Greek debt plans to be submitted

- Published

Greek PM Alexis Tsipras spent Thursday seeking support for his reform plans

Greece's government has agreed a reform programme and will submit its proposals to its international lenders soon, the defence minister has said.

The reforms are thought to include tax rises and pension changes.

Greece is due to present the proposals by 22:00 GMT on Thursday to try to secure a third bailout and prevent a possible exit from the eurozone.

The new proposals will be studied by eurozone finance ministers on Saturday and a full EU summit on Sunday.

Defence Minister and junior coalition party leader Panos Kammenos gave no further details of the agreed plans as he left the prime minister's official residence, where ministers had been meeting.

Prime Minister Alexis Tsipras has spent the day discussing the proposals with his cabinet.

Greek media are reporting that the reforms will be put to the Greek parliament on Friday for approval.

On Wednesday Greece formally submitted a request for an unspecified loan from the European Stability Mechanism bailout fund, external.

This would be a fresh loan "to meet Greece's debt obligations and to ensure stability of the financial system", Greece says - in other words, to avoid bankruptcy.

The President of the European Council, Donald Tusk, who will chair Sunday's EU summit, said he hoped to receive "concrete and realistic proposals of reforms from Athens".

Such proposals "will have to be matched by an equally realistic proposal on debt sustainability from the creditors. Only then will we have a win-win situation," Mr Tusk added.

Mr Tsipras was applauded by his cabinet as he arrived in parliament on Thursday morning

The PM's official residence was the venue for the Greek cabinet's meeting on Thursday afternoon

However the German Chancellor Angela Merkel said that "a classic haircut" (meaning reducing the value of Greece's debts) was "out of the question" for her.

All Greek to you? Debt jargon explained

Speaking in Sarajevo, Mrs Merkel said the eurozone had dealt with the issue of debt sustainability in 2012.

'Just do it'

She described Sunday's EU summit as a decisive and important meeting.

"We must not forget that the Greek people are suffering at the moment," she said.

German Finance Minister Wolfgang Schaeuble also ruled out debt relief for Greece, saying "there cannot be a haircut because it would infringe the system of the European Union".

Greece needs to implement reforms to win the trust of its eurozone partners, Mr Schaeuble said. He told a conference in Frankfurt that his message to the new Greek Finance Minister Euclid Tsakalotos was: "Just do it!".

Greek pensioners have been queuing at banks to get cash, as many do not have ATM cards

Cash machine withdrawals are limited to just 60 euros a day

The Greek government has meanwhile extended bank closures and the €60 (£43; $66) daily limit on cash machine withdrawals until Monday.

The curbs were imposed on 28 June, after a deadlock in bailout talks with creditors led to a rush of withdrawals.

Louka Katseli, the head of the Greek bank association, said on Thursday that there was enough liquidity in cash machines to serve the public until Monday.

Crisis countdown

Thursday 9 July: 22:00 GMT deadline for Greece to submit new proposals

Friday 10 July: ECB, EU and IMF discuss proposals at technical level

Saturday 11 July: Eurozone finance ministers discuss plans (Brussels 13:00 GMT)

Sunday 12 July: Eurogroup leaders meet (14:00 GMT) followed by summit of all 28 members of the European Union (16:00 GMT). Both Brussels

Monday 20 July: €3bn payment due from Greece to the European Central Bank

Germans have sympathy for Greeks but not their government, Jenny Hill explains

On Thursday, EU Economics Commissioner Pierre Moscovici said he was hopeful of a new deal: "I have the sense that the dialogue is established, or restored, and that there is a way out."

The IMF, lowering its economic growth forecast for the world for 2015, said events in Greece would have a "limited" effect on the rest of the global economy, as Greece makes up just 2% of the eurozone.

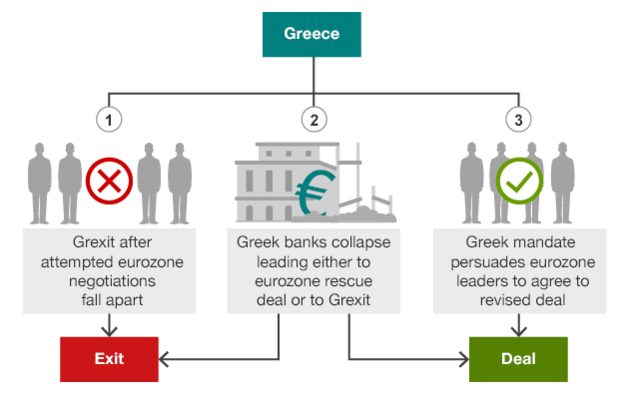

Greek scenarios

Greece's creditors - the European Commission, the European Central Bank and the IMF - have already provided more than €200bn in two bailouts since a rescue plan began five years ago.

The second bailout expired on 30 June.

The creditors had hoped for new, concrete proposals from Greece at a meeting on Tuesday but these were not submitted and they instead agreed to set a new deadline of Thursday.

Greece has been warned this is the "final deadline".

Mr Tusk has said this is "now maybe the most critical moment in the history of the eurozone".

Athens newspaper seller Pavlos Giannopoulos: "The closing of the banks was the worst that could happen"

"This is really and truly the final wake-up call for Greece and for us, our last chance," he said, adding that failure "may lead to the bankruptcy of Greece".

Mr Tsipras's Syriza party was elected in January pledging to oppose the harsh austerity measures demanded by creditors.

And on Sunday, the Greek people decisively rejected the latest bailout proposals from creditors in a referendum.

Energy minister and influential Syriza member Panayiotis Lafazanis insisted on Thursday that Greece would not sign up to a third bailout if it brought "harsh austerity, suffering and deprivation to the Greek people".

He insisted Greece had "alternative options to a new bailout deal" and there was "no gun pointed at its head".

Supporters of Greece staying in the euro held a rally in central Athens on Thursday night.