Budget 2015: What it means in Wales

- Published

George Osborne leads out his Treasury team before the Budget

Although a UK Budget, there is plenty of significance for people in Wales because of the make-up of our economy.

Full time earnings here average £473 a week and many earn much less than that.

The Budget now brings the promise of a National Living Wage of £9 an hour by 2020, but at the same time a scaling back of working tax credits that have helped families in employment make ends meet.

From April 2017, only the lowest of the low paid will be able to apply for working tax credit and child tax credit will only be paid for the first two children.

But for those on the minimum wage - and then the national living wage - they will not pay income tax at all.

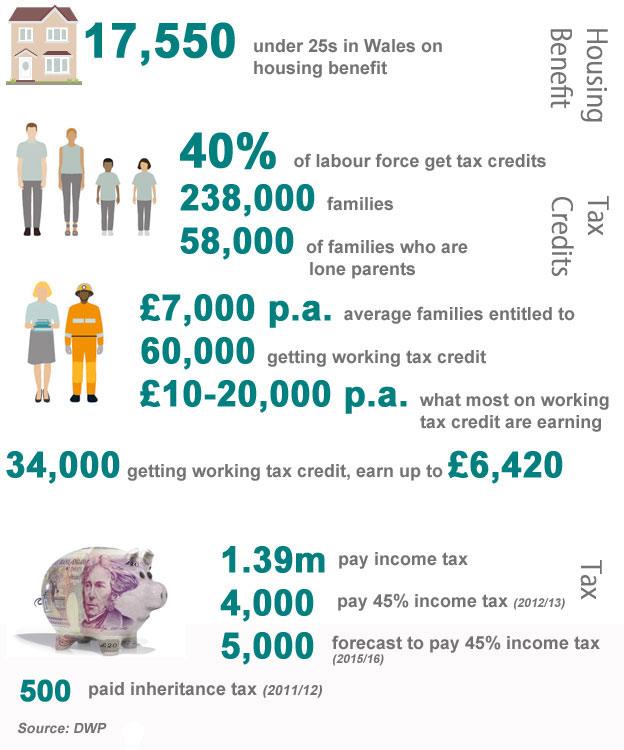

WALES, TAX AND WELFARE - BY NUMBERS

Rachel Wood, 22, describes how housing benefit has helped her

CASE STUDY: HOUSING BENEFIT UNTIL ABLE TO WORK

Rachel Wood, 22, lives in Newport in a housing association one-bedroom property.

She has had poor health including mental health issues but is about to start a nursing course. She also played football for Wales in the homeless world cup last year.

Her rent is paid for through housing benefit and she receives Employment and Support Allowance (ESA)., external

ESA for new claimants is to be "aligned" with Jobseeker's Allowance.

"It's nice to have my own space, I was always in hostels or B&Bs," she says.

Under the new arrangements announced in the Budget, new housing benefit claimants will have to be over 21. Rachel was younger than this when she first claimed it so a new claimant in similar circumstances in future would not get the help she received.

"It's not always a choice. If I could still be at the family home I probably would if things would work but it's not an option."

Rachel says if she tries find full time work now she will not be able to train for her dream job. She thinks she will be on housing benefit until she qualifies as a nurse and earns and pays tax.

Try the BBC Budget calculator to work out how you have been affected.

The relationship between tax credits and income tax is where the debate about working poverty has centred.

Is it better to give people extra cash in their pocket through a tax credit from the welfare budget - or a tax cut, reducing what they pay to the Revenue.

Middle earners will now be able to earn £43,000 from next year before they pay the 40% tax rate. At the moment 140,000 in Wales pay income tax at that rate.

The Chancellor has also brought down the maximum amount a household can get in welfare payments from £26,000 to £20,000 in Wales and other places outside London.

The total amounts some people get in benefits has become a big issue in the south east of England where high housing costs have pushed up some people's housing benefits.

Until now the benefits cap has not affected many people in Wales, in fact only about 700. Community Housing Cymru expects the new lower maximum level to result in 7,000 families in Wales being given less money.

With 325,000 public sector employees in Wales - one in four of the working population - this is another area to watch carefully. As part of attempts to reduce the UK deficit the lid is being kept on pay. It will rise by no more than 1% for the next four years.

But there is some better news with fewer cuts to public services than had been expected from Mr Osborne and than had been outlined in his pre-election Budget in March.

- Published8 July 2015

- Published8 July 2015