Scottish budget: How will the changes affect you?

- Published

- comments

Seonaide Barclay works in a care home and her husband Gordon works for the NHS

Deputy First Minister John Swinney has outlined the Scottish government's tax and spending plans for the year ahead.

He told MSPs how devolved tax revenues and the block grant from the UK government will be spent in 2023/24, announcing increases in income tax for everyone earning more than £43,662.

It follows a series of UK-wide spending cuts and tax rises announced by Chancellor Jeremy Hunt in November - some of which applied in Scotland.

What does the Scottish government have the power to change in terms of tax and spend, and how will the UK and Scottish announcements affect you?

Your pay slip: Income tax, national insurance and the National Living Wage

Most people in the UK can earn up to £12,570 every year without paying income tax on it. This is called the personal allowance and is set by the UK government.

The personal allowance and the main National Insurance thresholds have been frozen for a further two years, until April 2028.

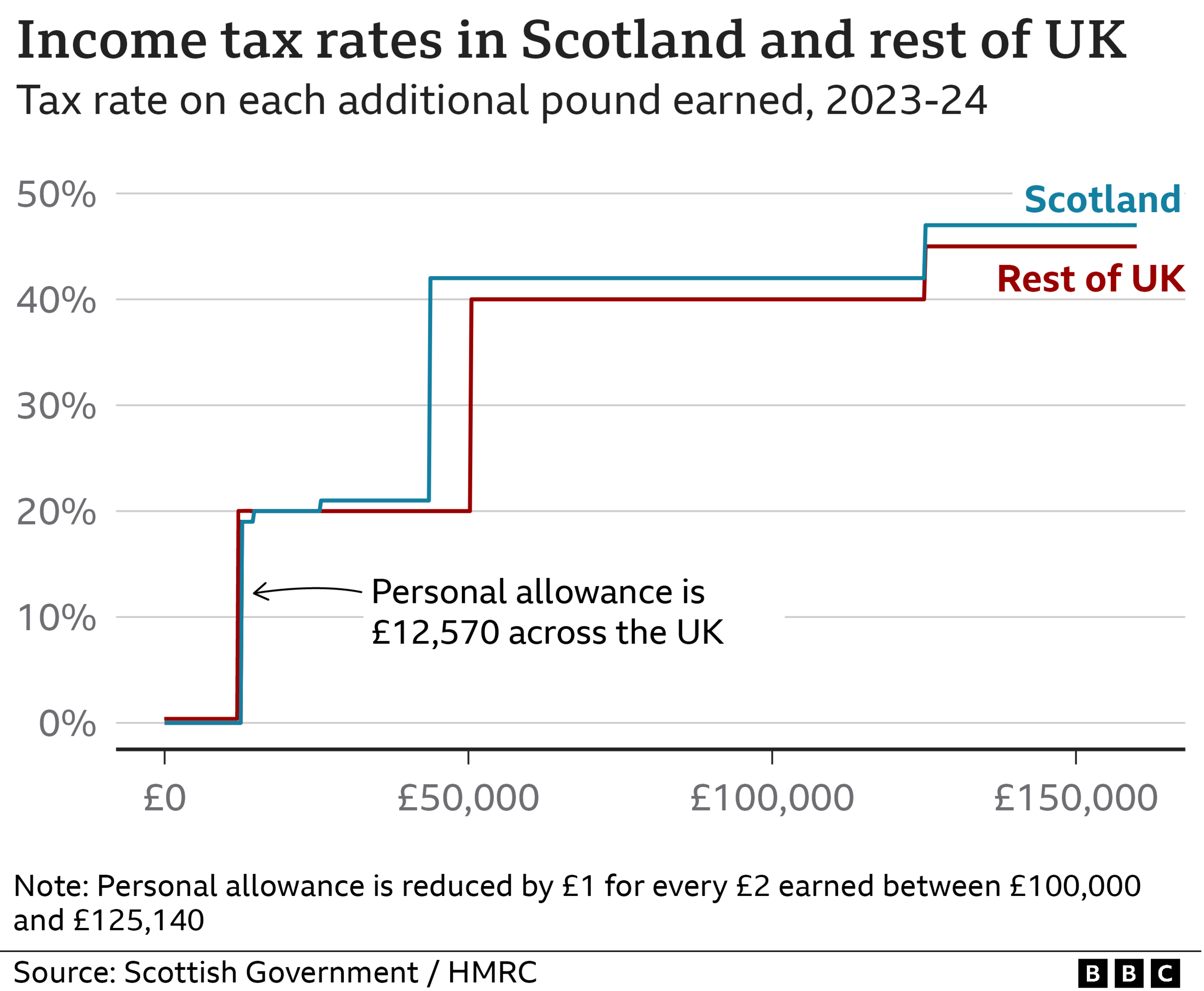

Since 2017/18 people in Scotland have been paying income tax at rates set by the Scottish government, rather than Westminster.

More people in England, Wales and Northern Ireland will move into the top tax bracket from April, under changes outlined by Mr Hunt in November.

Mr Swinney announced a similar change, as well as a 1p increase to the rate of tax paid in the higher and top bands.

The UK government sets the National Living Wage, which will rise from £9.50 an hour for workers aged over 23, to £10.42 an hour from next April.

Living Wage Scotland says the "real living wage" is £10.90, external , a calculation of what employees need to live on. This has been adopted by some employers.

Council tax and business rates

Council taxes pay for services like refuse collection, schools and gritters

Each local authority is responsible for setting their council tax rate but the Scottish government has in the past capped any increases at 3%.

