Cardiff council's debt to jump by 70% to £1.4bn

- Published

Cardiff council has currently borrowed about £841 million

Cardiff's public debt is set to jump by about 70% - to more than £1.4bn - during the next three years.

Cardiff council is currently borrowing about £841m, which is forecast to increase to £1.435bn by the 2023-24 financial year.

The local authority already pays about £34m each year in interest on its borrowing.

Council leader Huw Thomas said the borrowing was needed for new homes, schools and an indoor arena.

The borrowing figures were revealed in the council's treasury management annual report, which was discussed during a full council meeting on 21 October, according to the Local Democracy Reporting Service.

Liberal Democrat councillor Rodney Berman questioned whether the council would be able to sustain services in the city in the coming years given its level of borrowing.

He said: "How sustainable is it that we're letting our borrowing creep up to that level in the coming years.

"I really worry about where we're going to go as a city, and the affordability of the strategy that this Labour administration is overseeing," he said.

"Are they mortgaging us to the hilt?"

Cardiff council leader Huw Thomas says the borrowing is needed for new homes, schools and an indoor area.

However, Mr Thomas argued the council is investing its "way out of a crisis", and criticised the calls for less borrowing.

He said: "When you look at the projected borrowing for the coming five years, approximately £250m of that borrowing is through the housing revenue account.

"That's this council borrowing money to build good quality houses that are much-needed in the public sector rental market in Cardiff."

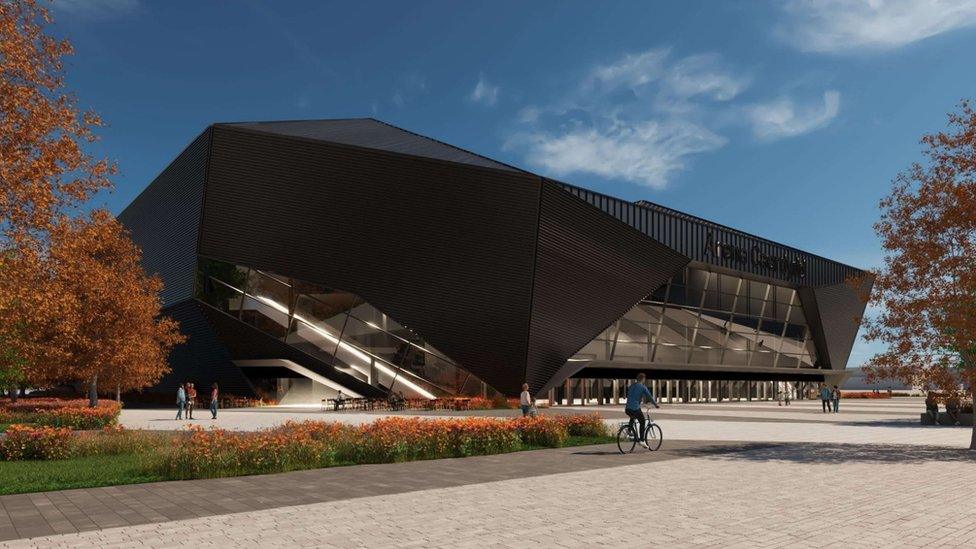

The council has said the indoor arena is the "missing piece" in Cardiff's infrastructure

He also said that borrowing in the general fund was "largely" to build new high schools, primary schools and an indoor arena in Cardiff Bay which would "deliver roughly £100m of inward investment into the city per year".

Council bosses previously said they were working on a "huge and historic" house-building programme of 4,000 homes to tackle the city's housing crisis, with 600 already built since 2019.

Several new schools are also being built across Cardiff, with more planned.

Related topics

- Published16 September 2021

- Published6 October 2020