Mark Carney says currency union 'economically possible'

- Published

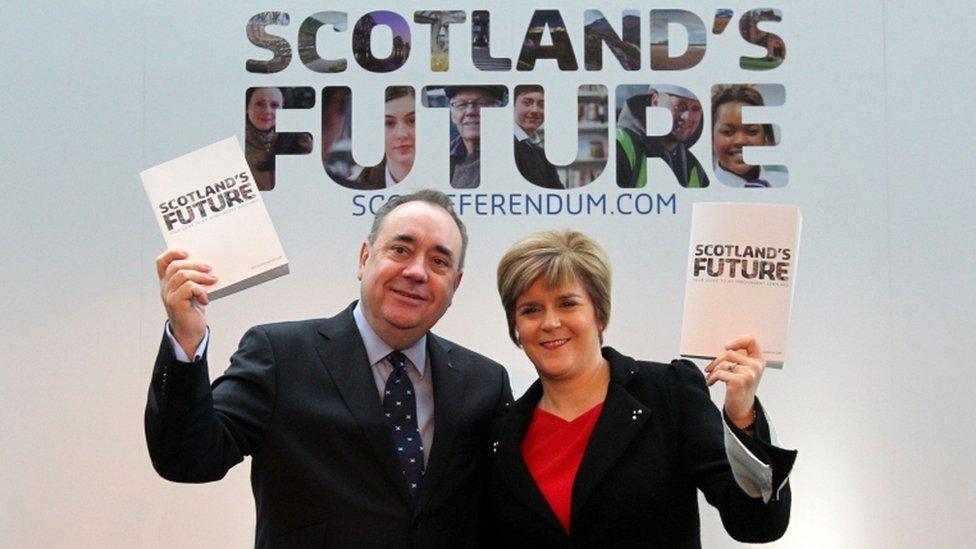

Mr Carney was speaking to MPs on the Treasury committee

The Bank of England governor has said it would be economically possible for an independent Scotland to have a currency union with the rest of the UK.

But Mark Carney said it would be for others to decide whether it was politically desirable.

He was speaking to the treasury committee ahead of the publication of the SNP's growth commission report.

It has been looking at economic policy options for an independent Scotland - including what currency it could use.

There has been speculation that the report, which was commissioned by Nicola Sturgeon in the wake of the Brexit vote in 2016, will back the creation of a separate Scottish currency when it is published on Friday.

The SNP proposed a currency union ahead of the 2014 referendum, which would have seen the country continue to use the pound.

But a formal arrangement was ruled out by then-Chancellor George Osborne in a move that was widely seen as being a key factor for Yes losing the vote.

The Scottish government wanted a formal currency union with the rest of the UK if Scotland voted for independence in 2014

At the time, the Treasury's top civil servant, Sir Nicholas Macpherson "strongly" advised Mr Osborne against agreeing to the currency union proposal, which he said would have been "fraught with difficulty".

Mr Carney was asked by MPs on the Treasury committee whether he believed a currency union also required a political union.

He replied: "No, from the strict economics it doesn't".

'Political ramifications'

He then went on to say it would be for others to judge whether there would be "political ramifications" from having the degree of shared sovereignty that would be "highly desirable for an effective currency union".

Mr Carney told the committee that he believed an effective currency union would include "an element of fiscal union" as well as "having a form of financial market union, banking union, capital market union - all the components that European monetary union is still trying to fully construct".

He said there were lots of examples where economic sovereignty is shared without a political union, including global financial regulation and trade agreements.

But he told MPs on the committee that this was "an observation that then drifts into politics for others to answer".

- Published20 May 2018