Paradise Papers: Oil firm uses tax haven 'shell' company

- Published

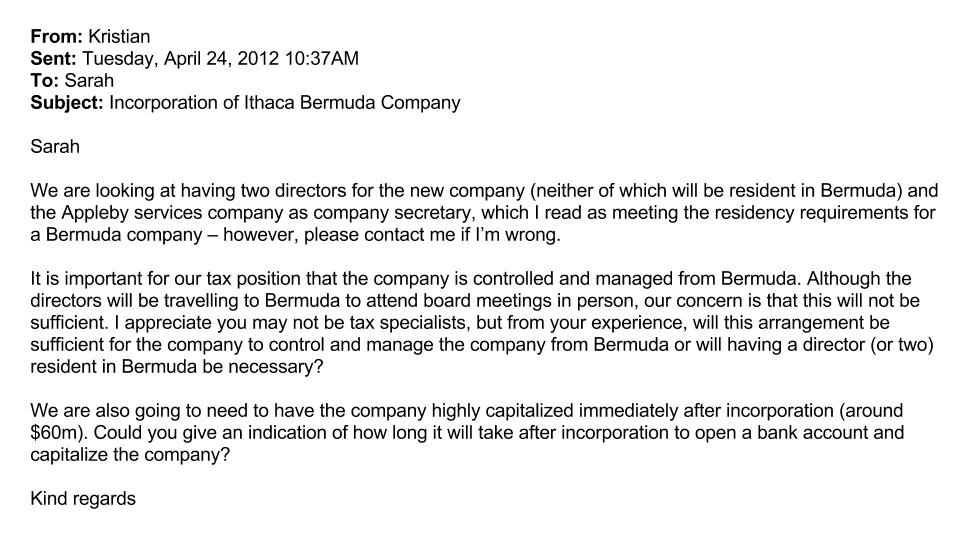

Ithaca bought the FPF-1 oil production platform in 2012

A major oil firm, headquartered in Aberdeen, uses an offshore haven for its "tax position," documents from the Paradise Papers reveal.

Ithaca Energy set up a "shell" company in the tax haven of Bermuda in 2012 to purchase its share in a $50m (£38m) North Sea oil production platform.

In the leaked papers, Ithaca stated it was "important" to its tax position the company was controlled from Bermuda.

Ithaca said its tax charges "are not reduced" by the Bermudian company.

A spokesman for the energy firm told the BBC the offshore company "was set up for corporate structuring reasons".

Paradise Papers - Tax secrets of the ultra-rich

Bermuda is a popular offshore financial centre because it does not levy income tax or capital gains tax.

Documents held by law firm Appleby and seen by BBC Scotland suggest Ithaca, which is listed on the Toronto Stock Exchange, was being managed and controlled from Scotland and Canada - not Bermuda.

Although the arrangement is not illegal, this could allow UK tax authorities to challenge the structure.

Source document

Tax experts consulted by BBC Scotland believe the structure is artificial, with control being exercised from the UK.

The experts believe it is designed to funnel profits into Canada in the form of tax-free loan repayments and dividends.

Holding company

Ithaca purchased almost 50% of two companies called FPF1 Limited and FPU Services, based in another tax haven, Jersey.

These companies in turn owned and leased the FPF-1 floating production unit, an oil platform the length of a football pitch and almost 30 metres high.

FPF-1 was modified for use in the Stella fields in the central North Sea and began production in February this year.

Immediately before the purchase of shares in the Jersey companies, Ithaca sought out law firm Appleby in Bermuda to set up a new holding company.

This would own its shares in the Jersey companies.

A Bermudian bank account was also set up for Ithaca and was "heavily capitalised".

This enabled it to finance the purchase of the oil platform and the required modifications through a series of inter-company loans to the Jersey companies.

In emails seen by BBC Scotland, it was made clear by Ithaca's legal team that: "It is important for our tax position that the company is managed and controlled from Bermuda."

However, the Paradise Papers reveal:

minutes of board meetings were being prepared from Aberdeen

a board meeting was held in Bermuda with no-one physically present on the island (Ithaca's chief financial officer, Graham Forbes, phoned in from Scotland and board member Chuck Lee joined the call from Canada)

on other occasions, Mr Forbes flew into Bermuda for a board meeting, despite there being no apparent commercial activity taking place in the country

Future taxes

Production from the oil platform only began this year, oil prices are low and UK producers are entitled to significant tax breaks which make it unlikely that there will be taxable profit from the production platform any time soon.

However, Prof Reuven Avi-Yonah, an international tax law specialist at the University of Michigan Law School, said the structure is about avoiding future taxes.

He said: "They say they won't pay tax until 2020 but at some point this will reverse.

"You want to plan ahead when you do these things because doing it when you actually are profitable is harder."

Prof Avi-Yonah suggested the "whole show" was being run from Aberdeen and not Bermuda.

He said: "I think the point is to take the profits that are derived from operations in the North Sea and to funnel them through the Jersey company to Bermuda and then have them sit there as long as you want until the Canadian company wants to have them, and at that point you send them out to Canada and they're tax exempt in Canada as well because they're treated as dividends.

"It's perfectly clear. The only reason to have a Bermuda company in there is because Bermuda is a tax haven.

"I can't see any other reason to have this extra holding company in this structure."

If the company was in fact being controlled from the UK, it would nullify any Bermuda tax benefits and potentially lead to a challenge from HMRC.

Ithaca boss responds to BBC questions over tax haven

Graham Forbes, Ithaca's chief financial officer, did not respond to questions about the purpose of the Bermudian company or about how it was managed and controlled.

But in an email, he said the allegations had an "absence of foundation" and BBC Scotland had a "wholly inaccurate understanding of the commercial structure of the Ithaca Group's business".

Mr Forbes said: "The tax charges of the Ithaca Group are not reduced by the existence of Ithaca's Bermudian company which was set up for corporate structuring reasons.

"The Jersey-registered company that owns the FPF-1 was not set up by Ithaca, rather it existed and owned the FPF-1 vessel for a number of years prior to Ithaca obtaining its interest.

"Ithaca acquired its interest in that company as part of a much wider set of transactions enabling the FPF-1 vessel to be used for the development of the Stella field."

Reporting team: Mark Daly, Calum McKay, Ian Bendalow and Rachael Miller.

The papers are a huge batch of leaked documents mostly from offshore law firm Appleby, along with corporate registries in 19 tax jurisdictions, which reveal the financial dealings of politicians, celebrities, corporate giants and business leaders.

The 13.4 million records were passed to German newspaper Süddeutsche Zeitung, external and then shared with the International Consortium of Investigative Journalists, external (ICIJ). Panorama has led research for the BBC as part of a global investigation involving nearly 100 other media organisations, including the Guardian, external, in 67 countries. The BBC does not know the identity of the source.

Paradise Papers: Full coverage, external; follow reaction on Twitter using #ParadisePapers; in the BBC News app, follow the tag "Paradise Papers"

Watch Panorama on the BBC iPlayer (UK viewers only)

Watch Scotland's Paradise Papers on Tuesday at 19:00 on BBC One Scotland.