Homeowners' insurance cancelled over concrete fears

- Published

The concrete was found to be in homes in Aberdeen's Balnagask area

Homeowners in a housing estate built with potentially dangerous concrete have had their insurance cancelled, BBC Scotland News has learned.

Reinforced autoclaved aerated concrete (RAAC) was used in about 500 homes in Aberdeen's Balnagask area, including 364 council-owned properties.

Council tenants have been told they will be permanently rehoused.

A private landlord told BBC Scotland it was "devastating" to discover his properties would no longer be insured.

The 1960s council housing estate, in the Torry area, was investigated after concerns over the crumbling concrete were raised across the UK.

About 140 of the affected homes are privately owned and either owner-occupied or rented privately.

Aberdeen City Council (ACC) said it would support its tenants and engage with owners and privately rented tenants to keep them informed.

It urged owners of affected properties to get independent assessments of their property, however, when some homeowners followed their advice to discuss their insurance policies, external with their provider, they were told their cover would cease.

The council's own housing insurance is unaffected, a spokeswoman confirmed. It contacted its insurer to check the matter after it learned RAAC was in properties in late 2023.

One couple, who did not want to be named, told BBC Scotland News they had been given two-weeks notice of cancellation of the insurance on two properties they rent out in Balnagask.

"I'm fuming, absolutely fuming," the owner said. "We just really can't believe this is happening - its devastating for everyone involved."

Their insurance broker responded to a query from the couple saying they had "referred the construction of your property to your current provider and they have advised that unfortunately they would not be able to continue offering cover".

It went on to say that none of the other insurers they worked with "would be able to offer terms either".

'They have just pulled the plug on us'

It added that their policy would be cancelled from the date of posting the letter and end on 15 March.

While there is no legal obligation for a landlord to have insurance in Scotland, it may be required by a mortgage lender.

The owner said he had been in touch with the ombudsman because the couple were "stumped" if anything happened to the properties and felt "helpless".

"We don't know what we can do to help our tenants, because if the council don't buy our properties back, we can't just go and buy more property without being refunded for those ones," he said.

"On the email we got from Aberdeen City Council, it says we needed to contact our insurance, so I was just following what they asked me to do. And now they have just pulled the plug on us."

He added: "We don't have mortgages, but we need that money back.

"What are they going to do - just knock them down and give us nothing? And that's our pension fund, basically.

"Nobody is concerned about the homeowners or their tenants. We aren't the government or the council - we don't have an endless pot of money."

Crumbling RAAC

The Scottish government has said it will continue to keep in close contact with the local council to ensure those affected receive the appropriate support.

Speaking in the Scottish Parliament, SNP MSP Audrey Nicoll warned that residents were facing problems with insurance and home values were going towards "potentially zero equity".

Ms Nicoll added that some of her constituents were facing a "very difficult financial predicament".

Social Justice Secretary Shirley-Anne Somerville called on insurance companies to behave responsibly.

She added that financial support was a matter for the local authority but that she understood on-to-one assessments were being conducted and "wraparound support" would be offered to those facing extra costs.

Ms Somerville said that Aberdeen council would ensure residents found suitable alternative accommodation, but said the buildings had not been assessed as "critical risk", meaning that immediate evacuation was not necessary and residents would not be compelled to leave.

