Tata buy-out team Excalibur willing to raise bid

- Published

Excalibur is concerned for how Port Talbot would fit in following a merger

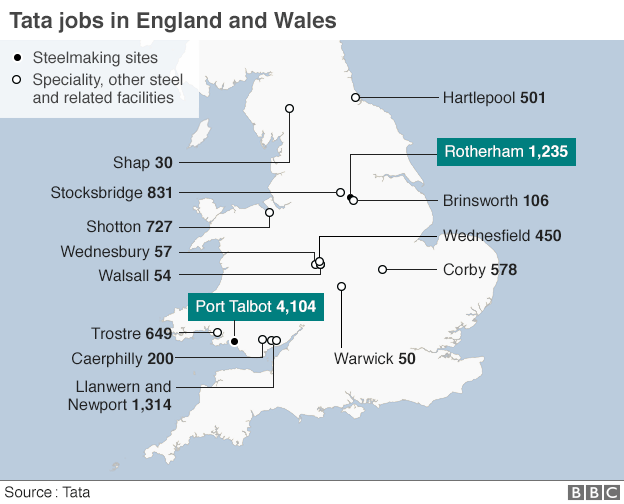

The team behind a management buyout of Tata is willing to increase its bid, work with competitor Liberty and look at taking on the pension scheme in order to buy Port Talbot and other UK sites.

Excalibur chairman Roger Maggs also said he is not sure Tata ever really wanted to sell its steel businesses here.

Tata has entered into merger talks with German rival Thyssenkrupp.

But Mr Maggs said: "We're on alert".

There are concerns a merger between the Indian and German groups would not secure the future of steel-making at Port Talbot in the long term.

Excalibur's chief executive Stuart Wilkie is a senior Tata director who has been given paid leave to work on the management buyout bid.

It was one of the bidders expected to emerge on a shortlist of potential buyers until Tata put the sales process on hold while it entered negotiations with Thyssenkrupp about its European operations.

Uncertainty

There were indications that the Indian company was unhappy with the standard and feasibility of the bids it received.

In Excalibur's first interview since the bidding process was put on hold, Mr Maggs put forward a number of steps he would be willing to take including increasing its bid, if it would get Tata back to the negotiating table.

Speaking exclusively to BBC Wales, he also said he would be willing to consider working with Newport-based Liberty Steel, another potential buyer of the UK facilities.

Dealing with Tata's pensions deficit of around £700m was considered to be one of the main issues adding to the uncertainty.

Plans by the UK government to change the law to reduce the deficit by allowing the pension scheme to cut benefits to members appear unlikely to progress due to concerns in Parliament about setting a precedent.

Excalibur is now willing to look at whether it could take on pension liabilities as part of any sale.

'Give us a call' - is Roger Maggs's message to Tata bosses

Mr Maggs said he was disappointed but not surprised Tata had "paused" the sales process.

"It always seemed to be an unreal - very fast - timetable and there was very little engagement," he said.

"We dealt with almost exclusively early on with Tata's agent. It was a filling-in-forms process and there was never any negotiation about the terms of any bid. We felt there wasn't an enthusiasm for a sale on Tata's side as there was on ours."

In July, Tata entered negotiations with German rival Thyssenkrupp about a European merger.

"I can only surmise that for the whole time, the merger idea with the Thyssenkrupp had been in their minds. I suspect that once they saw the quality of the bids, they decided to concentrate on the merger with the German group. All global steel analysts are all saying the merger is the right thing to do."

But Mr Maggs said his concern was where a merger would leave capacity in the UK - with plants in a new super-company in Germany, Holland and Brazil coming into the equation.

"Where does Port Talbot figure in that?" said Mr Maggs.

"Our concern is we know we have certain disadvantages, we're trying to get stronger. But that's what worries us and I'm sure that's what is worrying the UK government and Welsh Government and the consequences for us."

He said the merger itself was complicated, while in the background the UK government was now making the judgement about whether it still wanted a British steel industry.

"This dish is not cooked - something could go wrong," he said.

"Our responsibility is to just stay there, stay fit and, if there's an opportunity, we can just go straight back in there. Our advisers have agreed to that. We're on alert."

Tata Steel executives earlier this month when the latest quarterly financial results were announced in Mumbai

Tata Steel gave no update in its latest quarterly report earlier this month on the future of the company's Port Talbot plant.

Koushik Chatterjee, Tata's finance director, external, said Tata Steel UK "continues to be engaged" with stakeholders, including unions and the UK government, "to find a structural solution to the pension exposure of the UK business".

But he said the "positive impact" of structural restructuring in the UK in the last six months along with a weaker pound, cost reductions and an "effective hedging strategy" on raw material imports meant it was able to report a better performance for the quarter.

- Published28 September 2016

- Published28 September 2016

- Published12 September 2016

- Published25 April 2016

- Published30 March 2016

- Published1 April 2016