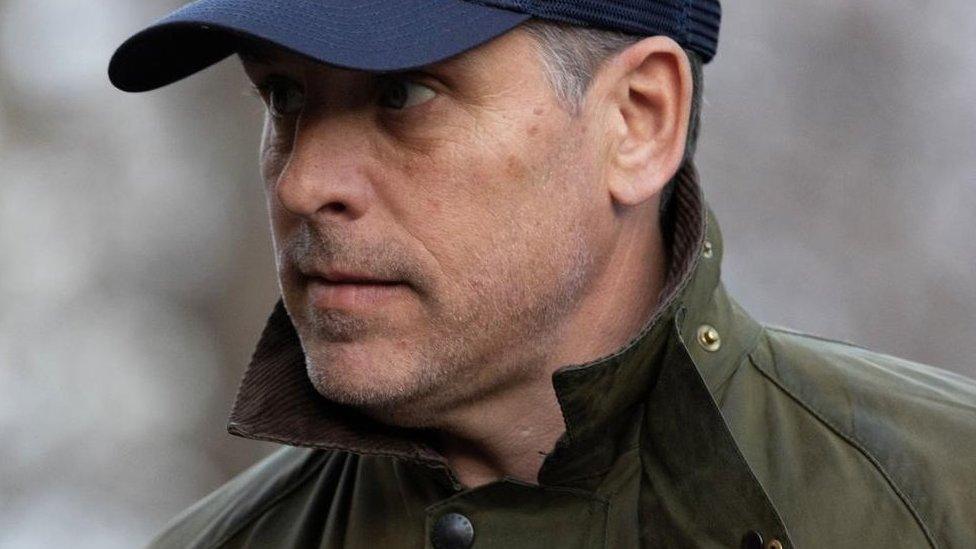

Hunter Biden's tax indictment: Drugs, escorts and girlfriends

- Published

US President Joe Biden's son, Hunter, is facing a nine-count criminal indictment for alleged tax evasion.

The 56-page charge sheet accuses him of evading $1.4m in taxes from 2016-19 and funding an "extravagant lifestyle".

Much of the recovering crack cocaine addict's alleged illicit activities occurred while his father was US vice-president under Barack Obama.

But the current US president is not accused of wrongdoing, or even mentioned in the latest indictment.

The Yale-educated lawyer faces up to 17 years in prison if convicted. Hunter Biden was separately hit with a federal indictment on gun charges in September.

How Hunter Biden earned millions of dollars

The indictment outlines how Hunter Biden reaped a "substantial income" amounting to more than $7m between 2016-20.

The payments were mostly made to business accounts he had created for his company, Owasco, PC, and were also allegedly funnelled through a company called Skaneateles, in which he owned a 75% stake.

Chinese energy: For two years, beginning in late autumn of 2015, Hunter Biden was in a business relationship with CEFC China Energy, a Chinese energy conglomerate. In 2017, he was promised $1m stemming from a deal with a CEFC associate, State Energy HK, a Hong Kong business. Hunter Biden went on to do business with a Chinese equity fund.

Burisma: The president's son began working for Ukrainian private energy company Burisma Holdings Limited in April 2014, with a starting annual salary of $1m. In March 2017, his salary was reduced to around $500,000 per year. The charging document lists payments of $1,002,016 in 2016, $630,556 in 2017, $491,939 in 2018, and $160,207 in 2019. Hunter Biden had previously told the BBC he was hired to serve on the company's board because Burisma had seen his name "as gold".

Romanian businessperson: In autumn of 2015, Mr Biden "entered into an oral agreement" to help an unnamed "Romanian businessperson… contest bribery charges he was facing in his home country". For his work between November 2015 to May 2017, he and two other business associates split a payment of over $3.1m "roughly" between the three of them.

How Hunter Biden allegedly spent the money

The indictment says the president's son allegedly spent his money on "drugs, escorts and girlfriends, luxury hotels and rental properties, exotic cars, clothing, and other items of a personal nature, in short, everything but his taxes".

His spending amounted to about $1m in 2016, $1.4m in 2017, $1.8m in 2018, and $600,000 in 2019, according to the charge sheet.

Between 2016-19, he withdrew $1.6m from cash machines alone.

In the same period he spent over $683,000 on "payments - various women", another $188,960 on "adult entertainment", $397,530 on clothing and accessories, and $237,496 on health, beauty and pharmacy, prosecutors say.

They list many of the luxury hotels Hunter Biden stayed in during the years that he chose to not maintain a residence. Most were in Los Angeles, New York City and Washington DC.

He used the hotels "for constant partying", prosecutors say.

Other funds went to hire a Lamborghini, which he used after moving to the West Coast while waiting for his Porsche to be shipped to him.

Payments included $1,500 to an exotic dancer at a strip club, $11,500 for an "escort" who was paid "to spend two nights with him", $27,316 in payments to an online pornography website and $10,000 "to purchase a membership in a sex club".

Hunter Biden tells BBC News his father "saved" him several times when he was in a dark place with his addiction battle

How he allegedly evaded taxes

In order to avoid higher tax payments, prosecutors say that he claimed multiple personal expenses as business deductions.

Luxury car rentals and hotels were claimed as business "travel, transportation and other", according to the indictment.

He deducted academic tutoring for his daughter as "legal professional and consulting" and claimed payments to escorts and dancers as "office and miscellaneous".

In 2018 he directed a personal aide to "place on payroll and provide healthcare benefits to three women with whom he had romantic or sexual relationships and a fourth woman who was related to one of those women".

An Arkansas woman with whom he had a child was among those he hired.

While in the throes of a crack cocaine addiction, he "claimed extensive business travel in 2018 when he had none".

How prosecutors used his own words against him

Prosecutors say Hunter Biden's memoir, Beautiful Things, explicitly lays out what the indictment alleges - that he did not have numerous business dealings in 2018 and was instead spending his money on months-long drug and alcohol binges.

While working with California accountants in 2018, he claimed expenses, including $388,810 in business-related travel, despite writing in his book that the year was "dominated by crack cocaine use 'twenty-four hours a day, smoking every fifteen minutes, seven days a week'".

Prosecutors say if the accountants had known about the drug use, they would have more closely scrutinised "his claims of hundreds of thousands of dollars in business expenses".

From April 2018, and for the next few months, Hunter Biden surrounded himself with a crew of "thieves, junkies, petty dealers, over-the-hill strippers, con artists, and assorted hangers-on", he wrote in his memoir.

The luxury hotels cited in the indictment correspond with the "very same hotels that the Defendant identified, by name, in his memoir as the locations of his monthslong drug and alcohol binge", court documents say.

Hunter Biden recounts staying "at the Sunset Tower, Sixty Beverly Hills, and the Hollywood Roosevelt" and a list of other California hotels. He describes his entourage "flashing fake Rolexes" and bringing along "their stripper girlfriends".

"They'd drink up the entire minibar, call room service for filet mignon and a bottle of Dom Pérignon," reads part of the defendant's memoir, prosecutors note.

They point out that the "defendant did not write that he conducted any business in any of these luxury hotels nor did he describe any of the individuals who visited him there as doing so for any business purpose".

Related topics

- Published4 October 2023

- Published28 November 2023

- Published20 July 2023