Local investors look to renewable energy projects in Wales

- Published

A group of 20 potential investors were show around the Awel turbine scheme

Community renewable energy projects are gaining momentum as an alternative option for investors in Wales.

With Bank of England interest rates at a record low, savers are turning to other ways of making their money grow.

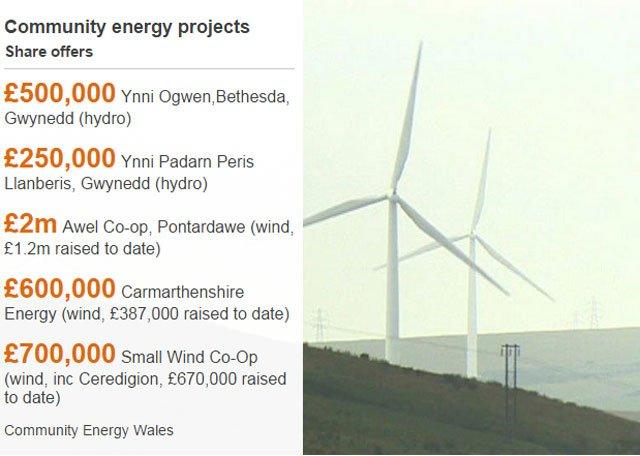

At the moment there are five projects in Wales offering interest above the level offered by most banks and building societies.

But while investors get an income every year, they are tied in for up to 20 years.

The largest project is by Awel Co-op near Pontardawe, which is building two wind turbines to generate power for 2,500 homes.

It is offering 5% per year in interest for 20 years, in return for investment of £50 upwards.

The co-op has already raised £1.23m in this way and hopes that it will reach its target of £2m by the end of October.

'Worthwhile'

Gerwyn Jones, a former teacher and community worker from Swansea, has invested in the project.

"We thought we'd like to put some investment back in the community," said Mr Jones.

"There's a risk involved but it is a cooperative and I understood the ethos, I thought it was a worthwhile way to use the money and the return was going to be healthy after that."

His wife Hilary, a former hairdresser, said: "I was worried about the financial side of it but I think it's the best investment now and the best for the children too.

Crowdfunding schemes - like Small Wind Co-op - and community share schemes - like the Awel Co-op - are not covered by the Financial Conduct Authority or the Financial Services Compensation Scheme.

Share offer documents explain how income would be generated, both through electricity sales and government feed-in tariffs, and that investments could be a risk.

Investors have to confirm that they have read and understand this before they apply.

Gerwyn and Hilary Jones were interested in an environmental investment with a good return

People who invested before the middle of June this year are being promised 7% a year by the Awel Co-op.

But like base rates, its level of interest has also reduced.

David Stonehouse, from Swansea, has invested £2,500.

"The investment will give a better return than what was being offered by the banks and it was also a chance to invest in green issues," he said.

"Considering what the banks are offering at the moment - only at best 1% - if it gets close to 7% or was even half that, it will be better.

"It's not a huge amount of money but it's not something to be sniffed at. I was prepared to take that risk."

Paul and Hilary Coffman are still making their minds up about whether to invest

Paul and Hilary Coffman, who are moving from Aberdare to live locally, are still making their minds up about whether to invest.

"Just leaving it in a bank or building society seems a bit of a waste of time at the moment and if there's something interesting to invest in, and with a better return, then we're interested in looking at it," Mr Coffman said.

"We could buy vintage cars or do all sorts of things with it, but this is worthy."

Dan McCallum, chairman of Awel co-op, said people had to be sure they wanted a long-term commitment and to leave before 20 years they would need to apply.

But he said there was a benefit to keeping it local.

"We're not borrowing it from a venture capital fund or a distant bank," he said.

"People are putting their own money in and getting a return on that investment. The returns from energy co-ops over the years have proved very reliable.

"There are risks with the project, but we're building it, we have a guaranteed feed-in tariff price for the next 20 years - a secure income - and a track record in developing these types of project."

- Published12 August 2016

- Published15 August 2016

- Published4 August 2016

- Published4 August 2016

- Published12 May 2016

- Published5 January 2011