Sam Bankman-Fried pressed in court over past comments

- Published

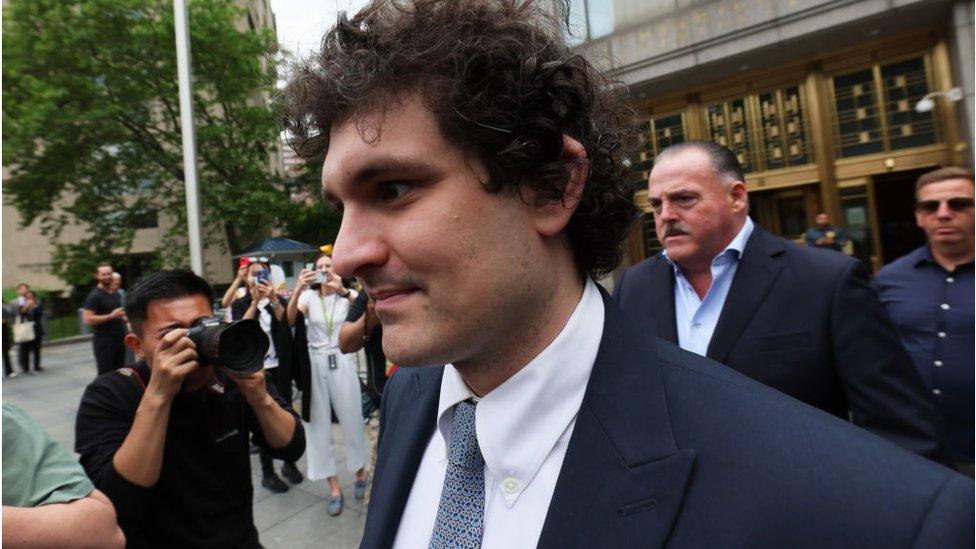

Sam Bankman-Fried struggled to account for the management of his now-bankrupt crypto exchange, FTX, as his fraud trial neared its conclusion on Tuesday.

Prosecutors in New York finished questioning the 31-year-old, who made the risky decision to take the stand in his own defence.

The former billionaire is accused of stealing billions of dollars from FTX customers and lying to investors and lenders.

He has denied the charges.

But he is facing the task of convincing a jury to discount weeks of evidence they heard from his former top deputies, including his ex-girlfriend Caroline Ellison, who have already pleaded guilty and were testifying against him to reduce their sentences.

Prosecutors have tied Mr Bankman-Fried to decisions that allowed the crypto trading firm he owned, Alameda Research, to take billions of dollars deposited at FTX. He is accused of spending the money to repay lenders, buy property, and make investments and political donations.

Prosecutors say he tried to hide the transfers between the two firms and their close relationship - and have buttressed their allegations with text messages, spreadsheets and tweets.

When FTX went bankrupt last November, Alameda owed the company $8bn (£6.58bn), money prosecutors say had been taken from customers.

The court heard earlier in the trial from Ms Ellison that Alameda ultimately took about $14bn (£11.4bn) from FTX clients, using it for investments and repaying lenders.

During his testimony, which started last Thursday, Mr Bankman-Fried expressed a mix of defiance, regret and frustration at comments and actions he felt were being taken out of context.

On Tuesday, he told the court that he thought it was "permissible" for Alameda to spend FTX customer funds but had not been aware until October 2022, just a few weeks before the bankruptcy, that the company had actually done so.

"I deeply regret not taking a deeper look into it," he said.

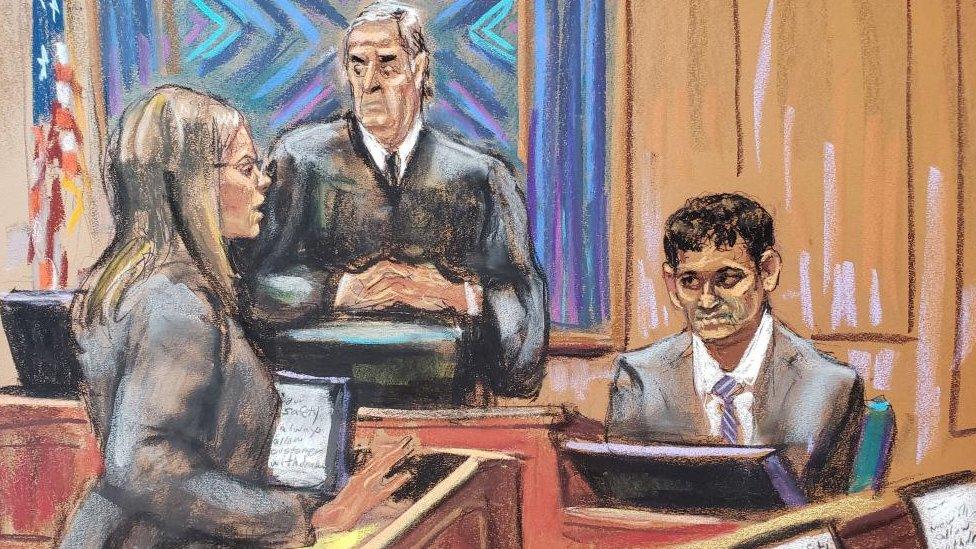

Prosecutor Danielle Sassoon pressed Mr Bankman-Fried to explain why he had not tried to understand what was happening between Alameda and FTX by June 2022, when it appeared at one point that the trading firm had gone bankrupt.

He said that he had "trusted" that his former friends and deputies had the situation under control.

"I was told they were busy and should stop asking questions," he said.

Mr Bankman-Fried has maintained that he was far more absent from decision-making than his friends had suggested, saying he could not recall, for example, going over spreadsheets that had been presented to him.

He has said Ms Ellison failed to "hedge" bets to better protect Alameda from a downturn in the market, as he had instructed her to do. But he acknowledged that he did not take action in response to the failure.

"I wasn't particularly interested in trying to dole out blame," he said, in explaining his decision not to fire anyone. "It generally wasn't something I tried to prioritize as a leader."

At times during Ms Sassoon's questions, Mr Bankman-Fried appeared visibly restless, blinking furiously and shifting back and forth, responding with curt "yeps".

Questioned by his own attorney, Mark Cohen, he was more expansive.

Under questioning from Mr Cohen, he said that he had stepped back from Alameda after handing off the chief executive role and was "essentially uninvolved" in core operations like day-to-day trading.

Mr Bankman-Fried finished testifying around mid-day and the jury was dismissed, while the judge conducted a hearing with lawyers from the two sides on what instructions he will give to the jury.

The entrepreneur has pleaded not guilty to seven federal charges including wire fraud, securities fraud and money laundering and could face a life sentence in prison if convicted.

Mr Bankman-Fried's defence team has argued he was following "reasonable" business practices, as his companies grew rapidly.

After the collapse of his companies last year, he admitted in media interviews, including with the BBC, to managerial mistakes but said he never intended fraud.

Closing arguments are expected to start on Wednesday.

Sam Bankman-Fried denies claims he knew FTX customer money was used for risky financial bets

Related topics

- Published3 November 2023

- Published27 October 2023

- Published10 October 2023

- Published6 October 2023