Covid in Wales: Return of VAT on PPE criticised by Mark Drakeford

- Published

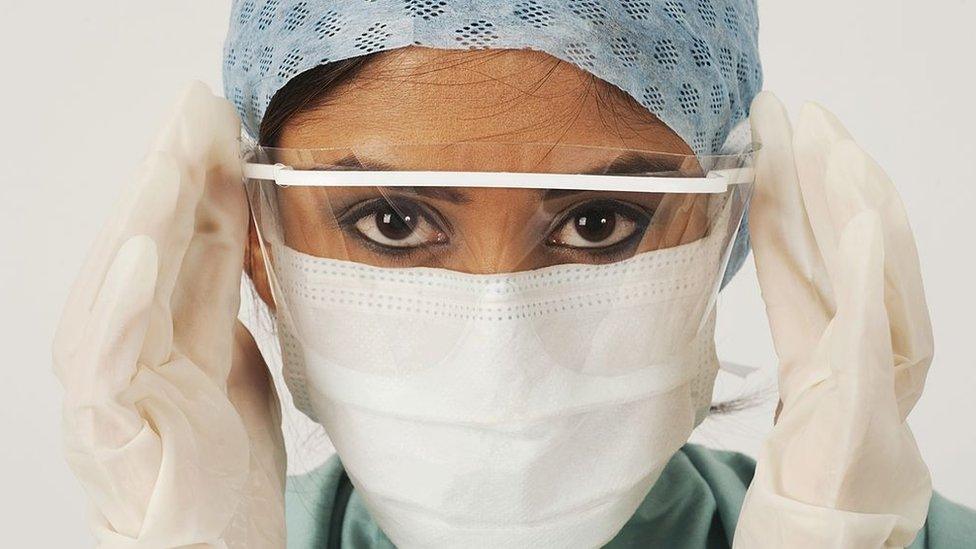

The VAT relief applied to medical grade PPE, not general face coverings

A decision to reinstate VAT on personal protective equipment is "unfathomable", Wales' first minister has said.

Welsh ministers wrote to the UK Treasury objecting in late October.

Mark Drakeford said paying the tax would cost £20m, money that cannot be spent "to provide services for cancer patients and cardiac patients".

UK ministers have said the VAT relief was "to accelerate the supply of PPE to the health and social care sectors... when they needed it most".

The tax was suspended in May until the end of October and is estimated to have cost the Treasury £255m.

During Tuesday's First Minister's Questions, the Labour Mid and West Wales Senedd member Joyce Watson asked Mr Drakeford to again ask the Treasury not to "force this safety tax on Welsh businesses and charities" during a pandemic.

"It's unfathomable to me as to why the UK government has decided that this is the right moment to add additional costs on to essential safety equipment," he replied.

'Really struggling'

The first minister said the Welsh Government had provided 440m items of PPE to the NHS and social care providers so far this year.

He said small business that are "really struggling during the pandemic" and are not VAT registered would not be able to claim the cost back, and neither would charities that are VAT exempt.

The UK government has previously said: "The VAT relief was designed to accelerate the supply of PPE to the health and social care sectors... when they needed it most."

The relief applied to medical grade PPE, not general face coverings.

- Published26 October 2020

- Published10 November 2020

- Published6 October 2020