Tax rise plan 'could reduce cuts impact by a third'

- Published

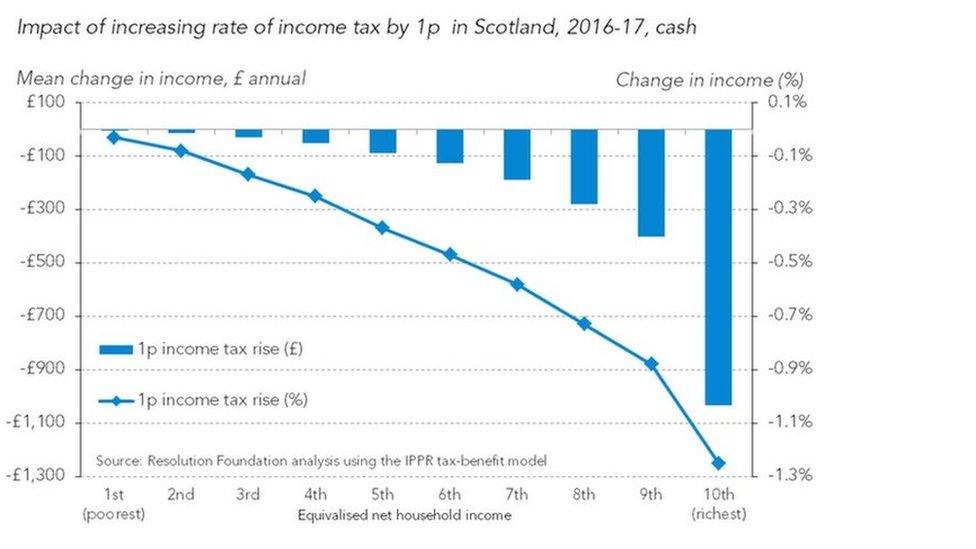

Opposition party plans to raise income tax rates at Holyrood could reduce the impact of spending cuts by about a third, according to new analysis.

The Resolution Foundation also say Scottish Labour plans would weigh three times more heavily on higher- than middle-earners.

They could even boost the income of those living on the least money, depending how rebates were paid.

The Scottish government has rejected calls for rates to increase by 1p.

Scottish Labour and the Liberal Democrats say that the new power at Holyrood to vary income tax rates should be used to protect public services.

Progressive plan

It has been hotly debated this week. SNP ministers argue that Labour's plans would hit workers of modest means. Conservatives say there should be no increase in the tax burden.

The Resolution Foundation, a think tank specialising in income and tax, whose executive is former Tory minister David Willetts, has confirmed Scottish Labour claims that its plan would be progressive.

Its analysis, from Torsten Bell, a former director of policy for the Labour Party who also worked in the Treasury, points to the highest 10th of earners paying an extra 1.3% of their income, or at least £1,000.

Middle-earning households would see take-home pay reduced by just under £100. That is 0.4% of their income.

Labour plans a rebate of £100 for those earning under £20,000.

The Foundation says this is a blunt way of compensating lower earners, and could be unfair to single income households.

A two-income household could get twice the rebate. On that basis, they say 60% of the rebate bill would go to the higher-earning half of households.

Because the lowest-paid 10th of households pay little income tax anyway - with the threshold for income tax soon to rise to £11,000 - a rebate would leave them better off.

However, the rebate plan is not clear, and partly depends on whether it would be taxable.

The analysis suggests that the tax rise is not enough to counter spending cuts being passed on from Whitehall.

In real terms, it would reduce the day-to-day spending cuts the Scottish government faces by a third - that is, a third of the planned 5% cut between now and 2019-20.

Cutting spending

The report authors say the policy's success would also depend on how those extra funds are spent. Money could be deployed to support high or low income groups most.

They warn that tax hikes in future years cannot all be loaded on to higher earners.

Holyrood is on track to have the ability, from April 2017, to vary income tax rates differently across bands, whereas the reform being introduced this April requires the same level of increase or decrease.