Last year was the first time councils were given complete freedom to set their rates since the SNP came to power in 2007.

The same flexibility will apply this year, which could mean increases to council tax.

Mr Swinney confirmed an extra £550m for local government next year although local authorities had been asking for much more.

He said councils should "consider carefully the cost pressures facing the public" when deciding the rate they will charge people.

In England, councils will be able to increase the tax by 5% next year.

Last year local government received an additional £120m in a bid to minimise council tax increases.

However, since then Finance Secretary Kate Forbes - who is currently off on maternity leave - has warned there will be a real-terms cut to funding of parts of the public sector, including local government.

Council umbrella body Cosla says local authorities are in an "extremely precarious financial situation" due to the real-terms funding cuts and rising prices.

The Scottish government also sets non-domestic rates, or business rates, which are taxes on "non-domestic properties".

The tax is administered and collected by councils and it helps pay for local council services.

Mr Swinney set out plans to freeze business rates after the measure was called for by 19 trade bodies.

The budget will also offer transitional relief for businesses seeing the most significant increases in their rateable values following the 1 April 2023 revaluation.

Taxes on property, profits and inheritance

In England and Northern Ireland, homebuyers have to pay stamp duty but Scotland has its own equivalent called the land and buildings transaction tax. , external

Homebuyers in Scotland start paying the tax on properties costing more than £145,000 (or £175,000 for first-time buyers).

South of the border, stamp duty only applies to properties over £250,000.

In Scotland, people buying a second home must also pay an additional dwelling supplement on properties worth more than £40,000 - the rate of which has now risen from 4% to 6% from 16 December.

The Scottish government has no control over capital gains tax - a tax on the profit when you sell something that has increased in value - as it is set at Westminster.

It may have to be paid on the profit from the sale of a second home, a valuable painting or jewellery, for example.

The UK government also controls inheritance tax thresholds, which will be frozen for a further two years, until April 2028.

VAT, fuel and alcohol duties

These UK-wide additional taxes are set at Westminster.

VAT is currently charged at 20% on many goods and services, with a reduced rate of 5% on domestic fuel and power, children's car seats and some other goods.

Motorists also pay VAT on fuel, as well as fuel duty of 52.95p per litre of petrol or diesel. The price of a litre of mid-strength beer includes 19.08p in alcohol duty.

Mr Hunt has said that road tax would have to be paid on electric cars, vans and motorcycles from April 2025.

Pensions and benefits

The full state pension is set by the UK government and is currently £181.15 a week, for those who reached state pension age after April 2016. It will rise in line with inflation to £203.85 a week next year.

People who reached state pension age before April 2016 currently receive £141.85 a week and will see their payments rise to £156.20 a week.

Some pensioners on a very low income also qualify for pension credit. Most will also receive a winter fuel payment of between £250 and £600, which this year includes a cost of living benefit.

Universal credit is available to people - in work and out of work - on low incomes. The amount they receive depends on their earnings.

A benefits cap means a couple cannot receive more than £20,000 a year (£13,400 for a single person) in universal credit and a number of other benefits.

These are all set by the UK government. The chancellor has said means-tested and disability benefits, as well as state pensions, will increase by 10.1%, in line with inflation.

The uplift will affect the incomes of about 472,000 people on universal credit and more than 900,000 receiving state pensions in Scotland.

Help with rising energy prices

Worried about energy bills? The BBC's Colletta Smith tells you - in a minute - about four discounts and payments that could help

The UK government has capped the maximum price people can be charged for each unit of energy as part of its Energy Price Guarantee.

Since October, that has limited a typical household's bill to £2,500. Mr Hunt said the cap would rise to £3,000 from April for one year.

Under Westminster's Energy Bills Support Scheme, external, all homes will also receive a £400 discount on their electricity bill this winter.

My Hunt said households on means-tested benefits would get a £900 cost of living payment next year, £300 for pensioner households and £150 for people on disability payments.

Meanwhile the Scottish government is replacing the UK government's cold weather payment with a winter heating payment.

It pays out £50 once a year to about 400,000 low income families. Westminster's payment pays £25 for each seven days period of very cold weather to people on certain benefits.

Mr Swinney announced £20m that had been set aside for an independence referendum will instead be used to extend the fuel insecurity fund - which helps people at risk of fuel poverty.

Payments for children

The UK government sets child benefit payments at £21.80 a week for the eldest child and £14.45 for each additional child.

Families on low incomes can also receive universal credit for their children, although this is limited to two children if they were born after 7 April 2017.

The Scottish government has called on Westminster to lift the two child limit and the benefits cap.

Meanwhile, Scottish ministers have put in place a number of benefits to help parents on low incomes with young children.

A Best Start pregnancy and baby payment of £642.35 is available for new parents welcoming their first child, or £321.20 for subsequent children.

Two more one-off payments of £267.65 are paid when the child is between two and three years, six months, and then at school age.

They could also qualify for the Scottish child payment - £25 a week for every child under 16 living in households in receipt of certain benefits.

Help for the disabled and their carers

Child disability payments have replaced the disability living allowance for children in Scotland, after it came under the Scottish government's remit.

A weekly rate of between £24.45 and £156.90 is available to cover the extra costs a disabled child might have.

The same rate is in place in the rest of the UK as the disability living allowance for children.

An adult disability allowance pays out between £61.85 and £156.90, after it replaced equivalent benefits paid by the UK government.

The UK government pays a carers' allowance of £69.70 a week. In Scotland it is supplemented twice a year with a payment which is currently £245.70.

- Published2 November 2022

- Published17 November 2022

- Published1 June 2022

- Published27 September 2022