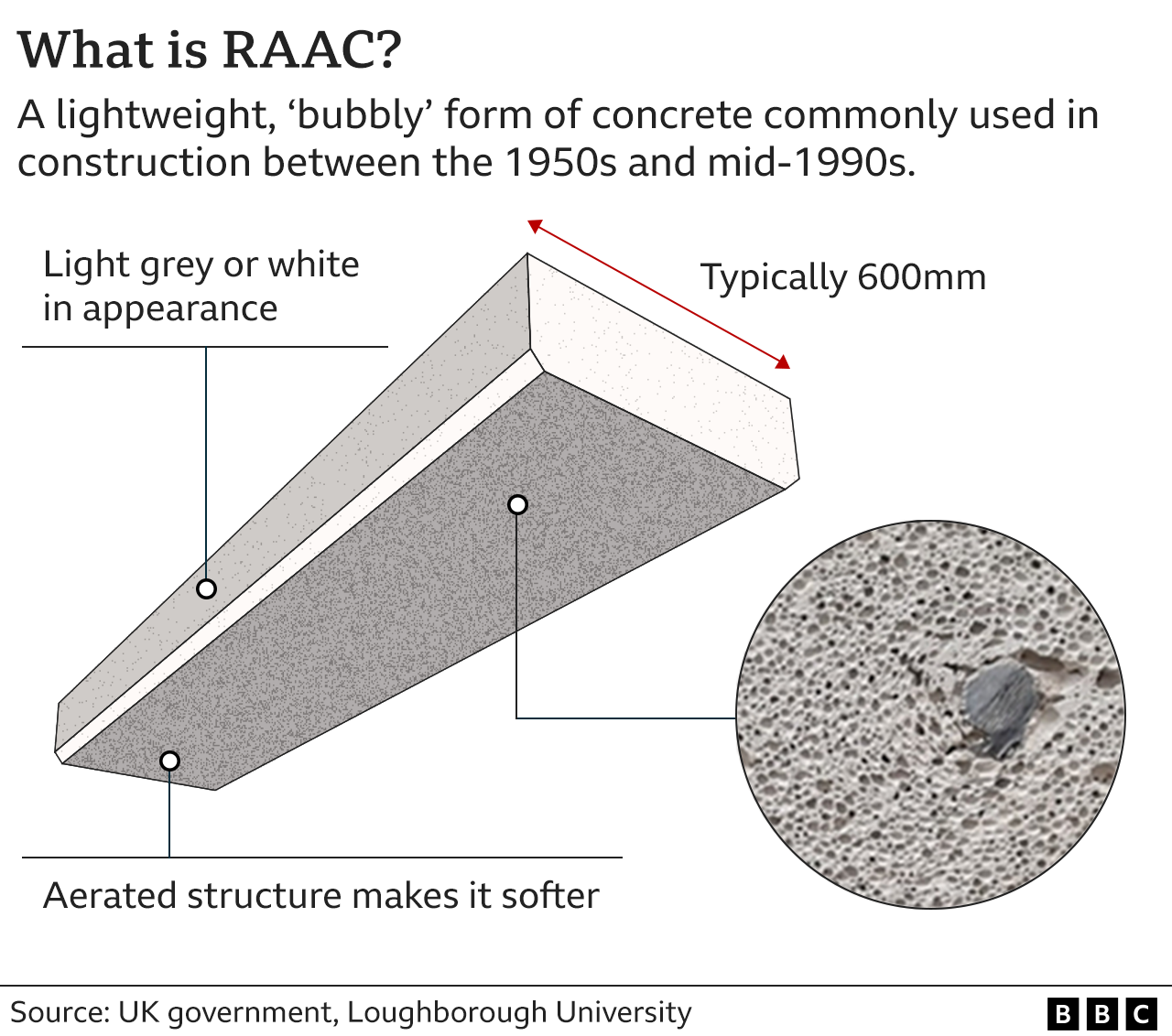

RAAC is a cheap version of concrete that was used mostly in construction between the 1950s and 1990s.

It has a lifespan of about 30 years and concerns have mounted about the impact of water ingress on its safety.

The Health and Safety Executive (HSE) said it was now beyond its lifespan and may "collapse with little or no notice".

The Association of British Insurers previously told the BBC that if a policyholder is concerned about RAAC in their building, they should contact their insurer as repairs may not be covered.

A spokesperson said: "Domestic buildings insurance policies are generally designed to cover damage from named perils such as storms, floods, subsidence or damage from theft.

"They're not intended to cover defects, cracking or collapse that might arise from the choice of building materials and so the use of RAAC may not be covered."

BBC Scotland News understands the council hopes the majority of council tenants will be rehomed by the end of the summer.

It is thought about 60 of the council-owned properties are currently empty.

Council officers are currently exploring options for the long-term viability for the site, which include remedial works or demolition.

A detailed appraisal will be presented to the council within six months.

Related topics

- Published1 March 2024

- Published29 February 2024

- Published3 October 2023

- Published6 September 2023