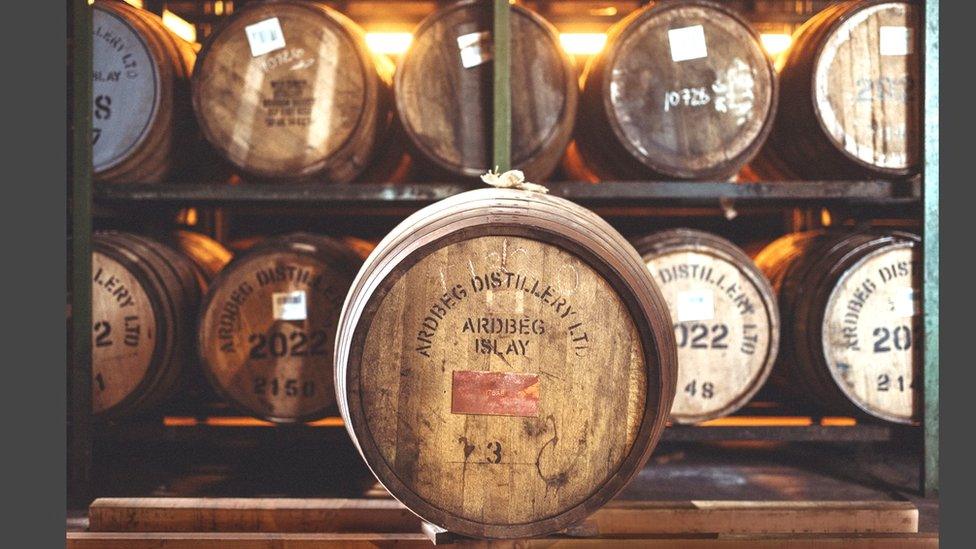

Chancellor defends hike in duty on Scotch whisky

- Published

Mr Hunt had been urged by the Scottish secretary not to increase the duty on whisky in line with inflation

Chancellor Jeremy Hunt has defended plans to increase duty on Scotch whisky by 10.1% despite industry concerns.

The Scotch Whisky Association said distillers were "not just livid, but insulted" and called for a reversal of the tax hike, which starts from August.

It accused the UK government of breaking a 2019 commitment to ensure the tax system supports the industry.

Mr Hunt told BBC Radio Scotland that in real terms, duty on whisky was at its lowest level for 100 years.

He said the government would continue to engage with the industry to ensure distillers were "successful and prosperous going forward".

Duty on alcohol will rise in line with inflation from 1 August. The tax on spirits was last increased in 2017.

Scottish Secretary Alister Jack Alister said on Wednesday he had tried to lobby against the increase in alcohol duty but had not been successful.

He added that it was a "matter of regret" that whisky duty was going up, and was "not what I wanted for the Scottish industry."

Graeme Littlejohn, director of strategy at the Scotch Whisky Association (SWA), said it was "telling" that the Chancellor did not have full support for the measure from his Cabinet colleagues.

The tax burden on the price of a bottle of whisky in the UK would rise from 70% to 75% from 1 August under the plans, Mr Littlejohn said.

This would mean that of £15.42, the average price of a bottle of whisky in Scotland, £11.40 would go directly to the Treasury in taxation through duty and VAT, he explained.

"I have spoken to many distillers in the last 24 hours and they are not just livid, they are insulted by the decision made by the Chancellor," he told the BBC's Good Morning Scotland programme.

"The UK government made a commitment back in 2019 to ensure the tax system is supporting Scottish whisky.

"Yesterday's Budget has increased the tax burden on Scottish whisky and it went further by increasing the competitive disadvantage that distillers face in pubs, bars and restaurants. We want a reversal of the 10% tax hike, which has broken that commitment."

Whisky has benefited from a freeze on duty in nine of the last 10 Budgets.

You can raise a pint to the chancellor, for freezing duty on draught beer in a pub.

Or you can drown your sorrows with a dram, as Jeremy Hunt pushes up duty on whisky by 10%.

His Budget sought to present the British economy as a glass that's half full rather than half empty.

After a grim few months for the Conservative government at the end of last year, Jeremy Hunt wanted to shift from crisis management to the front foot.

But if you look at the state of the economy now, it's not hard to see the glass as half empty.

Read more analysis from Douglas on Jeremy Hunt's 2023 Budget here.

Mr Littlejohn said revenue from Scotch whisky and other spirits in the UK had increased by more than £1bn since the previous duty rise in 2017.

It was now worth close to £4.5bn in total to the Exchequer annually, he said, and had "grown faster because of those freezes".

Consumers had been switching to more "premium" options in their drinking habits, he said.

"They are drinking less, and drinking better, which suits quality premium drinks like Scottish whisky," he added. "That in turn generates more revenue to the Exchequer."

He said that a rise in alcohol duty "of this magnitude" would "inevitably" be passed on to whisky drinkers.

"It is important the Chancellor re-thinks this," he added. "Currently, far from reducing inflation, this will be an inflationary measure by increasing the cost to consumers."

Mr Hunt told Good Morning Scotland he had been "working very closely" with the SWA on reforms to the alcohol duty system, which will mean duty is linked to the strength of the drink.

"We have frozen alcohol duty until August, and then we are bringing in the big reforms that they asked for in terms of a different approach, which will be beneficial to whisky distillers," he said.

"In real terms, this means we will have the lowest level of duty for 100 years, so we are keeping duty levels low.

"But we will continue to engage with the industry and we want to do something that means they are successful and prosperous going forward."

Related topics

- Published15 March 2023

- Published15 March 2023

- Published14 January 2023

- Published14 October 2022

- Published9 July 2022

- Published11 February 2022