What the yuan devaluation means around the world

- Published

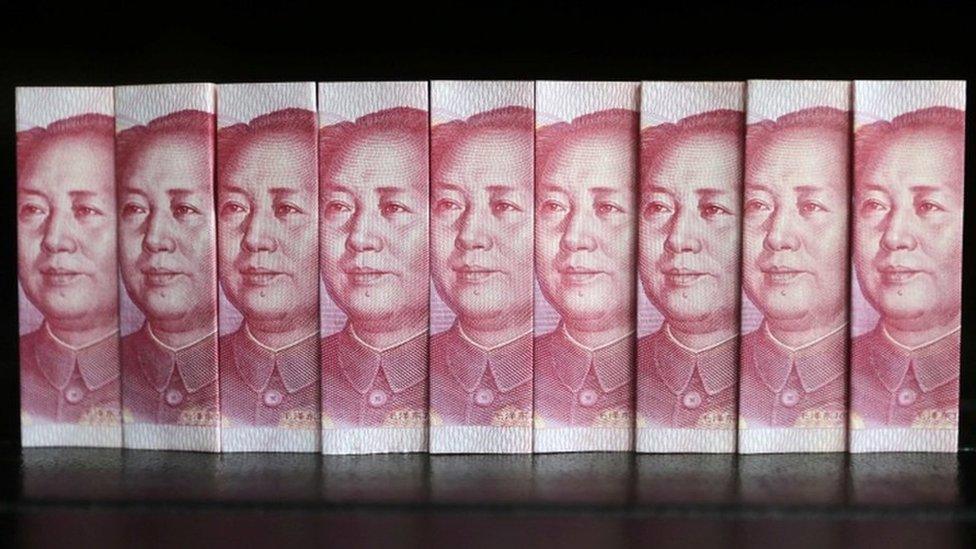

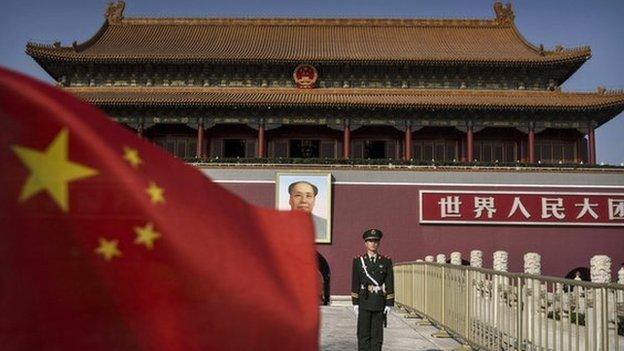

For the second day in a row, China has cut the value of its currency, the yuan.

Stock markets have been rattled, and with China a major exporter, buyer of commodities and having a huge consumer market, it will not just be investors who feel the impact.

Our correspondents around the world consider what the devaluation means where they are.

Africa, by Lerato Mbele, BBC Africa Business Report

China is now the number one trading partner for most African countries.

In an effort to make the buying and selling of goods much easier, some states introduced the yuan into their foreign exchange system.

In 2011, the Nigerian Central Bank pledged to store between 5%-10% of its foreign reserves in yuan, alongside dollars and euros.

At the time, the Chinese economy had the highest growth rates in the world.

African commodities, priced in dollars, could take a hit as Chinese buyers lose purchasing power

Nigeria believed that looking east would help protect the local currency, the naira, against the volatility of oil prices set in dollars.

Later on Kenya, whose port is a major gateway for Chinese goods, announced plans to set up a clearing house for the Chinese currency.

It was hoped that at the port of entry, Chinese clients selling manufactured goods could pay excise and taxes, and get their goods into the local economy speedily.

The immediate impact of the devaluation of the yuan cannot be seen or measured, but countries that have taken steps to transact in Chinese money could see pressure on their own local currencies.

In general, other African nations have limited exposure, because they still price their goods in American dollars.

Nonetheless, as China is now their biggest customer, they could feel the pinch indirectly.

If the yuan is devalued, buying anything priced in dollars becomes more pricey for the Chinese.

Therefore the sale of commodities such as platinum, copper or coal may become more expensive, which could reduce demand.

So while there is no immediate impact, in the medium- to long-term, the sales of African commodities and African currencies could take a knock.

Brazil, by Daniel Gallas, BBC South America Business Correspondent

Brazil has already been suffering in the wake of China's economic slowdown

Under normal circumstances, the devaluation of the yuan would have a huge, negative impact on the Brazilian economy.

China is Brazil's main commercial partner, and a weaker yuan would mean a Brazilian loss in its terms of trade with the Asian giant.

But these are not normal circumstances in Brazil, as the country is facing its worst economic downturn in two decades.

One of the few positive side-effects of this is that the Brazilian real has dropped to its lowest level in 12 years, favouring Brazilian exports abroad.

While the Chinese currency has dropped about 3% since January, the Brazilian real has lost 23% of its value.

If this were a purposeful currency war, Brazil would surely be "winning" in the race to the bottom.

Brazil's economy is in crisis largely due to China, but this has more to do with the overall slowdown of the Asian economy and the end of the commodities boom cycle in recent years than just currency fluctuations.

India, by Yogita Limaye, BBC India Business Report

Indian exports are likely to come under further pressure from the yuan's devaluation

Not far from our office in Mumbai, there is a big street market with rows and rows of little shops that sell a wide variety of shoes at very low prices. Some pairs cost as little as $4. All of them come from China, and that's not it.

India imports heavily from its eastern neighbour. The bill is $60bn (£38.4bn). The devaluation of the yuan will mean that companies which buy from Beijing will now have to spend a little less.

Firms that make electrical and electronic goods in India import a bulk of their components from China, so they are going to be happy.

Most analysts though, do not expect them to pass on that benefit to consumers here.

But there are several sectors where India competes with China to sell to the world.

Textile manufacturers and chemical producers might have it a little tougher now because in the global marketplace their goods might become less attractive than those from China.

This could be a problem for the economy as a whole because Indian exports have been contracting for seven months in a row already, so another dip might further affect the country's trade balance.

- Published11 August 2015

- Published11 August 2015

- Published11 August 2015

- Published12 August 2015