Welsh workers pay Scottish income tax in payment mix-up

- Published

A number of workers in Wales have paid the wrong amount of income tax after Scottish rates were applied instead.

HMRC have not said how many workers were affected by a mix-up over the tax codes used to show where people live.

In April, the Welsh Rates of Income Tax were introduced and the tax code which should be used is C.

HMRC said the error was down to some employers entering an S code for Scotland, which meant some paid too much tax and others not enough.

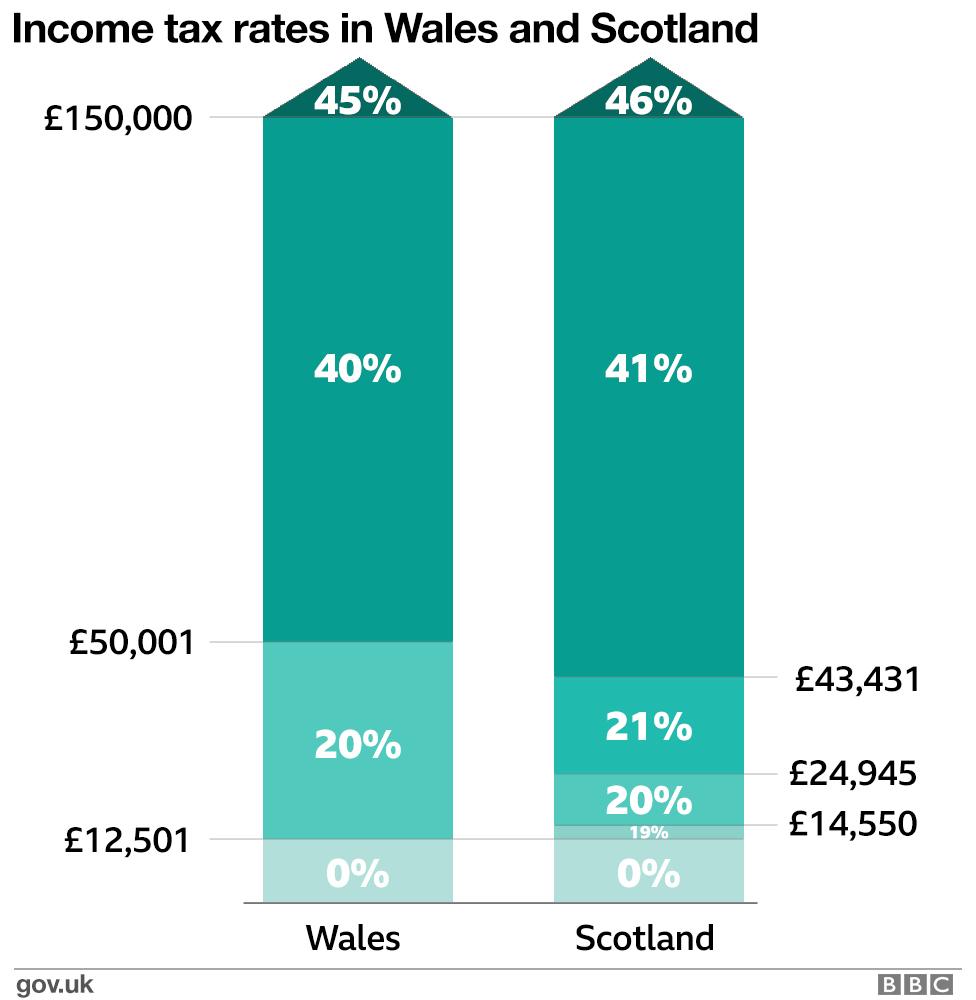

People earning £12,501 to £14,549 would have underpaid tax as the Scottish rate is 19% while in Wales it is 20%

All income between £24,945 to £43,430 would have been taxed 1% more than it should have been

People earning £43,431 to £50,000 would have faced a 21% hike on that portion of income, while income over £50,001 would have been overtaxed by 1%.

"We have been made aware of an error in the application of new income tax codes for Welsh taxpayers by some employers which has meant some taxpayers paid the incorrect amount of tax in April," an HMRC statement said.

It said any errors would be resolved through PAYE and the taxpayers affected did not need to take any action.

"It is the responsibility of the employer to apply the tax codes provided by HMRC and we are working closely with the employers affected and providing support as they investigate and correct the problem.

But the Welsh Assembly's finance committee chairman Llyr Gruffydd said HMRC was aware there could have been issues.

"HMRC's admission is deeply disappointing as this committee was repeatedly given assurances that mistakes like this would not happen," he said.

"We raised concerns about the flagging process for identifying Welsh taxpayers during our inquiries into fiscal devolution and the Welsh Government's draft budget.

"On each occasion we were told the matter was in hand and the lessons from the devolution of income tax powers to Scotland, where there were similar issues, had been soundly learned and would be put into effect."

- Published5 April 2019