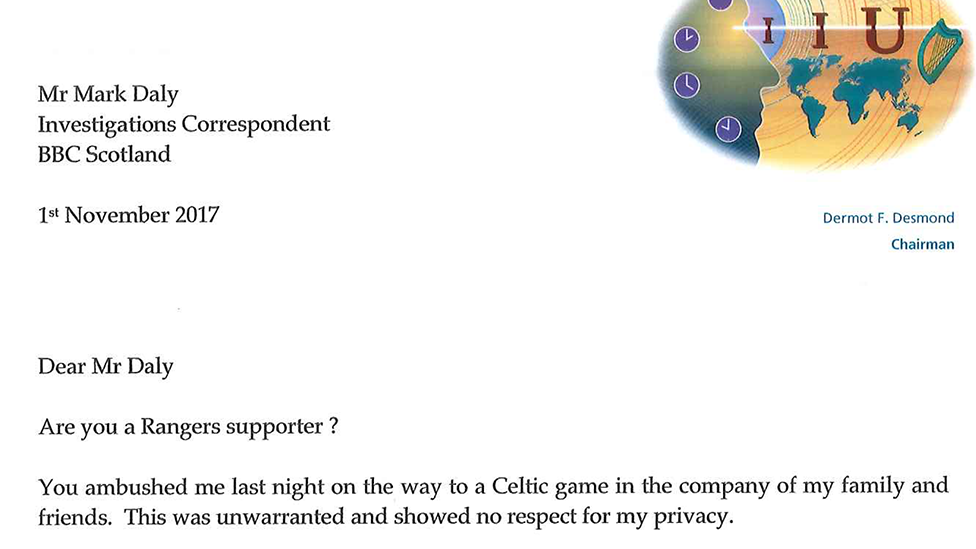

The next day Mr Desmond wrote to the BBC, asking: "Dear Mr Daly, Are you a Rangers supporter?"

Mr Desmond added: "I have not previously responded to your ill-informed questions.

"However, as I informed you last night, during my period of majority ownership, Execujet was tax and regulatory compliant in all jurisdictions it operated in; nor was it under any investigation.

"There are good operational reasons for having a presence in the Isle of Man and many international companies do so."

Mr Desmond continued: "If you choose to publicly state that my investments are not tax and regulatory compliant or make any other untrue allegation about me whether by innuendo or otherwise, I will take action against the BBC and against you personally in both Scotland and Ireland for defamation and breach of privacy."

Irish investigative journalist Matt Cooper, who was sued by Mr Desmond in 2011, told BBC Scotland: "You don't become a billionaire unless you are absolutely aggressive in making sure that you make as much profit as you can from your businesses and that you keep as much of that profit for yourself."

Mr Cooper added that "privacy trumps all" for the Irish billionaire.

He said: "I can only imagine he would feel that these are his private matters that are of no concern to the general public or to the media.

"But there certainly is a public interest in tax avoidance.

"This is one of the major issues internationally I think for a feeling of equality of fairness that there shouldn't be an elite who are able to minimise the contribution that they are making to the effective running of society at a time when ordinary workers have no opportunity to avoid taxes and they all pay their fair share."

Execujet said: "ExecuJet, a private company, operates in many countries around the world.

"It is very important to ExecuJet that it is compliant with all tax rules globally.

"Several years ago, ExecuJet chose the Isle of Man as it is a centre for insurance and re-insurance companies providing an attractive financial and fiscal environment.

"However, for some time now, ExecuJet IOM has not been required and is therefore no longer used."

Reporting team: Mark Daly, Calum McKay, Ian Bendalow and Rachael Miller

Who is Dermot Desmond?

The 67-year-old billionaire is one of Ireland's richest men.

He was born in Cork in 1950, the eldest of four children, and moved to the northside of Dublin when he was six.

Mr Desmond began his career with Citibank in Dublin and went on to be a banking consultant for PricewaterhouseCoopers in Afghanistan, leaving when the Russians invaded in 1979.

In 1981, he set up his own company, NCB Stockbrokers, and developed the business so that it became Ireland's third-largest stockbroking firm.

During the early 1990s, he became known as the promoter of the International Financial Services Centre (IFSC) in Dublin's docklands, which is now home to 400 international companies.

In 1994, Mr Desmond sold NCB to the National Westminster Bank (now the Royal Bank of Scotland) for a reported €39 million and started his own private equity firm, International Investment and Underwriting (IIU).

Over the years, Mr Desmond has amassed a sizeable fortune through acquisitions and investments such as his involvement in Esat, the telecom group founded by Denis O'Brien.

In 2006, Mr Desmond made headline news when he sold London City Airport for a reported €1.2bn (£750m).

He had bought the airport for about €30m (£23m) in 1995.

The investment was considered a large risk at the time, as London's docklands was in recession and Canary Wharf was in receivership.

The airport has since become one of the more profitable in the UK.

He also made substantial amounts from selling his share of Greencore in 2006.

The previous year Mr Desmond bought one-third of Latvia's Rietumu Banka.

Mr Desmond's other interests include Betdaq, a global player in the betting exchange sector, and the Titanic Quarter Development in Belfast.

Mr Desmond tries to keep out of the spotlight but his public profile is boosted considerably by his position at Celtic Football Club in Glasgow.

He previously had a stake in Manchester United but is now the largest individual shareholder of Celtic, owning more than 30% of the club.

The papers are a huge batch of leaked documents mostly from offshore law firm Appleby, along with corporate registries in 19 tax jurisdictions, which reveal the financial dealings of politicians, celebrities, corporate giants and business leaders.

The 13.4 million records were passed to German newspaper Süddeutsche Zeitung, external and then shared with the International Consortium of Investigative Journalists, external (ICIJ). Panorama has led research for the BBC as part of a global investigation involving nearly 100 other media organisations, including the Guardian, external, in 67 countries. The BBC does not know the identity of the source.

Paradise Papers: Full coverage, external; follow reaction on Twitter using #ParadisePapers; in the BBC News app, follow the tag "Paradise Papers"

Watch Panorama on the BBC iPlayer (UK viewers only)

Watch Scotland's Paradise Papers on Tuesday at 19:00 on BBC One Scotland.