The SNP has signalled that it wants to use the tax powers to re-balance the system towards taxing higher earners at higher rates.

However, the Resolution Foundation says: "It's difficult to raise significant sums through income tax without increasing the basic rate, as there simply aren't enough higher and top rate payers".

An additional complication it raises is that Whitehall reform to the benefits system - with the introduction of Universal Credit to replace six benefits currently paid out - will blunt the revenue-raising potential of a tax increase.

Those receiving Universal Credit, which experts say could be as much as half of families, would get back 65% of any tax rise in benefit entitlement.

And as that would come from Westminster's budget, the "no detriment" principle (a decision by Holyrood cannot leave the rest of the UK worse off, or vice versa) the extra welfare bill might have to be paid to the Treasury.

The report concludes: "Advocates of Scottish Labour's plans to raise income tax and reduce spending cuts can correctly argue that the proposals would raise money and do it in a progressive way.

"But those opposed may argue that there are even more progressive ways to bring in revenue, that the plans will still take money from middle earners' pockets, or that cutting spending is the right thing to do in the first place."

The SNP said the report raised serious unanswered questions on how Labour's policy would work - including how the tax rise would be impacted by the implementation of Universal Credit.

It added that even if Labour's proposed rebate was to be workable, many households on lower incomes would still lose out.

The Scottish government's Finance Secretary John Swinney acknowledged low-income households would be better-off if they received Labour's proposed £100 rebate.

But he said the rebate was "a complete mirage and cannot be delivered".

He told BBC Radio Scotland's Good Morning Scotland programme: "There was a reduction in revenue expenditure of £350m in the local government grant and aid.

"Once you put into the equation the £250m that the Scottish government is investing in the integration of social care - social care being one of the largest elements of local authority expenditure in Scotland - there is a reduction in local authority budgets of £100m, which equates to less than 1% of total local authority expenditure."

He added: "Over the years we have seen a reduction in public-sector employment - and I regret that fact very much.

"But what I have got to do is make a balance between whether or not we will be prepared to increase the tax bill for low-income households and put additional pressure on hard-pressed individuals, or ask local authorities to try to secure 1% changes in the way in which they are delivering public services."

Scottish Liberal Democrat leader Willie Rennie said: "This respected think tank is making it crystal clear to the SNP. Increasing income tax by one penny is progressive, with those on the highest incomes bearing the greatest burden."

Pension age

Meanwhile, an estimate of the cost of the rebate was put at almost £100m plus administration charges by one of Scotland's leading economists.

Professor David Bell at Stirling University has modelled the policy and agrees that it would be "progressive".

That is, it reduces the income of higher pay households by a higher proportion but it would increase bills for many around average pay.

It is claimed that about 970,000 people would be eligible to receive the £100 rebate, including 150,000 people of pension age.

But there is the condition on this that the rebate plan would have to be legal.

What is the Scottish Rate of Income Tax?

From April of this year, the UK rate of income tax will be reduced by 10p in the pound in Scotland, across the 20% band, the 40% band and the 45% band

It will then be up to the Scottish Parliament to set its own rate to replace the 10p that has been taken out

This rate could be exactly the same as the rest of the UK, or it could be higher or lower

In his draft budget, John Swinney set the Scottish Rate of Income Tax at 10p - meaning it will remain the same as the rest of the UK

Both Scottish Labour and the Scottish Liberal Democrats have proposed an 11p rate - meaning all bands in Scotland would be 1p higher than elsewhere in the UK

Under the Scotland Bill proposals which are currently going through the UK Parliament, Holyrood would be given greater control over income tax rates and bands

This would allow the Scottish government to create new tax bands, and to raise the rate of tax paid by higher earners without also raising it for lower paid workers

But the Scotland Bill will not come into force until next year at the earliest

- Published3 February 2016

- Published2 February 2016

- Published27 January 2016

- Published16 December 2015