Charities warn Universal Credit and pension rise 'gobbled up' by bills

- Published

Campaigners have warned a rise in benefits payments will be "gobbled up by a terrifying rise" in energy and household bills.

Means-tested payments, like Universal Credit, and the state pension have risen by 3.1%.

But official figures show that prices are rising twice as fast, and they are expected to accelerate further.

The new rates were set last year - before household bills soared to the highest level in decades.

Charities say this increase in state payments fails to tackle the cost of living pressure.

Annie McCormack, from Perth & Kinross-based charity Broke Not Broken, said people in the most deprived situations are being driven further into poverty.

She said: "Everything is increasing in cost yet benefits are only increasing by 3%.

"People are telling us they can only put the heating on once a week. There is going to be an increased pressure on community groups and food banks who will not be able to cope. The pressure is unsustainable.

"It is not a case of saying 'lucky them' getting a 3% increase in their benefits. That 3% is getting gobbled up in the energy bills.

"Access to adequate food and housing are human rights and those rights are being breached with people not able to afford adequate food".

It is estimated around half a million people across Scotland are in receipt of Universal Credit.

The UK government said it has provided billions of pounds in extra support to help people pay their bills.

Rise in benefits 'won't make a difference'

Patricia Gill, 36, from Castlemilk in Glasgow, relies on Universal Credit

Patricia Gill lives with her partner in Castlemilk, Glasgow. The 36-year-old is in receipt of Universal Credit.

She has a teenager daughter and is due to have her second baby this October.

She told the BBC: "My bills have gone through the roof. This rise today in benefits won't really make a difference because we have got our private-let rent, gas and electricity."

Patricia has a pre-payment meter which means she pays for her energy as she uses it.

She described how she slipped in to her emergency supply last week due to low funds: "We used to pay £10 per week on our electricity and now it is up to £30.

"A few days ago we hit the emergency credit. So I just topped it up again and that will only last us three days if we are lucky.

"It is a worry. We are just trying to make do as best we can."

