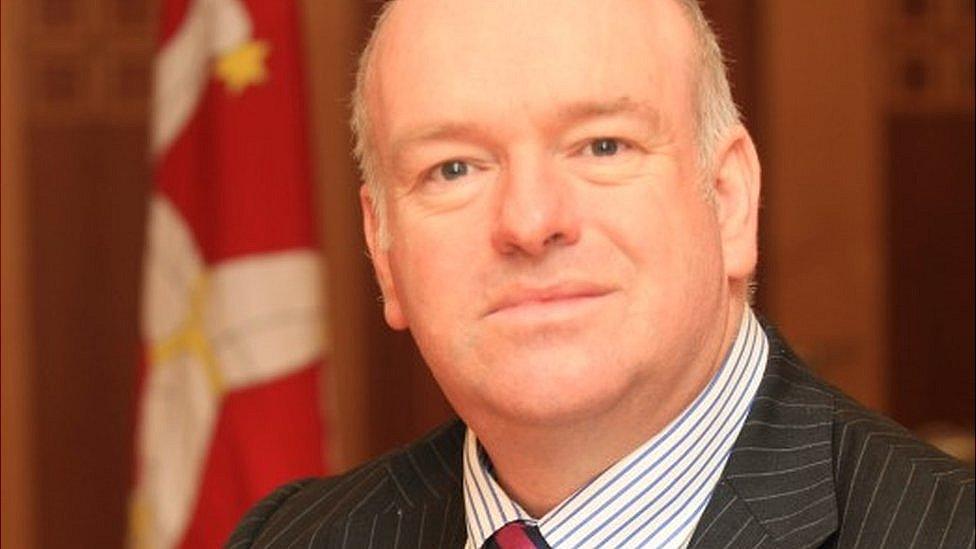

Isle of Man chief minister defends jet VAT position

- Published

Mr Quayle told the House of Keys the island must "comply with EU VAT legislation"

The Manx chief minister has defended the island's policy on jet ownership after the European Commission accused the UK of "abusive VAT practices".

The EU's legislative body lodged infringement proceedings, external with the UK government in relation to VAT refunds on Manx jets on Thursday.

A 2017 investigation found £790m of VAT had been returned to 231 leasing firms who had imported jets since 2011.

Howard Quayle said the island followed UK "rules and regulations on VAT".

Although not a member of either union, the Isle of Man is treated as part of the UK and EU for VAT purposes.

EU rules state VAT is not payable on jets registered solely for business in any member state, but can be charged on private aircraft.

'Complex'

On Thursday, a commission spokesman said the body had "stepped up its agenda to tackle tax avoidance... by implementing infringement proceedings on tax breaks being applied in the pleasure craft industries of... the Isle of Man".

Commissioner for Economic and Financial Affairs, Taxation and Customs Union Pierre Moscovici said it was "simply not fair that some individuals and companies can get away with not paying the correct amount of VAT".

"Favourable tax treatment for... aircraft is clearly at odds with our commonly agreed tax rules and heavily distorts competition."

Responding to an urgent question in the House of Keys, Mr Quayle said due to the 1979 Customs and Excise Agreement between the Isle of Man and UK, the island must "comply with EU VAT legislation".

The UK has two months to provide detailed information in relation to the commission's allegations.

A UK Treasury spokesman said the allegations were being looked at "in detail" and a response would follow in due course.

"The Isle of Man invited us to do a review of its procedures for the importation of aircraft and yachts, which we are now finalising," he said.

"This is a complex area of VAT law and it is important that we take our time to get this right."

The formal letter is the first stage of infringement proceedings, which could lead to the issue being referred to the EU's Court of Justice., external

- Published17 November 2017

- Published15 November 2017

- Published6 November 2017

- Published6 November 2017