Scottish Greens set out plans for a 60p tax rate for top earners

- Published

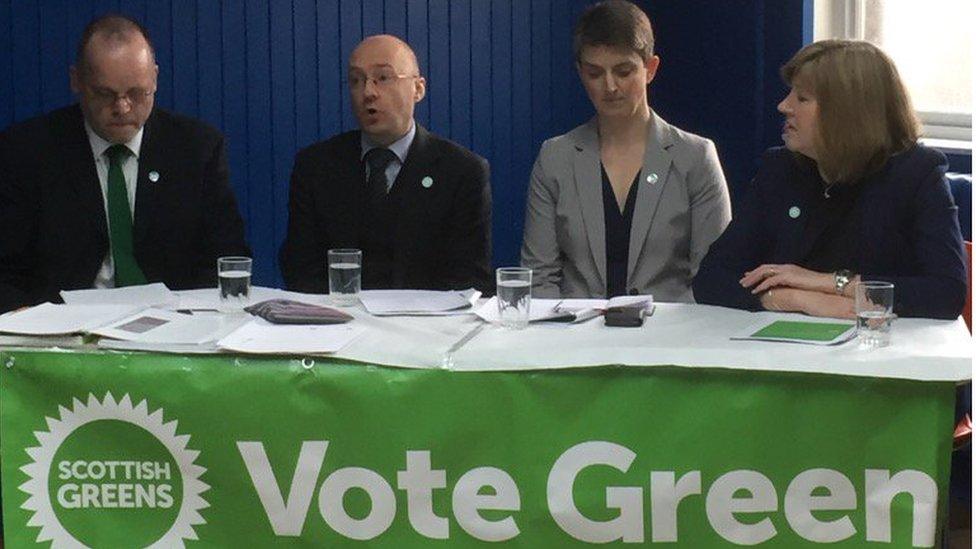

The Scottish Greens have set out plans to introduce a new 60p rate of income tax for Scotland's highest earners.

The party wants the new rate to apply to those earning more than £150,000 and it also plans a new 43p rate, starting at £43,000.

The Scottish Greens said they wanted to reduce the income tax paid by those earning less than £26,500 a year.

They also want to replace the council tax over five years with a new property tax based on up-to-date values.

Tax has become a key issue in the run-up to May's Holyrood election, with the Scottish Parliament getting powers over income tax rates and bands from April 2017 onwards.

The Scottish Green proposals would see the current basic rate of income tax replaced with a rate of 18% for the first £7,500 of cash above the personal allowance - which is to rise to £11,000 in 2017-18.

A rate of 22% would be applied to income above £19,000 and higher earners would pay 43% tax from £43,000.

Earnings above £150,000 would be taxed at 60%.

The party said it would also scrap the current council tax system and introduce a residential property tax, where the amount households pay would be based on an annually updated value of what their home is worth.

According to the party their plans would raise £331m additional funding to invest in public services.

The Scottish Greens said an MSP earning £60,685 would pay £938 a year more in tax, while someone on a full time salary of £27,710 would pay just £24 more a year.

Greens co-convener Patrick Harvie said: "Despite arguing for control over income tax, the SNP have failed to seize the opportunity to create a more progressive system to tackle inequality. There is an urgent need and the Scottish Greens are responding to it.

"People on generous salaries, such as MSPs, deserve to pay a fairer share to protect and improve the public services we all rely on. Someone earning less than the average and struggling with the cost of living deserves to keep more of what they earn."

He added: "With the SNP's reluctance to act and Labour's limited offering, our income tax proposals will find favour with those who see the chance to create a more equal Scotland."

What are the other main Scottish parties saying?

Scottish National Party - Leader Nicola Sturgeon said Scotland 'could lose £30m a year from 50p tax'. She added: "I've said I want to see a 50p tax rate. I don't believe the 50p tax rate should have been lowered to 45p. But I've got analysis prepared by civil servants that says if we do that right now then, within the current devolved powers, in Scotland alone then that could see us not raise additional revenue but lose us up to £30m a year. The reason for that is that while we have the power to set tax rates we don't have power over income tax avoidance. What I have said is we won't do that in the first year."

Scottish Labour - Leader Kezia Dugdale challenged the SNP to raise the income tax rate for Scotland's highest earners. She said her party wanted to put up taxes to increase investment in education in order to bring more high skilled jobs to Scotland. Labour also wants to put 1p on the basic rate of income tax in Scotland, with Ms Dugdale arguing: "If we did that we could raise enough money to stop the cuts, make different choices from the Tories."

Scottish Conservatives - Leader Ruth Davidson has warned against making Scotland the highest taxed part of the UK. She said: "Hanging a sign at the border that says 'higher taxes here' encourages neither the growth, the investment or the jobs that we need to properly fund our public services."

Scottish Lib Dems - Leader Willie Rennie said his party also wants to increase income tax for the highest earners. He added: "I want to make a transformational investment in education. Scottish education used to be one of the best in the world. Now it is slipping down the rankings. We need to invest £475m in education, for nurseries, for schools and for colleges to get Scottish education racing back up the international league tables."