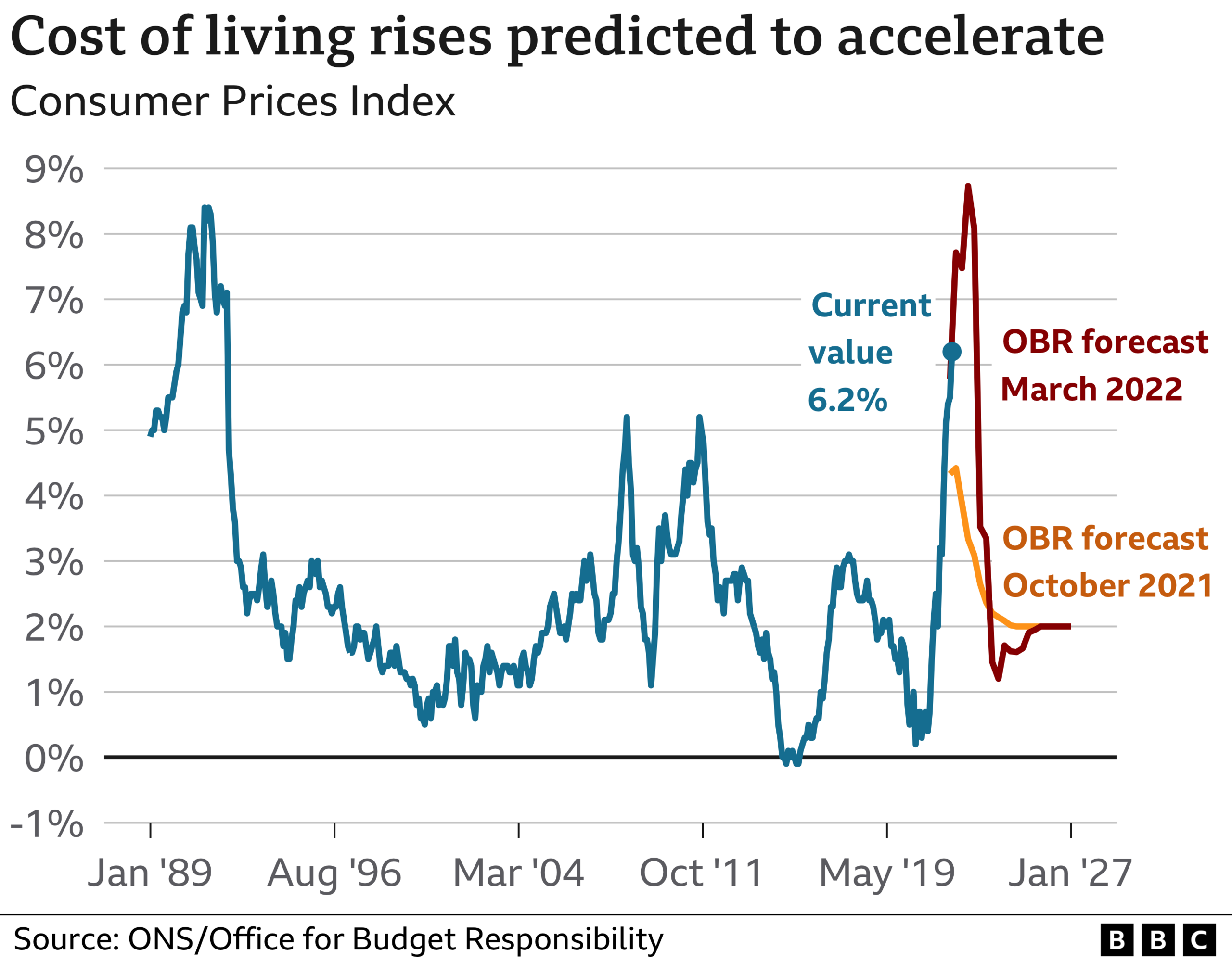

Prices are rising at their fastest rate for 30 years. Inflation is currently 6.2% but forecasters expect it to peak at close to 9% later this year due to more expensive gas and electricity bills.

A UK government spokesman said: "We recognise the pressures people are facing with the cost of living, which is why we're providing support worth £22bn [across the UK over] the next financial year and benefits are being uprated by the usual measure, September's inflation figure."

He added that support also included cutting fuel duty and money to help pay for energy bills. The minimum wage had also been increased.

Pensioners feeling the pinch

Normally under the triple lock formula, pensions increase by either inflation, the increase in earnings between May and July, or 2.5% - whichever is highest.

UK ministers said last September that the figures had been "skewed and distorted" by the average earnings rise, which was "statistical anomaly", owing to the impact of Covid and the withdrawal of furlough.

The House of Commons Library said that would have been about 8% and cost an extra £4bn to £5bn.

So the UK government decided to limit this April's rise to the greater of the inflation rate last autumn or 2.5%, hence the 3.1% increase now.

June Hickman said her bills were "crippling"

June Hickman, a pensioner from Aberdeen, told BBC Scotland: "I feel really angry. The pension did not go up as we expected it.

"I only retired in January. Lucky I managed to get a couple of days work a week otherwise I would not have managed. The heating bills alone are crippling. It's upsetting. It's scary."

Another pensioner, John Shepherd, said: "Our pensions are not keeping up with the rate of inflation.

"I am cutting down the heating and I am watching what I am eating."

The Scottish government has control of eight devolved social security benefits. Ministers have increased them to 6% to cope with the cost of living crisis.

Social Security Minister Ben Macpherson said: "We have acted urgently in response to growing pressures on the costs of living.

"We wrote to the UK government before the recent budget to urge them to increase benefits by more than 3.1% and it is extremely disappointing they chose not to do so."

- Published11 April 2022

- Published1 April 2022

- Published1 April 2022

- Published1 April 2022