Paradise Papers live coverage: evening summarypublished at 21:35 GMT 7 November 2017

We are going to finish our coverage at the end of day three of the Paradise Papers revelations.

The huge trove of leaked documents has made headlines around the world on the offshore financial affairs of hundreds of politicians, multinationals, celebrities and high-net-worth individuals.

Here are today's top stories so far:

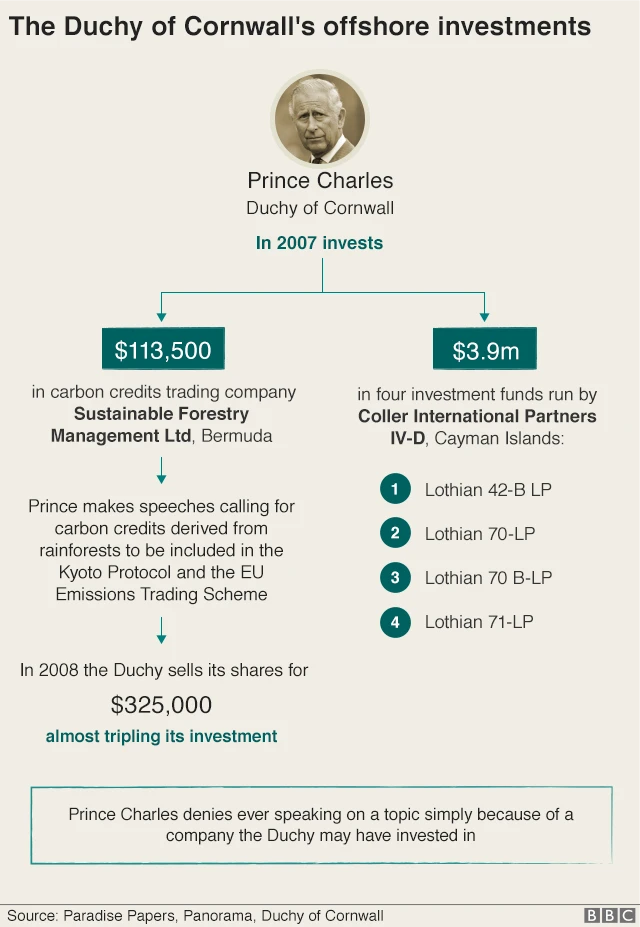

- Prince Charles campaigned to alter climate-change agreements without disclosing his private estate had an offshore financial interest in what he was promoting

- An entrepreneur charged with managing the oil wealth of the struggling African state of Angola was paid more than $41m in just 20 months

- The Isle of Man has rejected claims it is a tax haven, saying it doesn't welcome those "seeking to evade or aggressively avoid taxes"

They came after a wave of stories on Monday, including:

- Apple has protected its low-tax regime by using the Channel Island of Jersey

- Formula 1 champion Lewis Hamilton avoided tax on his £16.5m luxury jet, the papers suggest

- A Lithuanian shopping mall partly owned by U2 star Bono is under investigation for potential tax evasion

- How three stars of the hit BBC sitcom, Mrs Brown's Boys, diverted more than £2m into an offshore tax-avoidance scheme

And the stories on day one revealed:

- The Queen's private estate invested about £10m offshore including a small amount in the company behind BrightHouse, a chain accused of irresponsible lending

- One of President Donald Trump's top administration officials kept a financial stake in a firm whose major partners include a Russian company part-owned by President Vladimir Putin's son-in-law

- Lord Ashcroft, a former Conservative party deputy chairman, has denied allegations he ignored the rules around how his offshore investments were managed.