MSPs vote to keep Scottish income tax rate unchanged

- Published

MSPs voted on a Scottish rate of income tax for the first time

MSPs have voted to set a Scottish rate of income tax for the first time, opting to keep rates at current levels.

Holyrood has been given new powers over the income tax rate, with Labour and the Liberal Democrats calling for a 1p increase to raise extra funds.

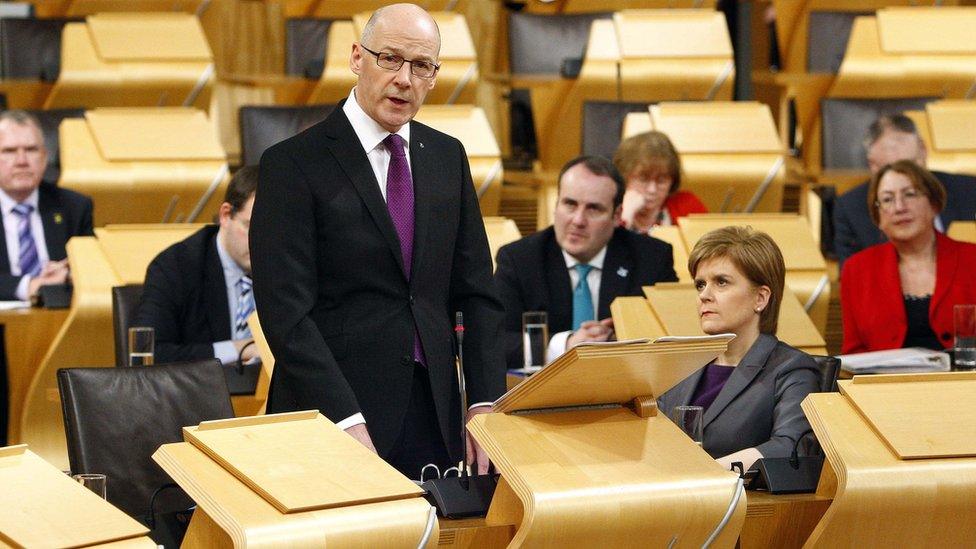

However, finance secretary John Swinney insisted the rate should stay the same.

After a heated Holyrood debate on the topic, MSPs voted by 74 to 35 to accept the government's plan to maintain the income tax at current levels.

Opposition parties said an increase could create funds to protect services, but Mr Swinney said it would punish taxpayers on low incomes.

Mr Swinney said it was a "historic" day for Holyrood, with a Scottish rate resolution being proposed for the first time.

The deputy first minister defended maintaining the rate at current levels following attacks from opposition members, saying his priority was to protect low-earning households.

He said Labour's 1p tax rise would "punish" people on low incomes, saying the party did not have credible plans. He said: "Labour is targeting working people busting a gut to make ends meet; this government will not punish those individuals."

John Swinney said it was a "historic day" for Holyrood, but argued against changing rates

Jackie Baillie, leading Labour's contribution, said the SNP was "voting with the Tories to continue the cuts".

She said members should "reject the do-nothing proposal", arguing that increasing the income tax by 1p would raise a nine-figure sum to protect local services.

Ms Baillie said there had been "extraordinary claims" from the SNP, saying: "these are cuts started at Westminster and continued by the SNP."

She said: "I call on members to reject hundreds of millions of pounds of cuts and choose to invest in our children and invest in the future prosperity of our country."

'Taxpayer's alliance'

For the Conservatives, Gavin Brown claimed there was a "taxpayers alliance" between his party and the SNP, describing the governing party as a "fiscal conservative party".

He said: "We don't think hardworking people in Scotland should be paying more in tax than people in the rest of the UK."

He said it would "send out entirely the wrong message" to raise taxes at the first opportunity with new powers.

Labour's Jackie Baillie said the SNP were "voting in line with the Tories to continue cuts"

Willie Rennie said the Scottish government had failed to live up to "this truly historic day", saying that in the face of cuts "the SNP do not one single thing, they don't take any opportunity to change the climate at all".

He said: "Their whole existence they've been living for this day, and what do they do? Absolutely nothing. How disappointing and despondent is that?"

He said the Liberal Democrat policy of adding 1p to taxes would be "progressive" and would have resulted in a boost to education spending.

"We should be celebrating today that we can undo the damage, but the SNP sit and do absolutely nothing."

Scottish Greens co-convener Patrick Harvie called for raising revenue at a local level to protect public services.

He advocated a "radical and local plan" to raise revenue by unfreezing the council tax.

After an often fractious debate, members voted to support the government's proposals by 74 to 35.

What is the Scottish Rate of Income Tax?

From April of this year, the UK rate of income tax will be reduced by 10p in the pound in Scotland, across the 20% band, the 40% band and the 45% band

It is then up to the Scottish Parliament to set its own rate to replace the 10p that has been taken out

This rate could be exactly the same as the rest of the UK, or it could be higher or lower

In his draft budget, John Swinney set the Scottish Rate of Income Tax at 10p - meaning it will remain the same as the rest of the UK

Both Scottish Labour and the Scottish Liberal Democrats proposed an 11p rate - meaning all bands in Scotland would be 1p higher than elsewhere in the UK

Under the Scotland Bill proposals which are currently going through the UK Parliament, Holyrood would be given even greater control over income tax rates and bands

This would allow the Scottish government to create new tax bands, and to raise the rate of tax paid by higher earners without also raising it for lower paid workers

But the Scotland Bill will not come into force until next year at the earliest

- Published3 February 2016

- Published2 February 2016

- Published27 January 2016

- Published16 December 2015