Standard Chartered agrees settlement with New York regulator

- Published

The bank had previously disputed the value of the transactions that broke US sanctions

Standard Chartered has agreed a $340m (£217m) settlement with New York regulators that accused it of hiding $250bn of transactions with Iran.

The hearing that had been scheduled for Wednesday has now been adjourned.

The British bank's chief executive Peter Sands has been in New York negotiating with the regulators.

It had admitted that some of its transactions did break US sanctions, but said that the amount totalled just $14m.

"The New York State Department of Financial Services (DFS) and Standard Chartered Bank have reached an agreement to settle the matter raised in the DFS order dated August 6, 2012," a statement from the regulator's superintendent said.

"The parties have agreed that the conduct at issue involved transactions of at least $250bn."

A short statement from Standard Chartered simply confirmed a settlement of $340m had been reached.

"A formal agreement containing the detailed terms of the settlement is expected to be concluded shortly," it added.

The bank also said it continued to "engage constructively" with other US authorities.

Close eye

According to the terms of the settlement, Standard Chartered will pay a "civil penalty" of $340m to the DFS.

What is Standard Chartered accused of? The BBC's John Moylan explains

It will also install a monitor for at least two years who will evaluate money-laundering controls at the bank's New York branch and report directly to the regulator.

"In addition, DFS examiners shall be placed on site at the bank," the statement said.

Finally, the settlement provided for permanent staff at the bank's New York office to audit any money-laundering controls.

The BBC's New York business correspondent Mark Gregory said the $340m was a "hefty penalty, but nothing like as hefty as it could have been" if the two parties had not negotiated a settlement. The DFS had, for example, talked of revoking Standard Chartered's New York banking licence.

'Surprise'

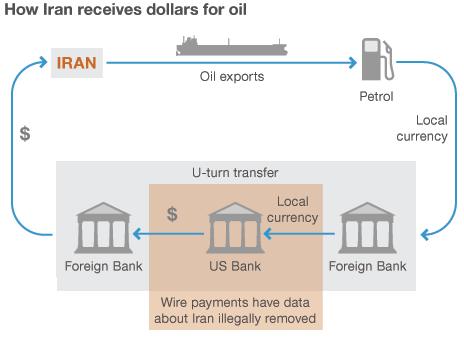

Last week, New York's DFS alleged that the US unit of the bank had illegally hidden 60,000 transactions with Iran worth $250bn over nearly a decade.

It accused the London-based bank of being a "rogue institution" for breaking US sanctions against Iran.

Mr Sands said at the time that he was "completely surprised" by the ferocity of the DFS's attack, which he described as "disproportionate".

He did, however, admit that 300 transactions did break US sanctions.

"This was clearly wrong and we are sorry that they happened," Mr Sands said.

- Published10 December 2012

- Published7 August 2012

- Published9 August 2012

- Published8 August 2012