India election 2019: Has the government controlled inflation?

- Published

Claim: The opposition Congress party in India has criticised the BJP government's record on inflation, saying it has done nothing to keep it in check, despite what it calls a favourable global outlook.

Verdict: Inflation - the rate of increase of prices for goods and services - has been kept lower under this government than the previous one. The drop in the global price of oil after 2014 has contributed along with a squeeze on incomes in the rural economy.

In the first in a series of articles looking at claims and pledges by the main political parties ahead of India's election, Reality Check looks at the figures behind one of the ruling BJP's key policy commitments.

India's prime minister Narendra Modi pledged to control prices and says that inflation is now the lowest it has been for decades.

But the main opposition Congress party has been strongly critical of the government's record.

"The BJP came to power on the promise of controlling inflation, but despite favourable global conditions, nothing was done by the government," said Sachin Pilot, the Congress leader in Rajasthan state, last year.

Rahul Gandhi, the national leader of the Congress party, has also called on Mr Modi to get prices under control or "quit the throne".

So, who is right?

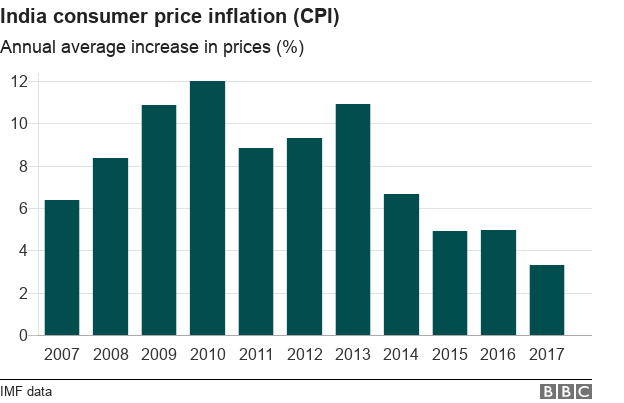

After the BJP won power in 2014, a target of 4% was set - allowing for a flexible two percentage point range either side.

Under the previous Congress-led government, inflation had reached a peak of nearly 12% in 2010 and in 2013, its last year in office, it was about 11%.

Inflation has fallen significantly since 2014 and it is now lower than it has been for a decade.

In 2017, the average annual rate was below 4%, with the latest figures for 2018 indicating a rise to around 4.5%. So on current evidence, the BJP is meeting its promise on prices.

How is inflation calculated?

In a large and varied country such as India, calculating inflation is a complex affair.

The authorities used to track wholesale prices in order to capture inflation.

But in 2014, the Reserve Bank of India - the country's central bank - switched to using the consumer price index (CPI).

CPI looks at the prices of goods and services used directly for household consumption or - simply put - retail prices.

A similar methodology is used in many other countries.

Foodstuffs make up a significant part of the inflation basket

Why has inflation come down?

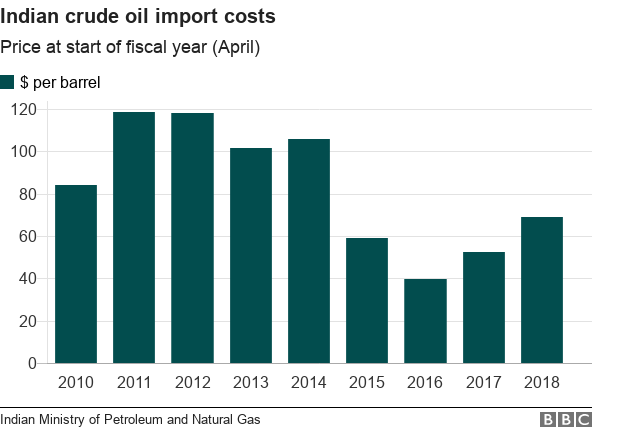

A steady decline in the oil price - during the first years of Mr Modi's term - has been cited by many analysts as one of the biggest factors.

India imports 80% of its oil and global price fluctuations can have an effect on inflation., external

India's crude oil imports cost nearly $120 (£90) per barrel in 2011, when Congress was in power.

This had gone down to just under $40 per barrel by April 2016, although the price went up again in the following two years.

But there are other elements at play in the economy that also affect inflation.

One important factor has been declining food prices, especially in rural areas., external

It is worth remembering that well over 60% of India's population live in the countryside.

Food prices in rural areas have been going down

India's former chief statistician Pronab Sen says that inflation has dipped in recent years because of a squeeze on farm incomes., external

He believes this is largely down to two things:

the current government reducing financial support for a huge scheme to guarantee incomes in rural areas

minimal increases in the prices that the government guarantees to farmers for their crops

"In the preceding eight to 10 years [of Congress-led rule], the rural employment scheme had raised rural wages, leading to increased food spending," says Mr Sen.

But he adds that these wage rises have now tailed off.

And that effectively reduces demand, and with it inflation.

Other factors at play

There have also been other policy decisions that have helped to keep demand in check and therefore curbed inflation.

The central bank has not been in a hurry to lower interest rates, which would have allowed consumers to borrow and spend more.

The rate cut announced in early February was the first for 18 months.

The government has also been aiming to keep its fiscal deficit under control - that is the difference between the amount it earns and the amount it spends.

Lower fiscal deficits tend to help check inflation, because the government is borrowing and spending less.

However, with an election looming, the government may feel under pressure to increase spending - particularly in rural areas - which would fan inflationary pressures.

- Published4 April 2019

- Published1 February 2019