Jeb Bush: My 36% tax rate is 'astounding'

- Published

- comments

Republican presidential candidate Jeb Bush is none too happy about the amount of money he's had to hand over in federal taxes.

"I paid the government more than one in three dollars that I earned in my career. Astounding," Mr Bush writes. "The total effective rate was 36%. I think I speak for everyone, no matter your tax rate: we need to get more money back in your pocket and less in the federal kitty."

The former Florida governor's lamentation accompanied the release, external on his website of 33 years of tax returns on Tuesday - and reporters have been picking over various nuggets.

Like many high-profile politicians, Mr Bush's net worth skyrocketed after he left public life, from $1.3m (£830,000) to around $20m.

He gave more than $300,000 to charity in 2014.

He made hundreds of thousands of dollars investing in a company that profited from President Barack Obama's healthcare reform legislation.

He earns between $40,000 and $50,000 per domestic speaking engagement - which he noted, external during a news conference was less than the $65,000 that fellow presidential offspring Chelsea Clinton brings in.

Perhaps most interesting, however, is the bite the feds have taken out of Mr Bush's earnings - and his apparent unhappiness over it.

A 36% effective rate - which doesn't include money paid in state or local income taxes (Florida is one of a handful of US states that doesn't have either) or sales taxes - puts Mr Bush on the higher end of his fellow presidential aspirants, past and present.

Hillary Clinton paid 30% (not including her relatively high New York state taxes) in 2014. In 2012 Republican candidate Mitt Romney grudgingly released his tax returns. He generated a spate of negative headlines when they revealed he paid a 14% effective rate, thanks in large part to his earnings coming from capital gains that are taxed at a lower rate.

According to a 2012 survey, external by the Washington Post's Brad Plumer, Mr Obama paid 27.9% in 2006. In 1998 George W Bush came in at 20.55%. Back in 1990, then-Arkansas Governor Bill Clinton paid an effective rate of 18.9%.

Joe Thorndike, director of the Tax History Project at the University of Virginia, tells Politico, external that Mr Bush's unusually high rate - 40.1% in 2013 - may be a result of his presidential ambitions. The media pay attention to the numbers and the public is sensitive to the perception that the elite play by different rules.

"I'm not sure why someone with his business interests doesn't have more from capital gains," he says. "I suspect there was some very shrewd political calculation going into this - he knew he was running for president and he knew he was planning to for some time."

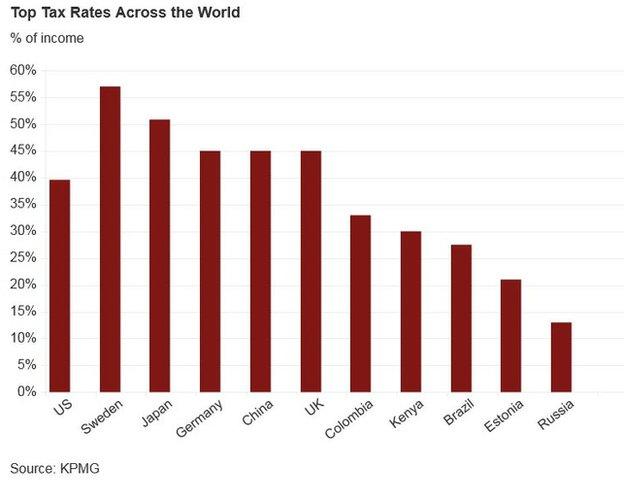

Then again, when compared with the tax rates in other nations, Mr Bush is getting off easy. In the US the current top marginal income tax rate is 39.6%. In many European countries, it's much higher.

In the UK and Germany, for instance, the 2015 rate tops out at 45%. In the Netherlands, it's 52%. And Sweden? In exchange for cradle-to-grave government services, the top tax bracket hits 57%.

Although Mr Bush objects to the rate he's paid over the years, he hasn't yet proposed what he sees as an appropriate level of federal taxation - just that it be "flatter" and "fairer". Perhaps he recalls that his father, George HW Bush, raised the ire of fellow conservatives when as president he broke a "no new taxes" pledge, external made during the 1988 Republican National Convention.

Some of the former Florida governor's presidential rivals, on the other hand, haven't been so reluctant.

Florida Senator Marco Rubio has put forward a 35% top bracket. Kentucky Senator Rand Paul suggests, external a 14.5% flat tax on all income over $50,000.

That would put the US in the company of flat-tax countries like Bolivia (13%), Hungary (16%), Russia (13%) and Estonia (20%).

In fact, Mr Bush singles out the Baltic state for praise in his comments accompanying his tax release.

"I just came back from Estonia where it takes residents less than five minutes to file their taxes," Mr Bush writes. "The tax release process sure would've been a lot easier if we were following the Estonia model."

Embracing the "Estonia model" definitely sounds a lot better for a Republican presidential hopeful than saying he wants to be just like Russia.

Then again, perhaps Mr Bush is best served sticking with simply calling the US rate "astounding".

Republican candidates in - and out - of the 2016 presidential race

- Published16 June 2015

- Published12 May 2015

- Published16 March 2016