Puerto Rico governor says US territory 'can't pay $72bn debt'

- Published

Mr Garcia Padilla said creditors must "share the sacrifices" imposed on Puerto Rico's residents

Puerto Rico's governor has said the US territory cannot pay its $72bn (£45bn) debt and is close to defaulting ahead of emergency talks with legislators.

In a TV address on Monday, Alejandro Garcia Padilla said he would seek a moratorium on repayments and form a team to restructure public debts.

White House spokesman Josh Earnest says the US government has ruled out a federal bailout for the US island.

The self-governing US commonwealth has been in a recession since 2006.

Legislators have to approve a $9.8bn budget on Tuesday, which calls for $674m in cuts and sets aside $1.5bn to help pay off the debt.

'Assume sacrifices'

Speaking on Monday evening, Mr Garcia Padilla urged the central authorities to grant Puerto Rico the ability to file for bankruptcy, enabling a postponement of debt payments for several years.

"Even if we increase revenues and cut costs, the magnitude of the problem is such that we would not resolve anything given the weight of the debt we're dragging," the governor warned in a TV address.

"The only way we'll get out of this hole is to join forces and agree, including bondholders, to assume some of the sacrifices."

Governor Garcia Padilla is hoping to negotiate a deal with Puerto Rico's creditors

Puerto Rico is currently not eligible to restructure its debts under US bankruptcy code because it is not a municipality.

According to Reuters, the White House said on Monday it would urge Congress to consider a change in the law that would allow the island to declare bankruptcy.

Mr Garcia Padilla earlier admitted the island was close to an economic "death spiral", in an interview, external with the New York Times.

A report released by international economists hours before the governor's address gave a blunt assessment of Puerto Rico's fiscal problems, saying its debts were unsustainable and needed to be restructured.

Analysis: Samira Hussain, BBC News, New York

Wall Street used to be confident that Puerto Rico would be able to find a way out of its current financial mess. But that certainty no longer exists.

In saying Puerto Rico cannot pay its $72bn in public debt, the governor has basically told Wall Street that the island is in default. On Monday, Puerto Rican bonds dropped by 12%.

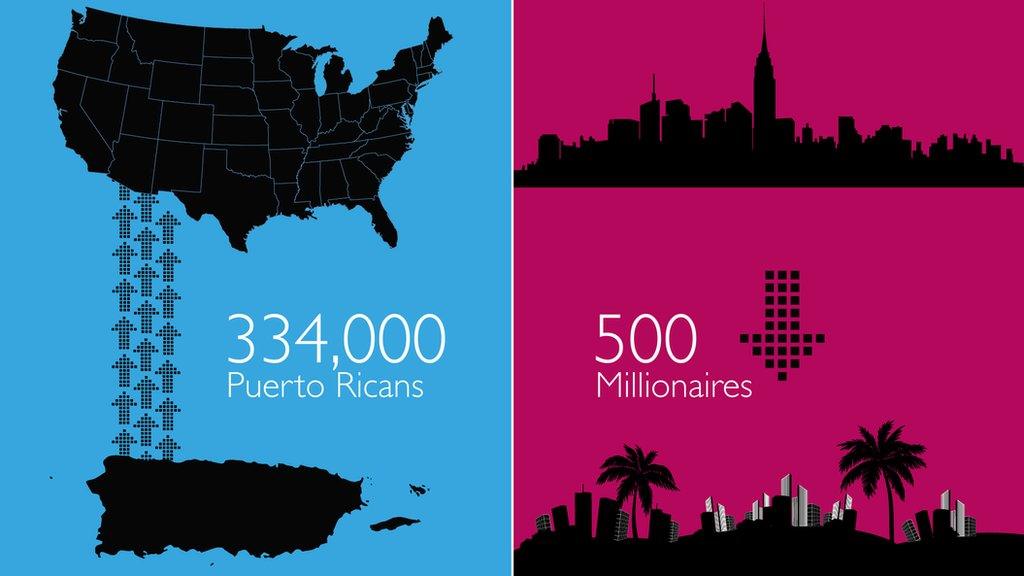

But why should anyone living on America's mainland care about an island with 3.6 million people?

Unlike Greece, where large institutions hold most of its debt, the same is not true for Puerto Rico.

Much of its debt is held by individual investors in the United States, in financial instruments like mutual funds. That exposes more individual Americans to its financial instability.

Puerto Rico must now negotiate with its creditors for some kind of deal. And as we are seeing with Greece, negotiating with creditors can be a long and messy process.

Although the island is a US territory whose residents are granted citizenship, it does not have the same status as other states and municipalities.

This means it is unable to file for bankruptcy in the same way that the US city of Detroit, Michigan, did in 2013 if it cannot raise enough money to repay its debts.

The territory's situation has drawn comparisons to Greece, where the government has shut banks and imposed restrictions on cash withdrawals.

Puerto Rico

• In 1898, the Spanish lost the Caribbean Island at the end of the Spanish-American war and it came under US control

• In 1917, its people became US citizens - they are allowed to serve in the military but still do not have the right to vote in US presidential elections

• The country is a self-governing territory of the US but the US Congress and the president have ultimate control, providing social services, foreign policy and defence

• It has a congressional representative who does not have voting rights

- Published5 May 2015

- Published11 September 2023