From Brexit with love: Lithuania sees its chance

- Published

Lithuania's capital is becoming a go-to city for UK financial technology companies

They are the hot new trend in finance, and Marius Jurgilas's mission is to lure them to Lithuania. Yet even he has been shocked by the "overwhelming" number of enquiries from UK "fintech" companies in recent months.

The reason is Brexit.

Financial technology companies are making last-minute plans in case of a no-deal Brexit on 29 March. Many are looking to secure financial licences in other EU states to protect their operations, and this Baltic nation has an eye on helping to fill the gap.

Mr Jurgilas, a Bank of Lithuania board member, has had some notable successes.

Customers of new-age bank Revolut might not know it has acquired its banking licence in Lithuania. Google's parent company Alphabet has one too.

Mr Jurgilas insists his country's new direction is not all about Brexit.

"It was a coincidence," he says. "Mostly we just want innovation to happen here, not 10 years down the road after things are implemented in Sweden."

The start-ups with EU credentials

Marius Jurgilas is not alone. On the seventh floor of a shiny new office block, the Blockchain Centre is on the hunt for hot new fintech markets in Lithuania's name.

Inside, it is silent and the mood intense. Workers in headphones stare at black screens awash with code.

Motivational posters on the walls carry messages such as: "The future will be decentralised."

This one-year-old centre - which offers co-working space and consultancy services to start-ups using blockchain technology - plays to its EU credentials. Its website has an EU rather than a Lithuanian domain.

Egle Nemeikstyte runs the Blockchain Centre in Vilnius

But chief executive Egle Nemeikstyte says the centre is casting its net far beyond Europe. Australia, Singapore and Israel all want EU partners.

There is still plenty of scepticism about how blockchain should be used, and Ms Nemeikstyte sometimes has to dissuade people from jumping on the bandwagon.

"Lots of people come to us with ideas and we say that's great, but you don't need blockchain for it. Go ahead without it," she advises.

What is blockchain?

Bitcoin and blockchain explained

Records data in a verifiable and permanent way across many computers at once

Every computer has its own copy of the records - and verifies every new piece of information

Faking one copy of the blockchain will not work - because it will not match every other copy

Best known for underpinning digital "crypto" currencies, such as Bitcoin

How tight will the rules be?

Lithuania's expansion has been compared to Iceland, where the three biggest banks grew too fast and collapsed during the financial crisis of 2008.

Marius Jurgilas insists such comparisons are unfair and Lithuania is far from gung-ho in the field.

"We don't have the framework yet to know how to manage the risks. We don't want to go too fast in that area," he says of blockchain and crypto-currencies.

And yet the Bank of Lithuania offers "no regulatory sanctions for the first year of operations, external", which some have suggested could be a sign of laxity. Officials will also be keen to avoid the money-laundering cases that befell its neighbours, Latvia and Estonia.

