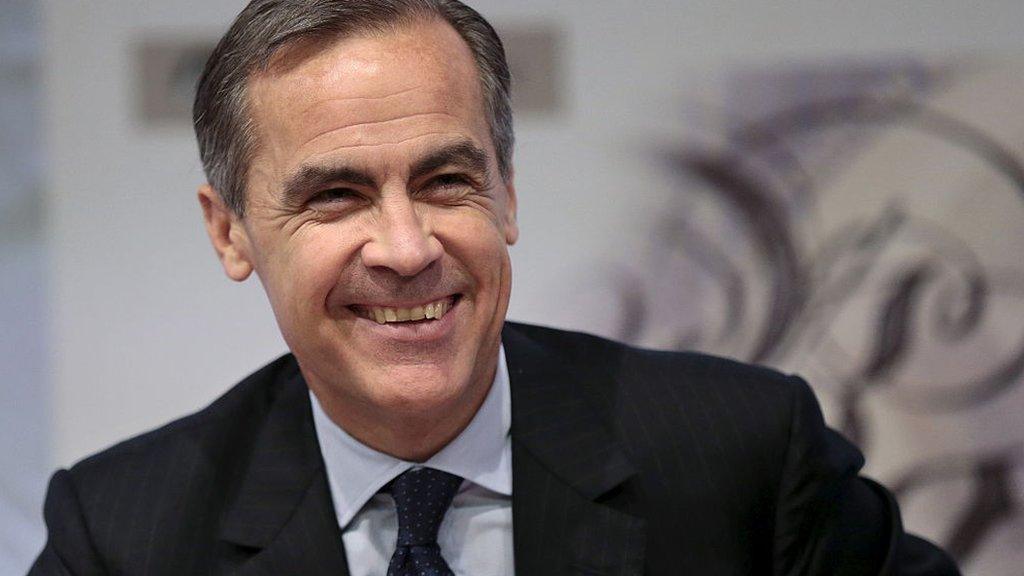

Did Mark Carney guide Canada to growth?

- Published

The UK has now got a "Carney commitment" on interest rates

In most spheres of life, telling people what you're going to do for the next few years does not sound like a big innovation.

But the communication of future moves on interest rates made by central banks has the ability to send financial markets wildly higher or lower.

The idea of "guiding" the markets, consumers and businesses on the future path of interest rates was pioneered by Mark Carney during his time as governor of the Bank of Canada.

With Mr Carney now in place as governor of the Bank of England, he has replicated a form of this "guidance" policy in the UK after presenting his first Inflation Report.

So what is the evidence of the success of the policy in Canada?

Financial meltdown

Mr Carney first introduced his form of guidance, known as the "conditional commitment" in Canada, in April 2009., external

The world economy was suffering palpitations brought on by the collapse of Lehman Brothers the previous year and the sharp recession that followed.

Canada was not immune to the global financial crisis

Canada's banks were far more stable than those in the US, but the country was still feeling the effects of turbulent world financial markets.

With interest rates already at a record low of 0.25%, Mr Carney decided that one of the only options left was a verbal commitment to keep interest rates low until the second quarter of 2010.

The conditional part of that commitment was that rates could rise if inflation got out of control.

By making what he called a "simple statement directly to Canadians", Mr Carney hoped to encourage them not to rein in spending and borrowing, in the confidence that rates were not about to rise.

Booming economy

In the following months, confidence returned: consumers started spending again, the housing market revived and the construction industry boomed.

Estate agent Ecko Jay says people have been stretching themselves to afford property

Economic growth in Canada soared to 3.2% in 2010, having fallen 2.8% in 2009.

Part of this was down to an improving outlook in the US, Canada's biggest trading partner, but some of it was also ascribed to the governor's confidence-inducing commitment to low rates.

It had always been stressed by the Bank of Canada there was no guarantee of low rates: the commitment was only good for as long as the economic situation remained bad.

And so the success of "Carney's commitment" proved to be its undoing as the strength of the economic recovery prompted the governor to abandon it in April 2010, following it with an increase in interest rates two months later.

So if the policy helped push up growth during a period of retraction, what's not to like?

'Too far, too soon'

Things could not be going better for Ecko Jay, a Toronto estate agent with 26 years' experience.

Showing me round a sprawling family home in an upmarket area of the city, he can barely contain his incredulity at recent property price moves.

David Madani says low interest rates in Canada have prolonged the housing boom

Mr Jay had put a house on the market a week earlier for nearly 1.3m Canadian dollars (£815,000, $1.25m) but had already had an offer of more than C$1.7m.

House prices in Canada are up 30% since 2009 and the Organisation for Economic Co-operation and Development (OECD) says the country has the third most overvalued housing market in the world., external

Critics say that Mr Carney's commitment to low rates encouraged people to take out mortgages, fuelling a construction and housing boom.

For Mr Jay the satisfaction of another house sale is tinged with worry for the future.

"Prices have gone up too far, too soon and people have been stretching themselves to afford property, taking advantage of low interest rates," he says.

If rates double from their current 1%, he thinks a lot of people could be "dead meat".

Loading up on debt

For the critics of guidance, the events in Canada highlight the downsides of a commitment to low rates: it tacitly encourages consumers to load up on debt.

"Low interest rates in Canada have definitely prolonged the boom, but households have also been part of the problem because they have been prepared to throw money at housing over the past few years," according to David Madani, of Capital Economics.

The Canadian government has attempted to keep booming house prices in check by tightening the rules on mortgage lending four times over the past five years, making credit harder to obtain.

But Mr Madani says these restrictions came too late and the impact of the housing boom has tarnished Mr Carney's reputation in his home country.

"I think when you look back at Mark Carney's record in five or 10 years' time, I think it will actually look quite ordinary."

As always with utterances from the central bank, it's what people take away from it that counts, not always what was actually said.

According to economist Don Drummond, who worked with Mr Carney before he went to the Bank of Canada, the public's selective hearing was part of the problem.

Transatlantic test

"Canadians only seemed to hear the first half of the commitment, the bit about low rates.

"What they forgot was that he also said it was dependent on inflation, and so they felt they had been misled when he abandoned the commitment and raised rates."

The host of cranes on the Toronto skyline is testament to the continued impact of Canada's housing boom.

There are plenty who feel that fears of a property bubble have been exaggerated and that the market will cool off, as many in government predicted.

The fact that the country has come through the recession in better economic shape than any of its fellow G7 nations proves to many that Mr Carney implemented the right policies at the right time.

As the new Bank of England governor attempts to bring some of his Canadian guidance magic to the UK, many will be looking closely to see how it survives the journey across the Atlantic.

- Published7 August 2013

- Published12 February 2014

- Published30 June 2013

- Published31 October 2016