Hospitality costs: How will firms survive after summer?

- Published

Will this be the last summer season for some hospitality businesses?

Surging costs mean the summer season may be the last for some hospitality businesses in the struggling sector, a politician has warned.

Plaid Cymru's Mabon ap Gwynfor said a 20% VAT rise for restaurants and hotels was the latest shock, and has written to Chancellor Rishi Sunak asking for a cut, and reversal of other measures.

The owner of one pub described the situation as "shocking".

The UK Treasury said the recent lower VAT rate had been a temporary move.

Sarah Hudson, who runs The Bell at Skenfrith, Monmouthshire, said: "It's shocking."

She added: "I have no chance to boost investment because I've had to close two days a week because of lack of staff.

The Bell owner, Sarah Hudson, said the situation is "shocking"

"In 2019 I had 28 permanent members of staff, I now have nine, and since then I haven't been able to employ one person.

"We need more people to serve in the industry so we can boost productivity and invest in our businesses."

Hospitality businesses have warned about the impact of rising costs

A bleak picture was also painted by David Chapman, executive director of UKHospitality Cymru.

"First of all there's very little chance of anyone in our industry being able to invest in their businesses after two years of cash reserves being drained, loans being taken out and now we're dealing with increased taxation and hyper-inflation really," he told BBC Radio Wales Breakfast.

"So how on earth we're expected to find money from nowhere and invest in those businesses, I don't know."

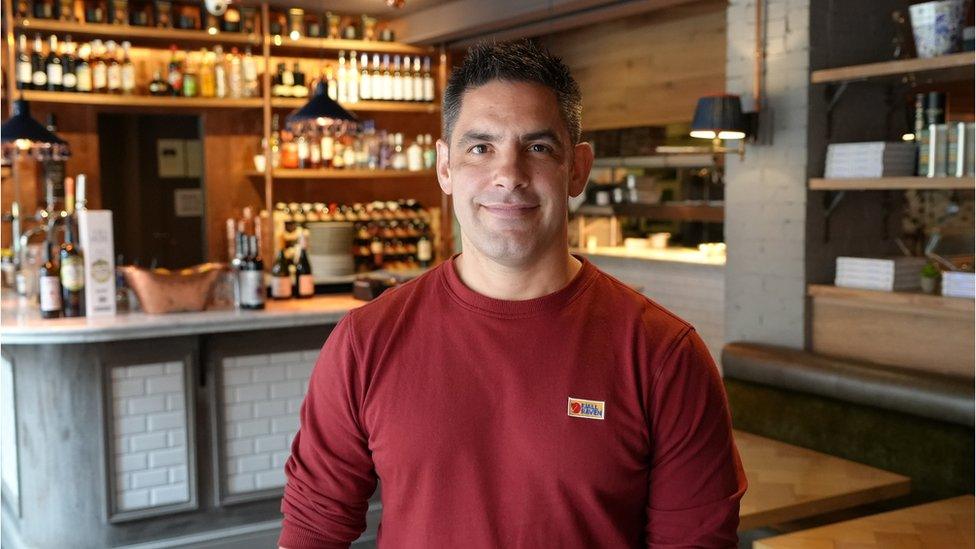

April's VAT increase immediately increased costs for Owen Morgan, who founded the 44 Group of restaurants in south Wales and Bristol.

Owen Morgan, founder of the 44 Group, called for VAT to be reduced

"Overnight, that put a huge increase on our annual labour bill across the sites," he said.

"It happened at the same time as the energy crisis and the fuel crisis. So overheads are much higher for the business."

Mr Morgan asked if VAT could have stayed where it was, "or even lowered again, which the industry is lobbying for, to be more on a par with European countries, where eating out with the family is a culture and more affordable".

Mr ap Gwynfor, the Member of the Senedd (MS) for Dwyfor Meirionnydd, has also urged the chancellor to reverse the increased cap on energy bills and the increase in national insurance contributions by employers.

"The sad truth is that the impact of these price rises is not only going to make it very difficult for a lot of these businesses, but we might well see that this season is the last season for many, unless they get the help they need now to tide them over for this difficult period," Mr ap Gwynfor said.

What has happened to VAT?

In July 2020 as the Covid pandemic took hold, the VAT rate for hospitality businesses was temporarily reduced from 20% to 5%.

It remained at 5% until October 2021, when it climbed to 12.5%.

But from April 2022 the rate returned to the standard VAT level, which is currently 20%.

The UK Treasury has been asked to respond to the calls for VAT to be cut again.

'I live day by day'

After 30 years running restaurants in Bridgend, Franco Scuto isn't sure his business can survive the rise in costs

Italian restaurateur Franco Scuto, who has run restaurants in Bridgend for 30 years, said the current crisis made him want to leave the industry.

"I don't think far ahead because if I think far ahead then I don't think there is any hope, I don't think we will survive. So I live day by day."

"I have been in Bridgend 30 years, I have got great customers who have supported me. But how long can we keep this going? I don't know. It is getting worse and worse every day."

Mr Scuto said the cost of ingredients had forced him to raise prices for customers at Ristorante Il Vecchio.

"We used to buy vegetable cooking oil for £14.95. Today it has gone up to £35. And tinned tomatoes went from £11 to £22. And you have to look at the staff costs too."

He said he was "not prepared to cut the quality of food" and would instead have to increase prices for customers.

HM Treasury said it had helped the hospitality sector during the pandemic with a £400 billion package of economy-wide support.

A spokesman said: "At the spring statement we went further, announcing a £1,000 increase to the employment allowance which will cut taxes for hundreds of thousands of businesses.

"We have also provided £2.5 billion extra per year to the Welsh government to spend on devolved matters, which includes business rates relief."

It said the lower VAT rate was a temporary measure.

LIFE IS SWEET: Picture perfect cakes and the people who make them

HEY, MACH ARENA: Highlights from the Machynlleth Comedy Festival 2022

- Published22 March 2022

- Published18 April 2022

- Published6 April 2022

- Published2 February 2022

- Published20 April 2022

- Published31 March 2022

- Published30 April 2022