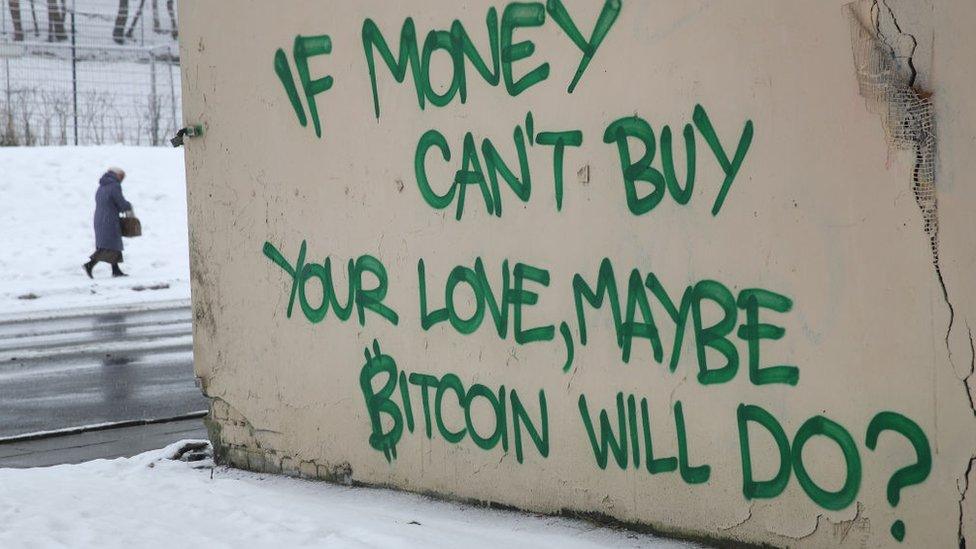

Crypto-related graffiti on a wall in Vilnius

What Lithuania does offer is a regulatory "sandbox", which allows financial technology companies to test products in a limited environment and under supervision.

Such sandboxes are not common, but they are cropping up in places as disparate as Arizona and Kuwait. Critics worry that they mark a race to the bottom, but supporters insist they boost innovation and can be well-managed.

'Using Lithuania as a springboard'

One of Lithuania's biggest coups, or perhaps risks, has been in backing financial technology company Revolut.

Valued at $1.7bn (£1.3bn), it is one of the world's fast-growing app-based banks.

Brexit is a primary reason for its move to Vilnius, but it will still retain its London HQ and the electric money licence it has from UK regulators.

Last year it advertised for its third head of compliance in less than 18 months, and some have argued that it may be expanding too fast.

However, the company insists it is just looking for the right fit.

The River Neris snakes through the capital Vilnius

And there was "no cutting corners" when the company secured its specialised banking licence from Lithuania, insists head of business development Andrius Biceika.

That will allow Revolut to offer full current accounts, pay interest on deposits and issue loans. By choosing Lithuania, it can operate across the EU.

"We are going to pilot all this in Lithuania and then passport to other countries," says Mr Biceika. "We are seeing lots of companies using Lithuania as a springboard."

Gearing up for no-deal Brexit

In the UK, all the talk about Lithuania has travelled the corridors of Level 39 - a three-floor tech hub in London's Canary Wharf, where a number of its residents have been making insurance plans for Brexit.

TransferGo - a money transferring company for migrant workers - received its electronic money licence from the Lithuanian central bank in July 2018.

BABB - a yet-to-launch money transfer company that has no connections to Lithuania - is also midway through the process.

While both made the decision because of Brexit uncertainty, both also cited Lithuania's local talent and helpful regulators as other motivations.

The 'G-spot of Europe'?

Go to an event for fintech start-ups in Vilnius and the room teems with enthusiastic young entrepreneurs.

In the wake of the 2008 financial crisis, various international companies came here to save money. Among them was Western Union, where many Lithuanians learnt the ropes of finance.

"We used to compete over low costs," says Vilnius Mayor Remigijus Simasius. "But now it is more about talent."

Vilnius has certainly been putting itself out there. In mid-2018, it launched a bizarre tourist campaign called "G-spot of Europe" complete with tagline: "Nobody knows where it is but when you find it, it's amazing."

The city's tourism office has launched a racy campaign to entice visitors to Lithuania

Co-working hub Rise Vilnius is where you will find dozens of the new companies. Backed by British bank Barclays, it is one of seven such hubs in Mumbai, Tel Aviv, London, Manchester, Cape Town and New York.

"There was scepticism that we would find enough fintech start-ups here, but we proved them wrong," says Mariano Andrade Gonzalez, executive director of Barclays' operations centre in Lithuania.

The mayor of Vilnius says companies have discovered that the city's workforce is particularly suited to the new start-ups, because Lithuanians have good mathematical skills.

"Maybe that goes down to the dark times of the Soviet Union. People studied these things instead of social studies.

"It was natural for us to move into fintech, even before Brexit. We are willing to adapt to the future, not fight it."

- Published25 November 2024

- Published2 March 2018

- Published19 December 2018