Jersey reviews GST charges on lower value imports

- Published

A 5% GST charge is currently only applied to personal goods valued at more than £135

A review into possibly charging Goods and Services Tax (GST) on all personal goods imported into Jersey, regardless of their value, has been launched.

Currently islanders pay the 5% tax on imports valued at more than £135.

The review will also examine reducing this 'de minimis' value and is intended to "modernise" the collection of the tax, the Government of Jersey said.

Any changes would help ensure a "level playing field' for Jersey retailers, Treasury Minister Susie Pinel said.

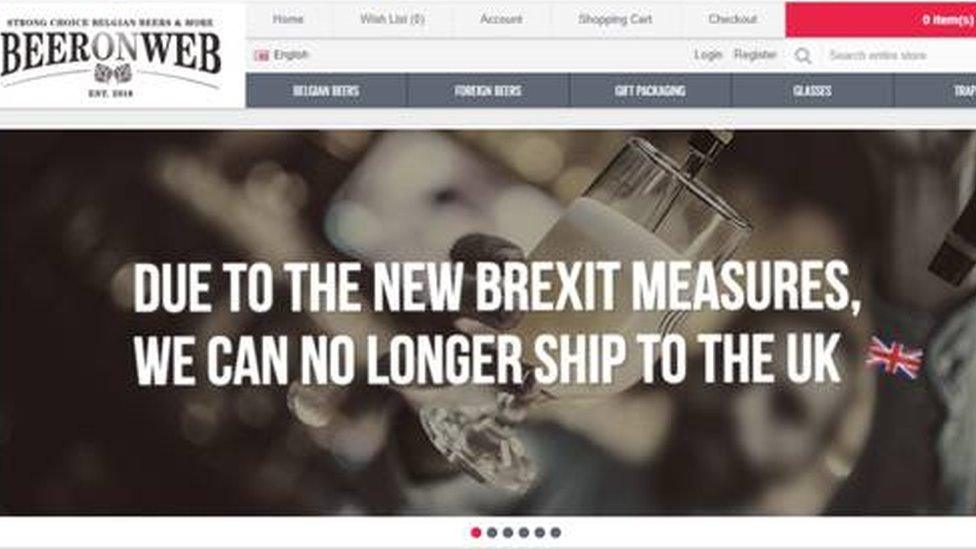

The review has been launched in the wake of the UK leaving the EU, which resulted in UK consumers being charged VAT on imports from the continent.

It will examine those new tax arrangements to see how similar methods of collecting tax on personal imports by islanders can be applied in Jersey, the government said.

The government will also evaluate methods to "simplify" for islanders to pay the tax on imported goods when offshore retailers cannot charge GST when purchases are made.

'Fair tax competition'

The review will involve consultation with a variety of stakeholders, including local and offshore retailers, consumer organisations and freight companies.

This £135 threshold, which had already been lowered from £240 last year, was never intended as a "tax relief", but existed to ensure taxes on personal goods collected "represented good value-for-money", the government said.

Treasury Minister Susie Pinel said the review abided by the government's "long-standing commitment to provide a level playing field" for Jersey retailers and would ensure "fair tax competition between offshore and local sales of goods".

She said: "The review will engage with retailers, industry and consumer organisations to ensure that any proposed changes support on-island businesses and ensure wide choice for consumers while remaining efficient to manage and administer."

Related topics

- Published26 January 2021

- Published21 January 2021

- Published4 January 2021

- Published19 October 2020

- Published24 August 2020

- Published16 October 2020