Cost of living: Interest rate rise fear for business owner

- Published

Domenico Scarpetta says the rising cost of food is adding to the financial problems

Some companies will not exist in January if interest rate rises continue, a business owner has warned.

It comes as the Bank of England has decided to raise interest rates from 2.25% to 3%, the biggest increase since 1989.

Domenico Scarpetta faced interest rate hikes in the 1990s, but back then, "all I had to worry about was my mortgage, not the price of food as well".

Food and electricity prices have also soared in recent months.

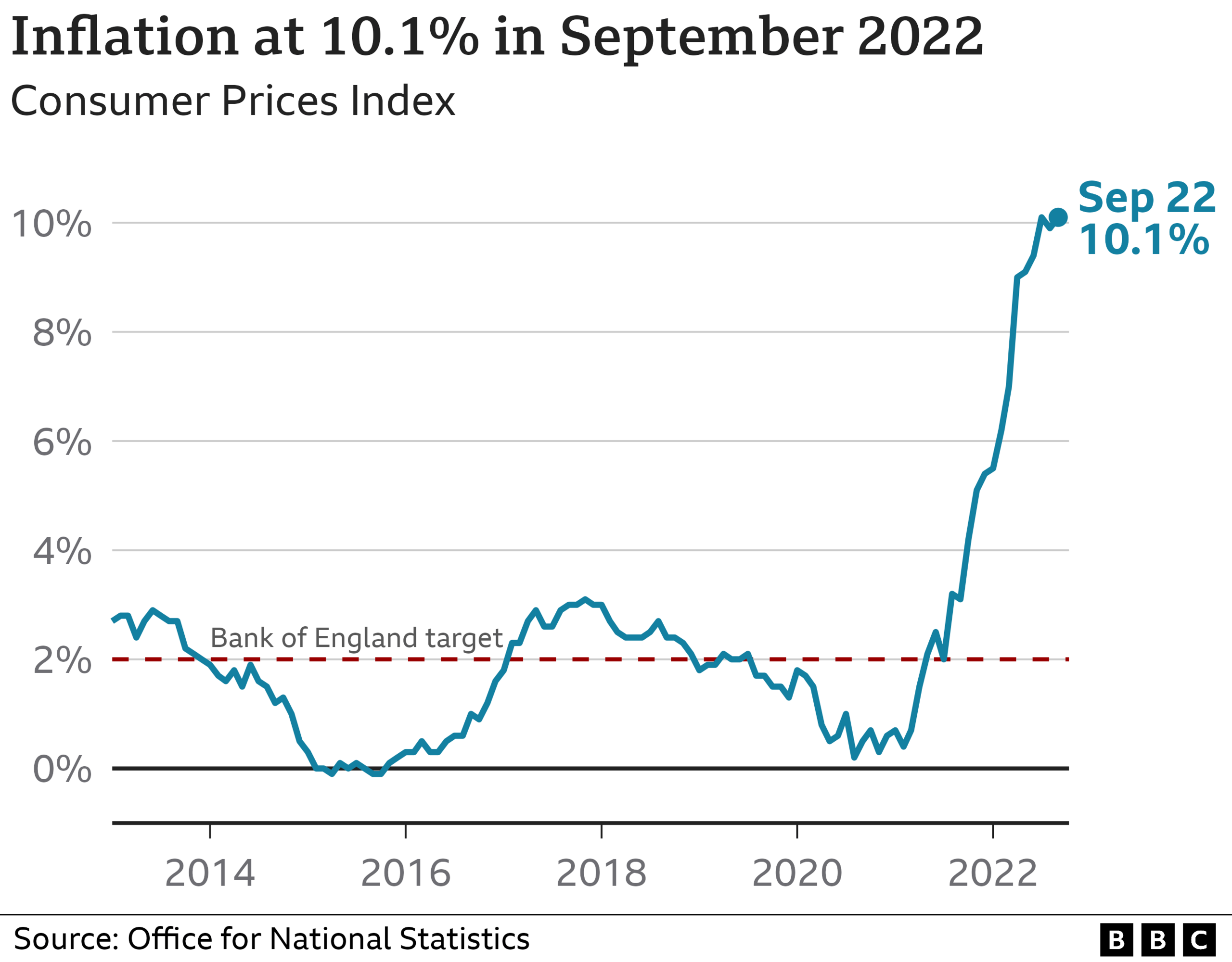

The general cost of items is currently 10.1% more expensive than 12 months ago, according to official figures.

The bank's target is to keep it at 2%.

Reacting to the rise in interest rates, Mr Scarpetta, who runs food producer La Mediterranea Food UK in Abergavenny, Monmouthshire, said the situation "cannot get worse" than currently.

He said that after the rise in interest rates, cost of electricity and price of food, he is paying about £1,000 more every week than he was a year ago.

Domenico Scarpetta had to deal with interest rate rises in the 1990s

"I know that I will be a winner if I just break even and survive this year," said Mr Scarpetta.

"I think a lot of businesses will fail and won't be in business in the new year, it's as plain and simple as that."

In theory, by raising interest rates the bank can slow down price rises.

But the increase makes some loans and mortgages more expensive, leading to another squeeze on household incomes.

"It does affect everybody, the poor, the wealthy and the middle classes," Mr Scarpetta said.

He is worried customers will cut back on their spending at his restaurant and at other businesses, making them less viable.

'This will cripple my business'

La Mediterranea spends 17.12p per unit of electricity used but from December it is rising to £1.24 per unit.

"It will be £3,500 a month, this will cripple my business," he said.

"The situation is really really bad, but if I panic now how do I dispose of ten full time staff? How do I dispose of five units?

"We have no choice, we have to carry on and take the hit."

Rising food costs have also seen his ingredients shoot up.

He buys 25,000kg of pasta flour a year which has doubled in price, while oil has risen from 89p a litre to £2.75 a litre and six cans of tinned tomatoes have jumped from £8 to £19.50.

Asked if he could pass on the price rises to customers, he said: "What can we put up by? Perhaps 10% but we can't put it up 100%, so it's affecting any business."

Myf Hywel has her eyes on 12 months down the line when her loan and electricity deals run out

Three doors down, Myf Hywel, 21, started making and selling takeaway food.

She has a loan for various equipment from cookers to vacuum packers and large fridges, which is fixed until October next year.

But rises in interest rates have left her worried about what happens when her deal ends.

"How am I going to pay it back when the months are quieter?"

"It's Christmas I have in the back of my mind.

"Hopefully that will keep me going but then we go into January and I know that will be a quieter time of year. It will be hard."

'Alarming' rise in interest rates

The Welsh government's Finance Minister Rebecca Evans said the rise would make a "difficult situation even tougher" for struggling people and businesses.

She said: "The chancellor must use his autumn statement to turn away from austerity and instead invest in the UK and deliver a meaningful and targeted cost-of-living support package."

Welsh Secretary David TC Davies said Chancellor Jeremy Hunt and Prime Minister Rishi Sunak were "compassionate" and their focus was "going to be on those that have the least".

He added: "Obviously, nobody wants to see the interest rates rise... it will have an effect on more mortgages sooner or later."

Meanwhile, Lloyd Powell, head of the Chartered Certified Accountants (ACCA) Wales, said the interest rate rise was "alarming".

He said: "Accessing finance is hard and is taking longer to access. It is vital to put finance in place well before it's needed. [Businesses] across the UK need stability and as much certainty from the Exchequer as it can provide to allow them to effectively plan, recover and grow."

WHAT'S KILLING OUR RIVERS?: Wyre Davies investigates what and who is to blame

Related topics

- Published31 October 2022

- Published2 November 2022

- Published18 October 2022