John Swinney: Property tax review 'right thing to do'

- Published

Changes to Scotland's property tax system are due to be brought in on 1 April

Scotland's Finance Secretary John Swinney has said reviewing the planned new tax rates for property sales was "the right thing to do".

The stamp duty system in Scotland is due to change on 1 April.

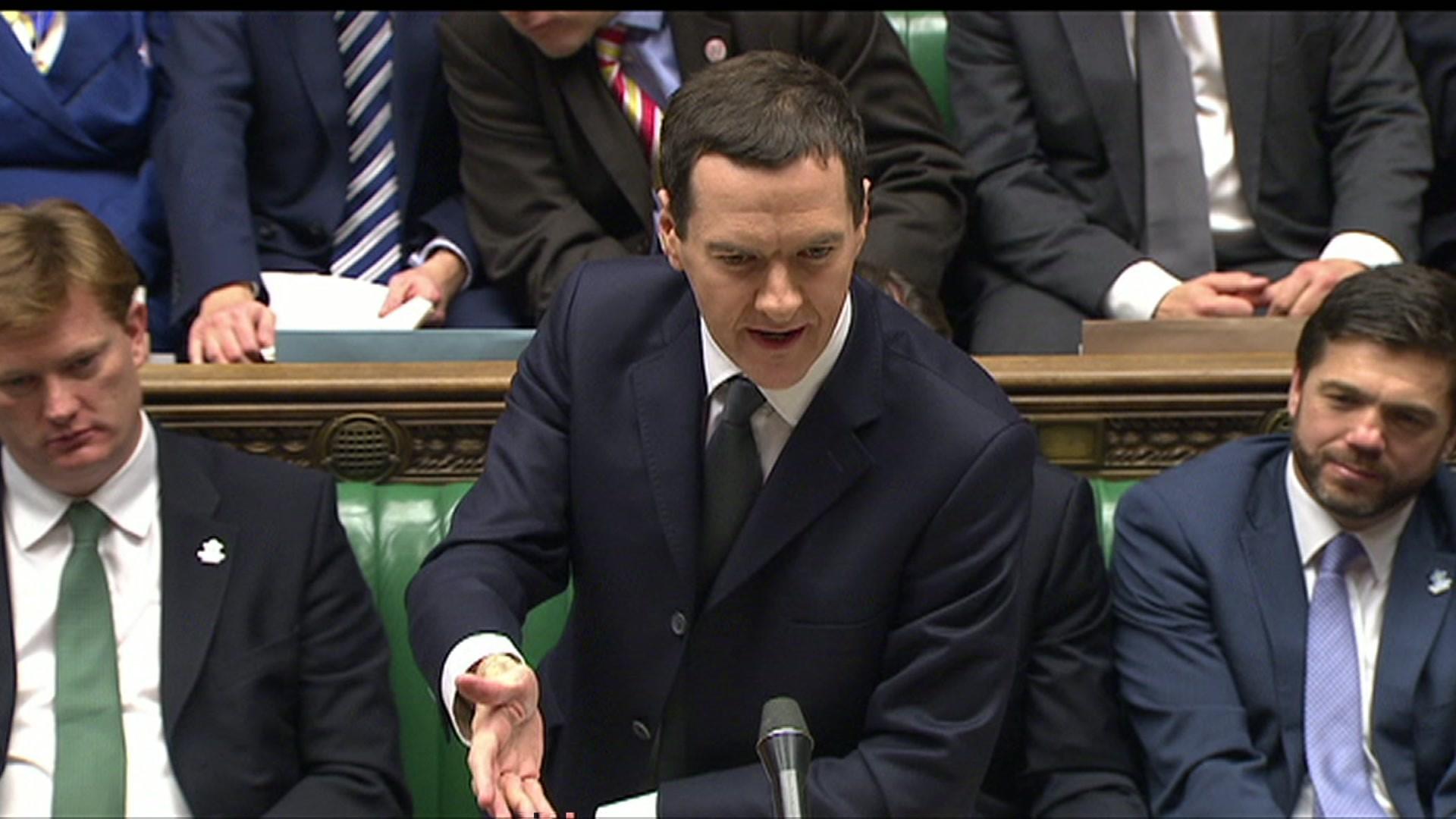

But Mr Swinney has been reappraising those changes in light of an overhaul of the UK property duty system brought in by Chancellor George Osborne.

The Scottish Tories believe the Holyrood government should replicate the UK Treasury's move.

Mr Swinney will tell MSPs on Wednesday how he will revise the bands and rates of the Land and Buildings Transaction Tax (Scotland) Bill, external.

He told BBC Radio Scotland that "from the outset" he wanted to make changes to the system that were "revenue neutral".

John Swinney: "The right thing to do is to look at these issues and I will conclude that review on Wednesday in parliament."

Mr Swinney explained: "I did not intend to raise more tax than the tax I was replacing or to cut tax.

"The consequence of the Chancellor's announcement in December is the amount of tax that he intends to raise from this has reduced quite significantly.

"So, if I want to remain true to my principle of this change being revenue neutral - that it doesn't increase or lower the taxes that are generated - then the right thing to do is to look at these issues."

Mr Swinney's initial plans raised the threshold for paying tax on a home from £125,000 under stamp duty to £135,000, with rates ranging from 2% up to 12% on the portion of any price above £1m.

Mr Osborne replaced stamp duty bands with a graduated rate in December, which applied immediately and will operate in Scotland until 1 April, when the LBTT replaces stamp duty.

The Conservatives have proposed that no tax be levied on house sales under £140,000, and that the 10% tax on homes between £250,000 and £500,000 be halved.

Its finance spokesman Gavin Brown said: "The eye-watering 10% tax rate has caused concern in many parts of Scotland and is having a distortion on the housing market.

"There is a clear and obvious way to fix this distortion - the Scottish government can use the windfall from UK stamp duty changes to create more realistic tax rates with a shallower increase.

"The Scottish Conservatives believe a 5% rate should replace the 10% rate, as well as an increase in the starting threshold.

"Our proposal would help those who aspire to own a family home and create a housing market that functions more smoothly.

"This can be done because the overall size of the tax being devolved is smaller. We have called for the changes to be announced as soon as possible, to provide certainty to people trying to buy and sell their homes."

- Published18 January 2015

- Published18 December 2014

- Published3 December 2014

- Published9 October 2014