Biden proposes student loan relief for more than 30 million Americans

- Published

Roughly one in eight Americans has outstanding student loan debt

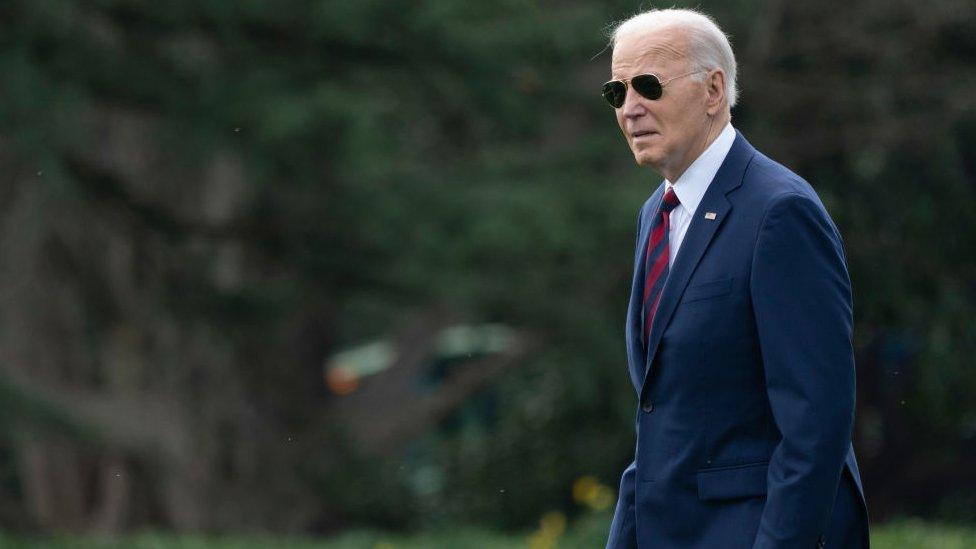

US President Joe Biden has unveiled his latest proposal to help millions of Americans pay off student loans, working to fulfil a campaign promise ahead of November's election.

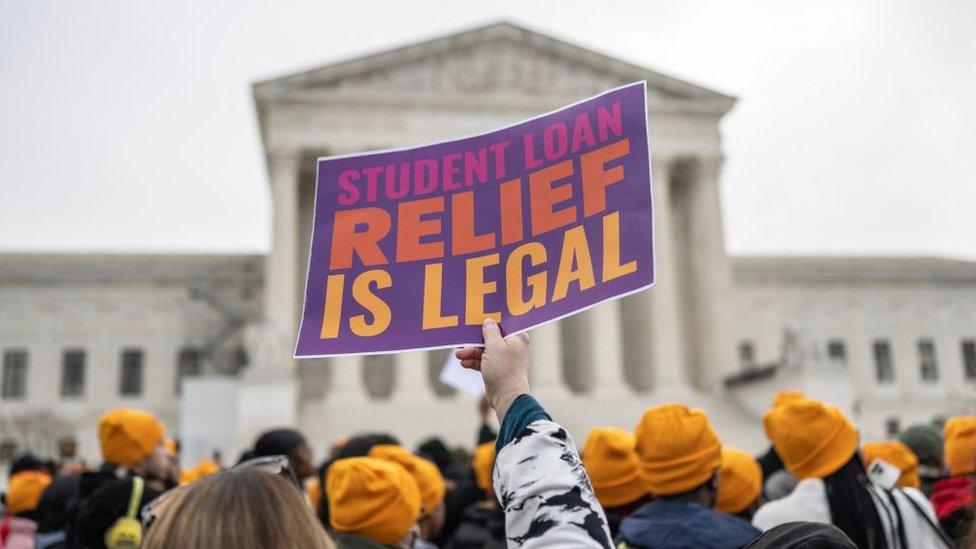

Last year, the Supreme Court rejected his initial plan to cancel as much as $20,000 (£15,800) for some borrowers.

This "Plan B" targets relief for five groups of borrowers, including those burdened with "runaway interest".

More than 30 million people could benefit, according to the White House.

Roughly one in eight Americans has outstanding student loan debt, including tens of thousands who finished college and entered the workforce decades ago.

Younger voters in particular often cite debt relief or forgiveness among their top issues, and many Democrats say the president has not fulfilled promises he made on it as a candidate four years ago.

As he seeks re-election, Mr Biden's latest actions could help patch over the fractures in a political coalition that has grown disillusioned with his job performance as well as his handling of the war in Gaza.

Donald Trump, the presumptive Republican nominee this November, opposes student debt cancellation.

Mr Biden will promote the plan later on Monday during a visit to Madison, a liberal college town and the state capital of Wisconsin, a crucial swing state where he narrowly defeated Mr Trump in 2020.

Vice-President Kamala Harris and other members of the administration will also fan out across the country and pitch the effort to voters in coming days.

An outline of the plan was posted on the White House web site early on Monday.

The plan will not go into effect right away. Because the education department is following a multi-step rule-making process, it could take months. Portions of the new rule will likely be implemented sometime in the autumn, providing a boost ahead of the election.

Monday's announcement spells out relief for:

Borrowers who now owe more in student loans than they took out originally because "runaway interest" has built up;

Long-term borrowers who have carried the debt for more than two decades;

Borrowers who were eligible for relief but "have not been able to overcome paperwork requirements, bad advice, or other obstacles";

Borrowers who attended student programmes that shut down, cheated families or otherwise failed to provide financial value; and,

Borrowers experiencing hardship that prevents them from fully paying back the loans now or in the future.

According to the White House, these actions would fully forgive debt for more than four million people, eliminate the interest balances of up to 23 million and relieve at least $5,000 for more than 10 million.

In some cases, borrowers eligible for these kinds of relief will not have to apply to the programme, and will instead be identified and see adjustments automatically credited to their accounts.

Watch: Moment medical students find out school will be tuition-free after $1bn donation

But the latest effort is likely to be beset by a host of conservative legal challenges.

Opponents of debt relief say it does not solve the problem of costly college education, does not stimulate the economy and ignores financially-burdened Americans who did not attend college. They add that targeted proposals are also unfair to borrowers who have already managed to pay off their student loans, in some cases by making financial sacrifices.

Last June, the nation's top court struck down the president's sweeping plan to use an existing law to wipe away $430bn in student debt, completely erasing the outstanding balances of about 20 million people.

In its 6-3 decision, the court's conservative majority ruled that the Biden administration had reinterpreted a statute to "[expand] forgiveness to nearly every borrower in the country".

Since then, the White House has used existing provisions to approve $146bn in debt relief for nearly four million people while also working to reform the student loan system in other ways.

Related topics

- Published21 March 2024

- Published30 June 2023

- Published27 February 2023

- Published28 February 2024