US Supreme Court strikes down student loan forgiveness plan

- Published

Watch: Biden spells out new path for student loan relief

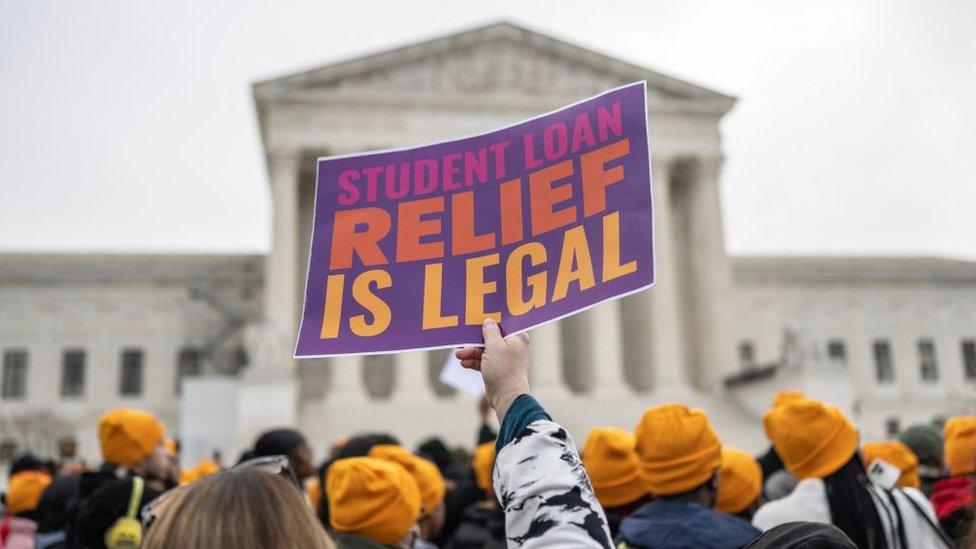

The US Supreme Court has struck down US President Joe Biden's proposal to wipe out billions in student debt.

The 6-3 ruling effectively cancels the plan, which would have forgiven about $10,000 (£7,800) per borrower - and up to $20,000 in some cases.

The decision affects the loans of more than 40 million Americans.

It has left the US public "angry," Mr Biden said. He pledged to put in place new measures to reduce university debt using other existing laws.

The loan forgiveness plan has been in limbo since some conservative states sued, arguing the president overstepped his authority. The Supreme Court agreed.

In the wake of the decision, Mr Biden spoke from the White House, saying: "I know there are millions of Americans in this country who feel disappointed and discouraged or even a little bit angry. I must admit I do too."

But he vowed to work with the Department of Education to find other means to help people ease the financial burden.

"Today's decision has closed one path. Now we're going to start another," he said.

The total federal student debt has more than tripled over the past 15 years, rising from about $500bn in 2007 to $1.6tn today.

Last year, the US Treasury took a $430bn charge to cover $300m in costs associated with the loan forgiveness programme, as well as additional costs associated with an extension of a Covid-era moratorium on payments through the end of the year.

The Biden administration faced plaintiffs in two separate cases, one involving six Republican-led states - Nebraska, Missouri, Arkansas, Iowa, Kansas and South Carolina - and the other involving two individual student loan borrowers.

In both cases, plaintiffs argued the executive branch did not have the power to so broadly cancel student debt.

The Supreme Court ruled the two individual borrowers did not persuasively argue they would be harmed by the loan forgiveness plan, effectively ruling that they had no legal standing to challenge the Biden administration's proposal.

During arguments in February, the Biden administration said that under a 2003 law known as the Higher Education Relief Opportunities for Students Act, or Heroes Act, it had the power to "waive or modify" loan provisions to protect borrowers affected by "a war or other military operation or national emergency".

In its ruling, the Supreme Court ruled that while the act allows Mr Biden's education secretary, Miguel Cardona, to "make modest adjustments and additions to existing provisions, not transform them".

Justice John Roberts wrote that the modifications made by the Biden administration "created a novel and fundamentally different" loan forgiveness programme that "expanded forgiveness to nearly every borrower" in the US.

He added that the administration's use of the Heroes Act "does not remotely resemble how it has been used on prior occasions".

The high court's ruling fell along ideological lines, with its three liberal judges dissenting.

In her dissent, Justice Elena Kagan wrote that "the result here is that the court substitutes itself for Congress and the Executive Branch in making national policy about student-loan forgiveness".

"Congress authorised the forgiveness plan... the [education secretary] put it in place; and the president would have been accountable for its success or failure," she wrote.

"But this court today decides that some 40 million Americans will not receive the benefits of the plan (so says the court) that assistance is too 'significant'".

Watch: Student loan borrowers react to Supreme Court ruling

The White House had previously estimated that almost 90% of US student borrowers would have qualified for relief under the plan.

"This decision is going to impact a lot of people in this country. But it's disproportionately going to impact people who are already historically marginalised," Ranen Miao, a 22-year-old recent graduate told BBC News outside the Supreme Court.

"The people who take out student loans are not the children of millionaires and billionaires. They're the children of working families," added Mr Miao, who declined to disclose how much student debt he has.

