Europe: Central Bank rides in

- Published

- comments

Mario Draghi vowed to do whatever it took to prevent countries defaulting in 2012

Once again the European Central Bank (ECB) is set to demonstrate it is the most powerful institution in Europe.

Once again the bank is set to ride to the rescue of the eurozone.

In 2012, ECB President Mario Draghi pledged to do whatever it took to prevent countries defaulting and contagion spreading.

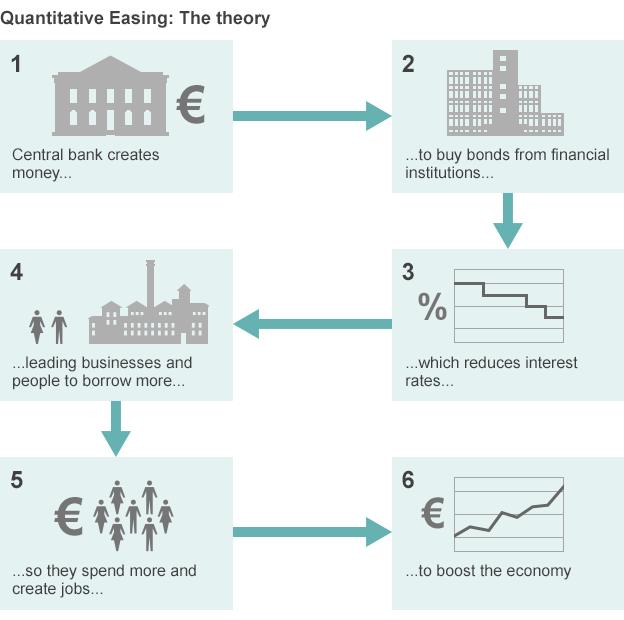

In 2015, on Thursday, it is likely he will announce a programme of quantitative easing, printing money to fight an economic slump and deflation.

Investors, politicians, European officials all now expect the ECB to start buying government bonds on a large scale. France's President Francois Hollande appeared to announce it as a matter of fact.

Demand for government bonds is already being driven up in countries like Spain.

Quantitative easing (QE) was embraced by the US and the UK early on in the financial crisis.

War chest

The ECB has had to wrestle with the limitations of its own powers and the prohibition of directly supporting struggling governments by printing money. So this major step has been debated for months but, even now, is tinged with uncertainty.

QE should ensure a lower valued euro, making exports cheaper and imports more expensive, so eventually raising inflation. The aim of this exercise is to restore "price stability", which means bringing inflation closer to the target of 2%.

But no one knows the size of the war chest to be deployed.

How much will the ECB add to its own balance sheet? Some say €500 billion (£380bn; $580bn). Others say it will have to be twice that amount.

'Dramatically devalued'

Then there are the political headwinds.

The German Bundesbank is opposed to the move. German political opinion is sceptical.

QE has raised old fears of inflation and weakening of the currency. German officials have been warning that the value of the euro could be "dramatically devalued" if the ECB goes ahead.

The Germans are also clear they do not want to share the risk of any country defaulting.

So on Thursday the ECB may ensure that bought government bonds remain with the national central banks and so they shoulder the risk.

Some in the eurozone believe this undermines solidarity.

Irish Finance Minister Patrick Noonan said there will be "no mutualisation of risk and it will be a reversal of policy used in the banking union". Mr Noonan sees it as almost the renationalisation of the banking sector.

'Backburner'

German Chancellor Angela Merkel does not want QE to take priority over reforms to competitiveness

Mario Draghi will struggle to achieve unity at the ECB for this highly controversial decision.

At least one central banker believes such important steps should be decided by democratically-elected governments and not bankers.

Apart from reservations in Germany, the Netherlands, Estonia and Luxembourg have concerns too.

But, despite five years of struggling to save the eurozone, trust remains weak.

German Chancellor Angela Merkel says: "It must be avoided that ECB actions could be seen in any way as putting on to the backburner what must be done in the area of fiscal policy and competitiveness."

That is also what is exercising German commentators, that printing money will enable countries to back off reforms, which in many places remain half-hearted and tepid.

So the judgement on what Mr Draghi is expected to announce will come down to how this programme is designed and how credible it is and how many political concessions have had to be made.

Quantitative easing, if it happens, casts a harsh light on the eurozone crisis.

After five years, political leaders and the ECB have managed to take the euro off the critical list.

No-one any longer believes that a eurozone country could fail to pay its debts and bring down other countries with it.

That risk has gone. But the eurozone, after years of austerity, is facing anaemic growth and high unemployment.

French Economy Minister Emmanuel Macron (L) has stepped up efforts to revive his country's economy

It is suffering from a chronic lack of demand. The price of trying to make these very different economies competitive with each other has been stagnation.

Structural reforms, at a time of near-recession, may in the short term have made matters worse. Public debt has continued to rise.

Although both France and Italy have taken steps to free up their labour markets, making it easier to hire and fire workers, both governments feel they are up against the limit of what the people will accept.

That is underlined by the frequent warnings that austerity is undermining social cohesion and support for the European project.

So it seems that the ECB will try to stimulate Europe's economy by the large-scale purchase of government bonds.

The virtual printing presses will be switched on. It is a last throw of the dice to boost Europe's economy.

- Published20 January 2015

- Published22 January 2015

- Published14 January 2015