Micro-finance provider Grameen Foundation Scotland folds

- Published

A Scottish charity which provided micro-credit business loans in deprived communities has collapsed.

A provisional liquidator was appointed to Grameen Foundation Scotland after its debts became "insurmountable".

The Glasgow-based foundation's cash flow was hit after some of its customers fell into arrears.

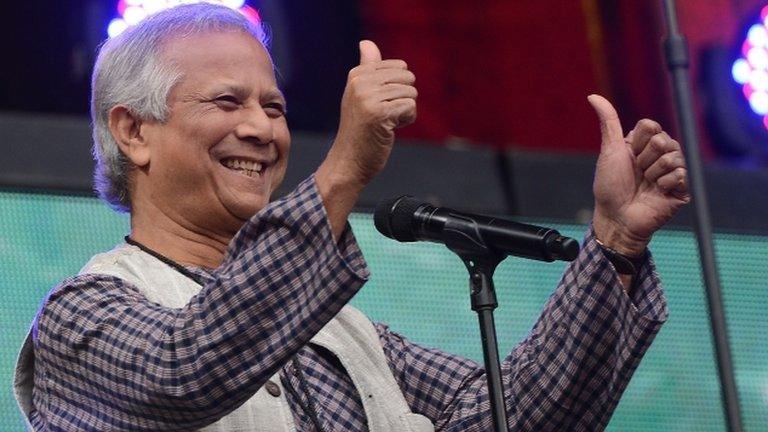

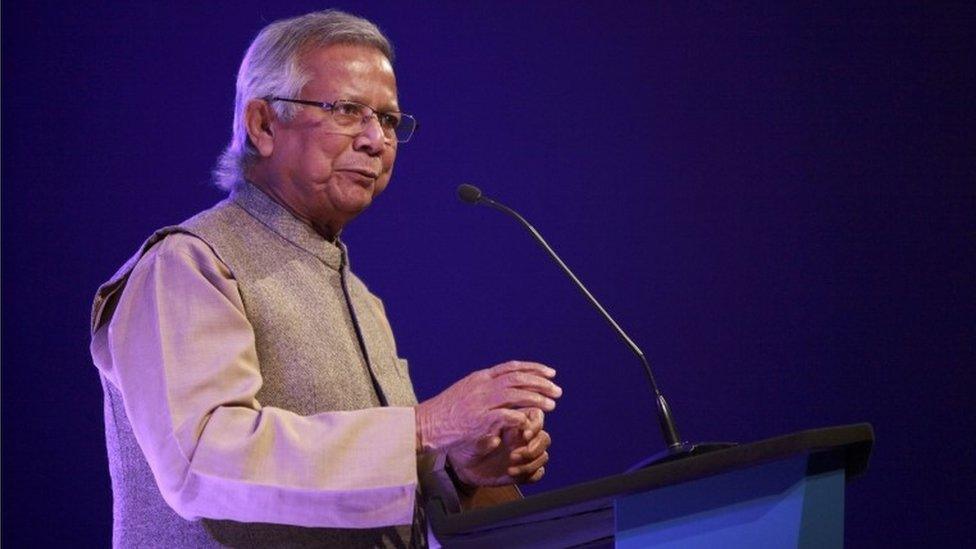

The initiative was inspired by the Grameen system in Bangladesh, which was created by Nobel Peace Prize winner Prof Muhammad Yunus.

Prof Yunus was one of six directors of the foundation, which traded as Grameen in the UK, until its collapse.

Provisional liquidator Brian Milne, from business advisers French Duncan LLP, said the business had now closed with the loss of all four jobs.

Nobel Peace Prize winner Prof Muhammad Yunus was a director of Grameen Foundation Scotland

Grameen, which was based at Glasgow Caledonian University, offered small loans to people unable to access mainstream financial services.

Its stated goal was "to improve the economic situation of the most financially disadvantaged in the UK, initially in the west of Scotland, on a sustainable basis".

Launched in 2012, it provided loans to about 1,000 people.

Mr Milne said: "The Grameen Scotland Foundation is unable to continue trading as its debts have become insurmountable.

"Creditors are due around £300,000 and the main reason for the financial collapse is that a number of the foundation's customer have fallen into arrears which has had a detrimental effect on the company's cash flow.

"The directors petitioned for liquidation as the company is insolvent."

- Published11 June 2015

- Published19 October 2012