Tax, spend, borrow and squeeze

- Published

It's Budget Day, and two government ledgers are being weighed.

In one, this is the point at which John Swinney sails his 2015-16 budget through Holyrood, with the fair wind of an SNP majority.

It's given some extra help with a few million being scattered this week around energy efficiency, the film industry and Scotland's ski resorts.

The opposition parties can only lay amendments which require them to explain which budget cuts they want to see in order to fund their different budget priorities. And as there's an election coming up, there isn't much they can do to change the course of spending.

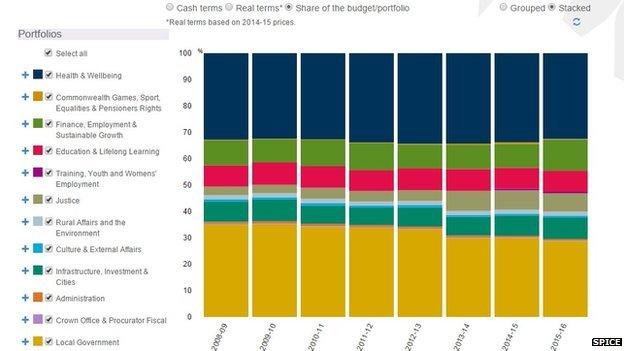

You can see how Mr Swinney's budgets have changed over his time in charge of Holyrood's finances from the Scottish Parliament's research centre:

Protected health

It's clear that health remains dominant, and that it's been protected, while it is local government that has taken the biggest squeeze. This year, it's down more than 1% in real terms, which is quite a lot in an £8bn budget.

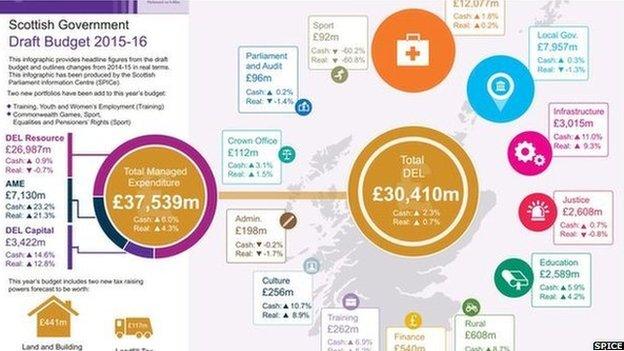

This shows the draft budget from autumn and, again, it is from the Scottish Parliament Information Centre (SPICE):

There have, since this was drawn up, been some adjustments from additional health spending in Whitehall being allocated to the Scottish total and passed on to NHS Scotland, and from the additional funds being sent north in lieu of the sum used to soften the impact of stamp duty reform.

You can see that the biggest loser, proportionately, is sport. That's because we don't have any Commonwealth Games this year.

While the NHS remains dominant, and there's a political pledge to protect it, it is clear that the growth in its budget is very small.

Much bigger is the allocation to housing, through the infrastructure budget. That is down to a relaxation of the squeeze on the previous years' capital budgets.

And if you look at the total budget, to the left side, you'll see Annual Managed Expenditure is rising much faster than any other budget - up by more than 20% in both cash and real terms.

That is mainly the budget for public sector pensions, over which Holyrood has no control. While the Treasury pays for it, it lacks much control over it as well. But it has to be paid out.

Austerity

You'll hear a lot about the squeeze on public spending over the next weeks of Westminster election campaigning.

To put it in context, the total budget over which Holyrood has control has risen from £19.6bn in 1999-2000, the first year of the Scottish Parliament (in today's prices - it looked more like £13.8bn back then) to more than £32bn in 2009-10, when Alistair Darling turned the spending taps on to counter the downturn.

And since then, it fell to £29.5bn in the current year before a real-terms rise of less than 1% for 2015-16.

It should be no surprise that budgets are relaxed a bit going into an election. But as the Institute of Fiscal Studies has shown today, it's no surprise either if taxes rise after an election.

The IFS was setting out the pressures bearing down on George Osborne as he prepares his pre-election budget on 18 March. Coinciding with Scotland's budget day, this was the annual "green budget".

It suggests that all the talk of austerity, as in harsh cuts to spending, has been somewhat ahead of the reality. The total budget has fallen only slightly, and much less than planned, while there has been redistribution within it.

Paying for the UK's debt is a lot more expensive than it was. Interest rates remain low, but each year of huge deficit continues to build up a larger debt on which that interest is paid.

The state benefits for pensioners have been protected. That helps explain why the social security total budget has not fallen, even if cuts have been imposed:

And the IFS points to some rather large giveaways, despite all the austerity talk; raising the starting threshold for income tax above £10,000, freezing duty on petrol and diesel, and that stamp duty reform.

'Dicey'

The next decade continues to look "dicey", says the IFS. Some £92bn of squeeze is yet to be put in place, if you follow through George Osborne's figures from December.

That's 45% of the total squeeze, and most of it looks likely to fall on day-to-day spending for public services, rather than the capital budgets which have been the most squeezed since 2010.

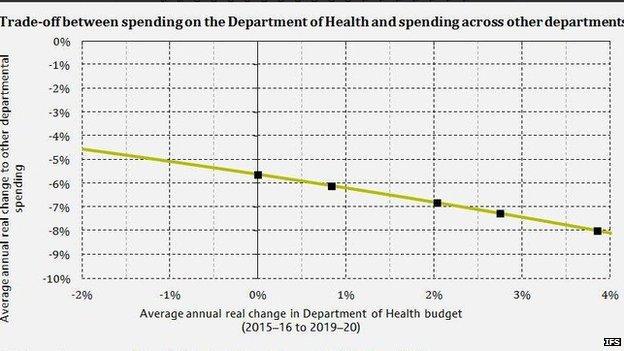

Within those day-to-day budgets, some are being more protected than others - the NHS being the best protected of all.

But if you ensure it doesn't take any real term cuts, look what it means for other spending departments, according to the IFS:

That is, if the UK budget for the NHS is held steady, in real terms, then other spending departments face an annual squeeze averaging nearly 6%. And if the NHS gets 4% more in real terms each year - as is thought necessary to keep pace with the pressures on it - then the annual squeeze on others looks like 8%.

Choices

While Osborne stuck, roughly, to the balance of spending cuts and tax rises that Labour had intended in 2010 (82% of the consolidation in cuts, 18% in tax rises) that would change if Tories are re-elected to see the plan through.

The Tories are looking to taxes to take only 2% of the strain for the next rounds of squeezing. Spending would therefore have to take 98%.

As Robert Peston points out, the IFS analysis has highlighted the choice between Tory-led cuts and higher debt with Labour, which would have its own downsides.

Of course, there are other party choices available, all of which come with similar constraints.

As Syriza's success in Greece has shown, finding the effects of debt and deficit intolerable doesn't mean they will go away.

The IFS points out with its green budget, meanwhile, that this election's political and budgeting choices come after the longest, consistent cut to public service spending per head since 1945.

And things will probably be more difficult next time because: the easier cuts have been made; public sector spending will be harder to constrain if private sector pay is rising; the pensions bill keeps going up; and demographic change towards more older people is a slow-burning but very significant pressure.