Budget 2015: Welsh warning over welfare cuts

- Published

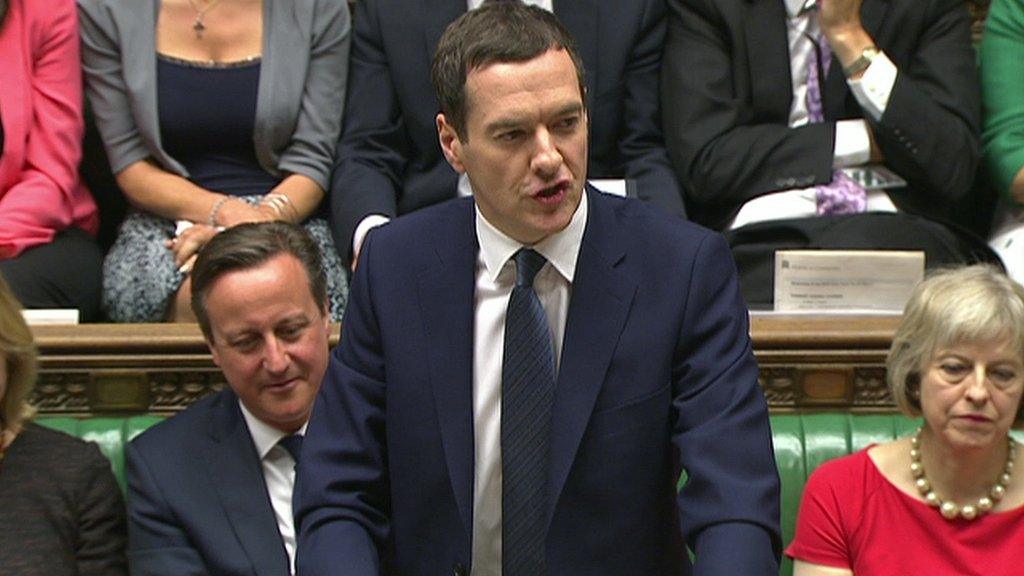

George Osborne presenting his first Conservative-only Budget

Chancellor George Osborne has unveiled plans for £12bn of welfare cuts in his Budget, amid warnings from Wales about the impact on the poorest in society.

He also announced a compulsory "living wage" of £7.20 an hour from next April, rising to £9 by 2020.

Shadow Welsh Secretary Owen Smith said he doubted the living wage would offset the "massive cuts" to tax credits.

The chancellor stressed his commitment to a funding floor and more powers for Wales, and road and rail improvements.

Presenting his Budget, external in the Commons on Wednesday, the chancellor told MPs he aimed to keep moving the UK to a "higher wage, lower tax, lower welfare country".

Measures announced include:

Working-age benefits to be frozen for four years - including tax credits and local housing allowance, but excluding maternity pay and disability benefits

An increase in the inheritance tax threshold to £1m for married couples by 2017

A fresh clampdown on public sector pay rises, which will be limited to 1% a year for the next four years

New cars and motorbikes will not need MOTs for the first four years, rather than three

Fuel duties frozen for the rest of this year

Local councils offered the right to vary Sunday trading hours

Corporation tax cut to 18% by 2020

Jane Hutt says the Budget will have serious consequences for families

Mr Osborne said the £26,000 benefit cap - the amount one household can claim in a year - would be cut to £23,000 in London and £20,000 in the rest of the UK.

He announced an extra £8bn a year for the NHS in England by 2020, which would mean extra funds coming to Wales under the rules of the Barnett formula on public spending cross the UK.

Welsh Secretary Stephen Crabb said the Budget was "all about securing a sustainable and affordable long-term recovery for people in Wales".

"The measures outlined by the Chancellor today will boost business in Wales and reward working people whilst making sure that those with the broadest shoulders bear the largest burden," he added.

Analysis by David Cornock, BBC Wales parliamentary correspondent

So what does the Budget mean for Wales?

There was one brief reference to Wales in the chancellor's speech: "In Wales we are honouring our commitments to a funding floor, and to more devolution there, and investing in important new infrastructure like the M4 and the Great Western line."

The official Budget documents offer more detail: "The government is committed to taking forward the St David's Day agreement for Wales to the timetable set out in the command paper.

"This includes implementing a funding floor at the spending review in the expectation that the Welsh government holds a referendum on the devolution of income tax."

It adds: "The devolution of Air Passenger Duty (APD) to the Welsh assembly will continue to be considered alongside the review of options to mitigate the impacts of APD devolution on regional airports. The government is publishing a discussion paper on regional airports alongside the Budget, setting out how some of the options could work."

The UK government also claims that Wales grew faster per head than London and the UK average in 2013.

Welsh Secretary Stephen Crabb tweeted: "A landmark one nation Budget. Living wage, lower business taxes & deficit falling - a strong foundation for Wales to prosper."

'Tough budget'

Stuart Ropke, chief executive of Community Housing Cymru, which represents housing associations, said thousands of people in Wales would be worse off due to welfare cuts.

"The proposed changes in today's budget will increase in-work and child poverty and impact on the most vulnerable and poorest in our communities," he said.

"It's a tough budget for working families and young people, and many will be hit by two or three different changes."

Benefit reforms are making life harder for many families, advice bodies are warning

Reacting via Twitter, Labour's Shadow Welsh Secretary Owen Smith said: "As ever with an Osborne budget you have to look at the small print: will his 'Living Wage' offset the massive cuts to Tax Creds? I doubt it."

The Welsh government's Finance Minister Jane Hutt said: "While we cautiously welcome the National Living Wage and have in fact already delivered it for NHS staff in Wales, it is unlikely to cover the cuts to tax credits for most families."

She added that around 5,000 households in Wales could be hit by the lowering of the benefit cap, and 1,200 young adults could be affected by changes to housing benefit entitlements for 18-21 year olds.

Plaid Cymru's Treasury spokesperson Jonathan Edwards MP said cuts to tax credits were "likely to punish thousands of working families".

"The only way to rectify this is to end the subsidising of low pay and legislate to ensure workers receive a genuine living wage - a key Plaid Cymru commitment," he said.

Ceredigion Liberal Democrat MP Mark Williams said: "When today's Budget fireworks fizzle out, thousands of public sector workers, families and young people face another four years struggling to get by."

Wage costs

Janet Jones, Wales Policy Unit chair for the Federation of Small Businesses, welcomed "positive" moves such as the cut in corporation tax, but warned that some firms might find paying the national living wage "challenging".

CBI Wales director Emma Watkins, representing larger firms, said it was a "double edged Budget" for business.

"Firms will welcome measures to balance the books and boost investment, but they will be concerned by legislating for wage increases they may not be able to deliver," she said.

Neil Brierley, chair of the Royal Institution of Chartered Surveyors (RICS) Wales, praised the renewed commitment to upgrading the M4 and the Great Western railway line, and urged ministers to work with others to "deliver these vital projects as soon as possible".

The Budget prompted a demonstration in Cardiff, attended by several hundred people - including the singer Charlotte Church. About 20 anti-austerity campaigners also held a rally in Aberystwyth.

- Published8 July 2015

- Published8 July 2015

- Published8 July 2015

- Published8 July 2015

- Published7 July 2015

- Published7 July 2015

- Published7 July 2015

- Published5 July 2015

- Published2 July 2015

- Published18 March 2015