US issues 'cannabis cash' guidelines to banks

- Published

The new guidance is intended to increase transparency in a semi-legal business that has operated largely in the shadows

The US government has offered guidance to banks that want to accept deposits from marijuana sellers, lowering their risk of prosecution.

The move is intended to enable cannabis sellers in states with medical or legal marijuana to access banking services.

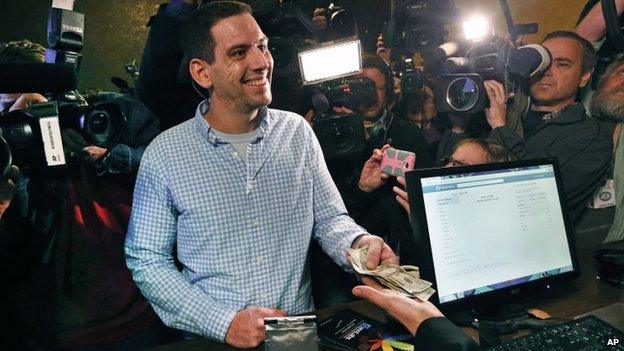

Currently, sellers deal almost entirely in cash, increasing the risk of robbery and the ease of money laundering.

Colorado and Washington State voted in 2012 to legalise cannabis. Other states are expected soon to follow.

"We hope today's guidance will give banks the comfort they need to begin doing business with the legal marijuana industry in Colorado," Michael Elliott, executive director of the Marijuana Industry Group, a trade organisation, said in a statement.

The changes out of Washington DC reflect the shift in political attitudes toward the drug, says the BBC's Rajini Vaidyanathan in Washington.

At present, federally insured banks which take deposits from the proceeds of marijuana sales risk drug racketeering charges.

'Underlying challenge'

The new guidance from the justice department and the Financial Crimes Enforcement Network (FinCEN), an office of the treasury department, does not provide immunity to banks who want to work with marijuana businesses.

But the guidance says that criminal prosecution is unlikely should the financial institutions meet the specified conditions, including a requirement they report "possible criminal activity" to law enforcement.

And it is intended to promote financial transparency in an industry that has long operated in the shadows.

Although 18 states and Washington DC allow some medical use of marijuana and the two states have legalised it, marijuana possession and sale remains illegal under federal law.

A leading financial services industry trade association said the new guidelines did not go far enough.

"While we appreciate the efforts by the Department of Justice and FinCEN, guidance or regulation doesn't alter the underlying challenge for banks," American Bankers Association chief executive Frank Keating said in a statement.

"As it stands, possession or distribution of marijuana violates federal law, and banks that provide support for those activities face the risk of prosecution and assorted sanctions."

Banking issues force marijuana shops to make transactions in cash, even in Colorado where marijuana is sold openly and legally, at least under state law

- Published5 February 2014

- Published30 January 2014

- Published20 January 2014

- Published8 January 2014

- Published2 January 2014

- Published7 November 2013

- Published19 November 2012