Clegg Ivey told CBS, the BBC's US partner, the Supreme Court had "made the right decision" and that he disagreed with the Biden administration's approach to the issue.

"I have student loans and I certainly would have benefited," he said. "But if that's what we want, let's talk to our congressman. Congress... should actually do its job."

Polling data shows that support for the student loan forgiveness proposal largely fell along political lines.

One poll conducted by Marquette Law School in May found that 31% of Republicans favoured the proposal, compared to 69% of independents and 87% of Democrats.

The Supreme Court's ruling on Friday was swiftly applauded by senior Republican lawmakers.

House Majority Leader Kevin McCarthy said the loan initiative is "unlawful" and would mean that Americans without student loans "are no longer forced" to pay for those who do.

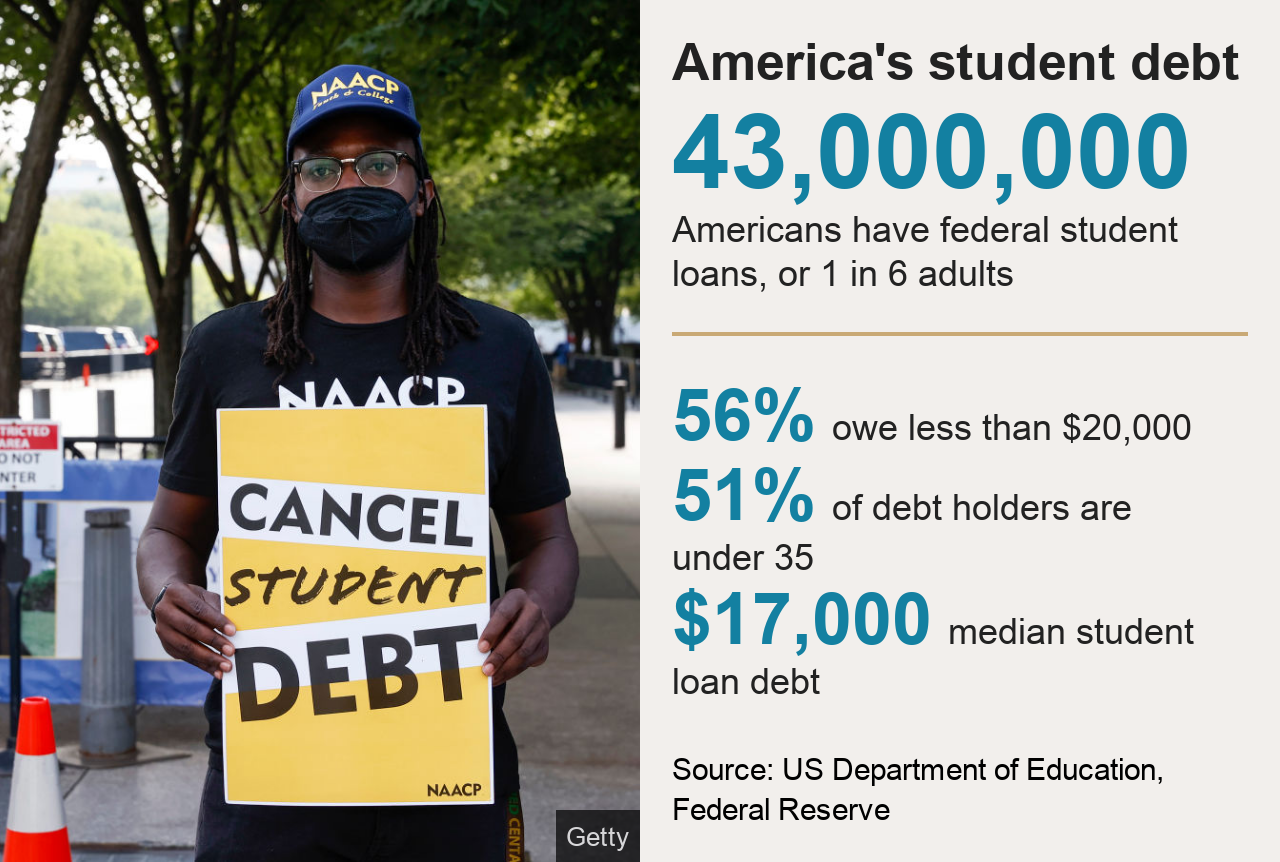

In total, approximately 43 million people in the US owe money for student loans - or about one-in-six US adults with at least some post-secondary education.

Federal reserve data shows that the median student loan is about $17,000. About 17% of borrowers owe less than $10,000, while about 7% owe over $100,000.

Can student debt forgiveness make a difference?

Among those on the high end of the debt spectrum is Satra Taylor, a part-time student and campaigner for the group Young Invincibles who owes about $103,000. She told the BBC she expects the figure to grow as she continues a doctoral programme.

"My family does not come from generational wealth. I had no other option but to take out student loans to ensure I could put food on my table and pay my rent," she said.

"I'm deeply saddened by this decision... but I'm also hopeful that President Biden will ensure student debt cancellation happens."

Related topics

- Published30 June 2023

- Published28 February 2023

- Published27 February 2023

- Published4 November 2022