Tax reform planned for offshore oil and gas industry

- Published

The UK government has announced plans which could radically change the way the offshore oil and gas industry is taxed.

It is moving away from a focus on maximising revenue for the Treasury.

The government has admitted that the new priority of maximising extraction will mean a lower tax burden.

Danny Alexander, the chief secretary to the Treasury, said ministers would consult on several new approaches to taxation.

These will be in addition to tax concessions announced in the chancellor's Autumn Statement, which included an immediate cut in the supplementary charge element of offshore tax, from 32% to 30%.

There was also more flexibility in tax allowances announced for companies that have yet to see an income stream from their investments.

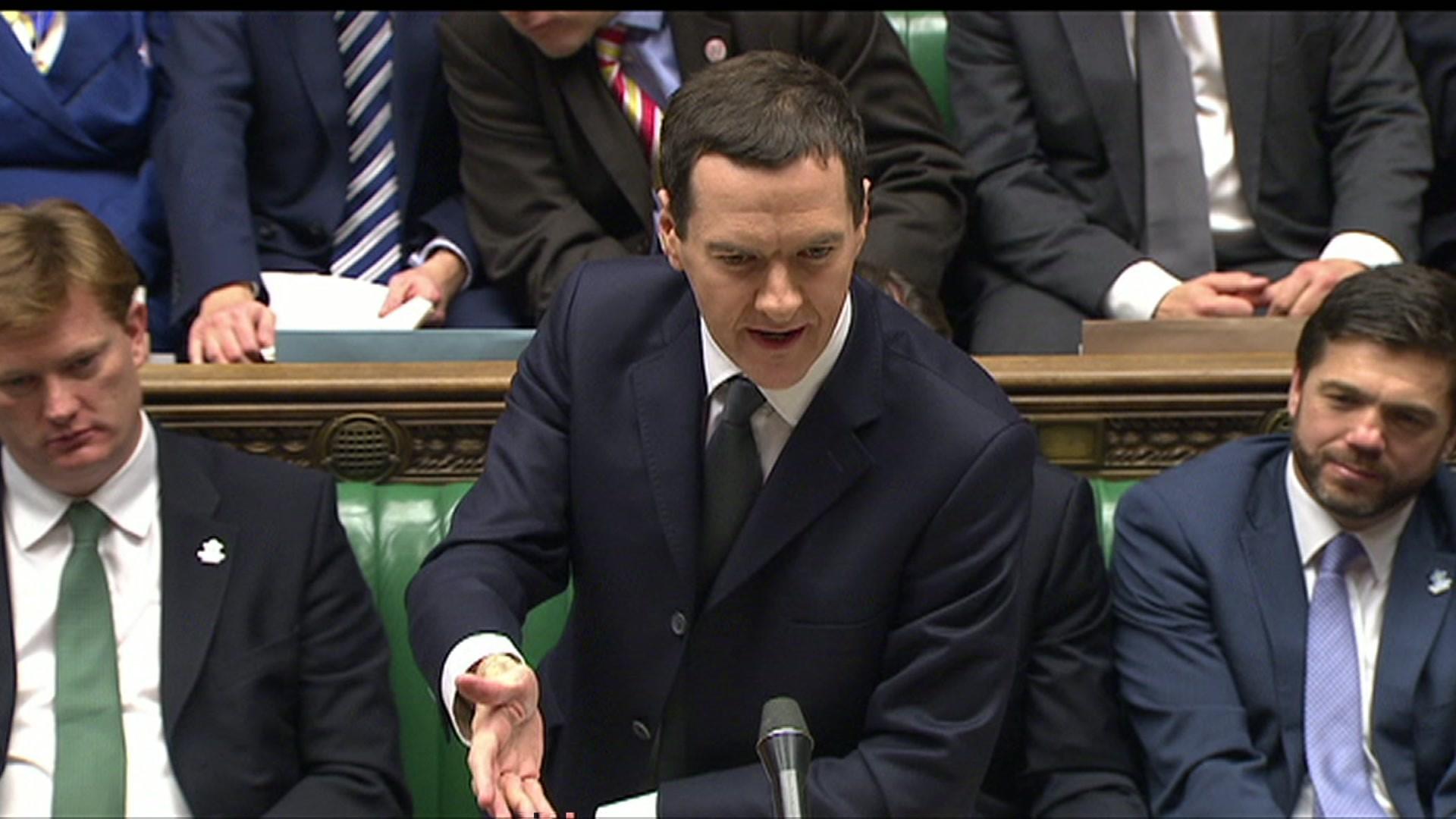

Chancellor George Osborne also said he was expanding the allowances for clusters of fields with high pressure and high temperature reserves of hydrocarbons, which require new and more expensive technology.

