Santander to shut 15 Scottish branches

- Published

The Santander branch on Market Street in St Andrews is one of 15 branches that will close in Scotland

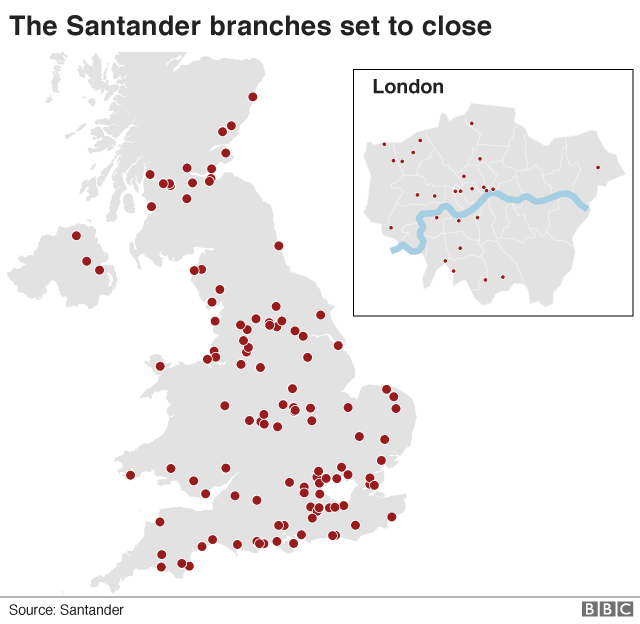

Spanish-owned bank Santander is slashing its branch network by almost a fifth, closing 15 branches in Scotland.

Across the UK, the 140 branch closures are putting 1,270 jobs at risk. It is not yet clear how many Scottish jobs are affected.

The bank blamed the closures on "changes in how customers are choosing to carry out their banking".

It said branch transactions have fallen 23% in the last three years, while digital transactions have soared 99%.

Santander said it has consulted trade unions on the closures and will seek to find alternative roles for the workers affected.

Closure programme

The shut down programme starts in April, when Bathgate and Helensburgh branches will kick off the Scottish closures.

They will continue throughout the year with the last of the planned closures hitting the Edinburgh Morningside branch on 12 December.

The proposed closures are in:

Aberdeen - 99 George Street (closing on 7 November 2019)

Alloa - 69 Mill Street (closing on 6 June 2019)

Bathgate - 14 George Street (closing on 25 April 2019)

Brechin - 24 St David Street (closing on 9 May 2019)

Edinburgh Leith - 15-21 Leith Walk (closing on 9 May 2019)

Edinburgh 194-196 Morningside Road (closing on 12 December 2019)

Forfar - 83 Castle Street (closing on 25 July 2019)

Glasgow - Forge Shopping Centre (closing on 27 June 2019)

Glasgow - Springburn Shopping Centre (closing on 20 June 2019)

Helensburgh - 1-3 West Princess Street (closing on 25 April 2019)

Kirkcaldy High Street - 133 High Street (closing on 13 June 2019)

Lanark - 112 High Street (closing on 4 July 2019)

Renfrew - 7 High Street (closing on 18 July 2019)

St Andrews - 145 Market Street (closing on 2 May 2019)

Troon - 17 Portland Street Troon (closing on 18 July 2019)

Susan Allen, head of retail and business banking, said: "We have had to take some very difficult decisions over our less visited branches."

The bank said its remaining network of 614 branches would be made up of larger branches offering improved community facilities and smaller branches using the latest technology to offer more convenience.

It plans to spend £55m over the next two years refurbishing 100 branches to fit its new branch vision.

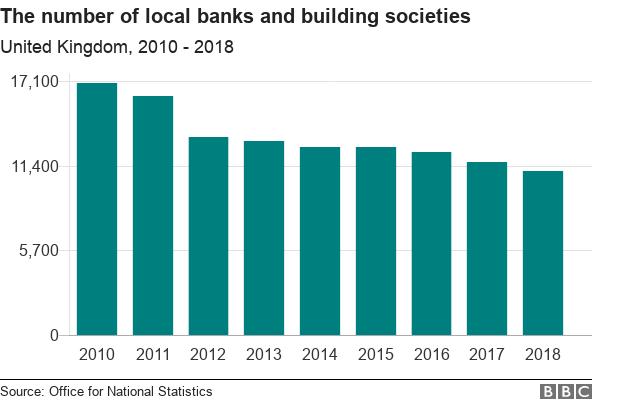

Figures from the Office for National Statistics (ONS) show that a third of local branches have shut since 2010

- Published23 January 2019

- Published15 June 2018

- Published21 January 2019

- Published19 October 2018