The broader changes to the tax regime follows Sir Ian Wood's review of the sector, which recommended a new regulator, and a requirement that the industry, government and that regulator should co-operate more closely.

Danny Alexander spoke to oil industry figures in Aberdeen

More collaboration between oil producers is also being expected.

After a consultation, the Treasury now says that it foresees a lower tax burden on the industry, as new projects become more marginal.

Scottish Energy Minister Fergus Ewing said: "Following the UK government's admission that it has been 21 years since the oil and gas industry last received a tax reduction, the package of measures announced at the Autumn Statement is a first step to improving the fiscal regime for the industry.

"In driving forward these changes, it is essential that the UK government engages with the industry, the new regulator and the Scottish government to maintain momentum with these critical fiscal reforms."

Malcolm Webb, chief executive of industry body Oil and Gas UK, said: "We are encouraged to note that fiscal policy will now be framed in the context of the sector's wider economic benefits and will also take account of the global competitiveness of the industry in terms of commodity prices and costs.

"Mr Alexander paid particular attention to the need for the Treasury to work with the new Oil and Gas Authority (OGA) and the industry in the tripartite approach as called for in the Wood Review."

Friends of the Earth's policy and campaigns director Craig Bennett said: "Ministers must end their obsession with dirty fossil fuels and build a clean economy for the future based on energy efficiency and the nation's huge renewable power resources."

Analysis

By Douglas Fraser, BBC Scotland Business and Economy Editor

The oil industry has been awaiting a significant package of tax reforms from the Treasury.

It faces fast-rising production costs, the challenge of more difficult and expensive oil and gas reserves, ageing equipment, and a recent sharp fall in the price it gets for oil on the global market.

It has also been through a rough period of lobbying the Treasury, after the £2bn tax raid in the 2011 Budget, impressing on Whitehall how sensitive it is to even small tax changes.

The announcements in George Osborne's Autumn Statement were seen as modest by the industry, and a first step.

The range of measures now published could meet many of the industry's expectations, and make it financially viable to push for more extraction rather than leaving reserves under the seabed.

However, there is limited room for the Treasury's manoeuvre, given its vast deficit problems. And it is far from applying numbers to the plans it has set out. Consultation could take up valuable time, when investments hang in the balance due to the falling oil price.

The government is signalling that it is going to have to change its approach to offshore energy, meaning lower tax receipts.

Instead, it can look forward to more oil and gas being extracted, prolonging the lifespan of the industry's big employment footprint, and minimising the need to import oil and gas.

The Treasury will consider the wider economic benefits of maximising productions in addition to the revenue benefits.

And the new regime concedes that it will have to take more account of the competing and often more attractive investment alternatives for oil companies which operate in other countries' oil basins.

The new proposals include:

An investment allowance covering the whole of the UK Continental Shelf (UKCS, meaning British waters), to reduce the effective tax rate for investing companies.

New financial support for seismic surveys in under-explored areas of the UKCS, working with industry and seeking shared funding models.

Considering options for targeting support at exploration opportunities, using the tax system.

Adding to the tax breaks already in place to help companies with the cost of decommissioning platforms and equipment as they are retired, as well as other elements of infrastructure that need investment.

There is to be consultation on these next year, with some new details to be published with the Budget in the spring.

Making the announcement in Aberdeen, Mr Alexander described the tax review as an ambitious move to support a valuable sector.

He said: "We're incentivising and working with the industry to develop new investment opportunities and support new areas of exploration.

"This will help ensure that the industry continues to thrive and contribute to the economy. This level of support is only possible because we can draw on the combined strength and resources of the United Kingdom."

Falling prices

Derek Leith, an energy tax specialist with accountancy firm EY, welcomed the recognition that higher oil prices did not necessarily lead to higher profits, as costs also tended to increase.

However, he said the current concern was over falling oil prices.

"Provided that these measures can be implemented quickly, and a further tax rate reduction can also be delivered, the government has taken some critical steps to protecting the longevity of the oil and gas industry in the UK.," he said.

"However, with the low oil price making the need for reform acute, there is absolutely no room for complacency."

- Published3 December 2014